Despite a more or less optimistic start to the week, Bitcoin closed in the red on Monday, and on Tuesday dropped below $59,000 per coin. The main question, as usual in such situations, is how deep the correction can be. I suggest that you first study what is happening behind the scenes of the price (which includes everything), and then answer this question.

Mass liquidation of long positions

Over the past 24 hours, the total market capitalization of digital assets has dropped by almost 10%, from $2.9 trillion to nearly $2.6 trillion. Although if we evaluate the dynamics since the beginning of the year, capitalization growth is still 250%.

As is usually the case with price collapses, the current correction has triggered significant liquidations. Long positions worth $510 million have been liquidated in the last 24 hours, according to Coinglass. Over $190 million in longs have been liquidated on Bitcoin alone.

Quantitatively, the Coinglass report shows the liquidation of over 152,000 cryptocurrency trading positions. The largest order, worth $8.46 million, was liquidated on Bitmex.

Bitcoin whales continue to build up their positions

It should be noted that the correction did not scare the Bitcoin whales. Firstly, while the main cryptocurrency is holding above $60,000 per coin, secondly, they used the drawdown to build up positions.

Monitoring network data from November 16 shows that the third-largest Bitcoin whale address has increased its holdings by 207 BTC.

The balance of this account is 193,433.46915660 BTC, while they bought additional cryptocurrencies for $12.84 million at a price of $62,053 per bitcoin.

Journalist Colin Wu, covering the event, noted:

"As of now, this address has increased its holdings by 635 BTC in November. The current balance of this address is 108,528.56 BTC, and the unrealized income is 4,632,109,617.37 USD."

Bitcoin on the cusp of a powerful bullish breakout

This is what cryptanalysts say, who compare the situation on the chart of the main cryptocurrency with previous growth cycles.

In their opinion, the current technical characteristics of BTC resemble its structure at the end of 2020, when the main cryptocurrency consolidated below $20,000 and then soared to $64,000.

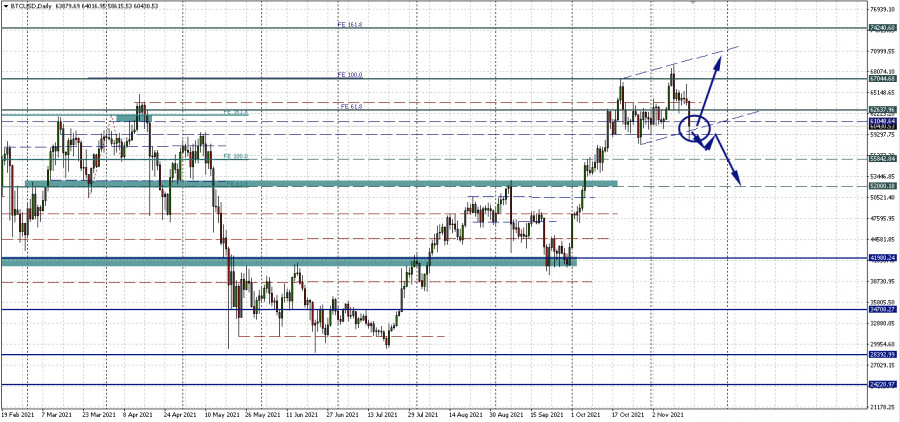

It is also noteworthy that Bitcoin is now consolidating below the 161.8 Fibo Expansion level. And during the bull cycles of 2013 and 2017, a parabolic rally in the main cryptocurrency occurred after it broke the 1.618 Fibonacci region.

Is the upward trend relevant?

As suggested earlier, an ascending channel has emerged on the Bitcoin chart. At the end of last week, the second minimum, at which the support line can be drawn, has not yet been formed. But if we assume that this border will be parallel to the resistance of the two rising highs (although this is not true, let's assume), then the correction could go deeper into the area of $60,000-$61,000 per coin.

Now this low may be forming, and if the channel assumption is justified, we may soon see the price retrace to the $70,000 area.

In case of breakdown and consolidation below the 60,000-61,000 zone, the main cryptocurrency can be adjusted up to $55,000, or even $52,000 for one bitcoin.