Wave pattern

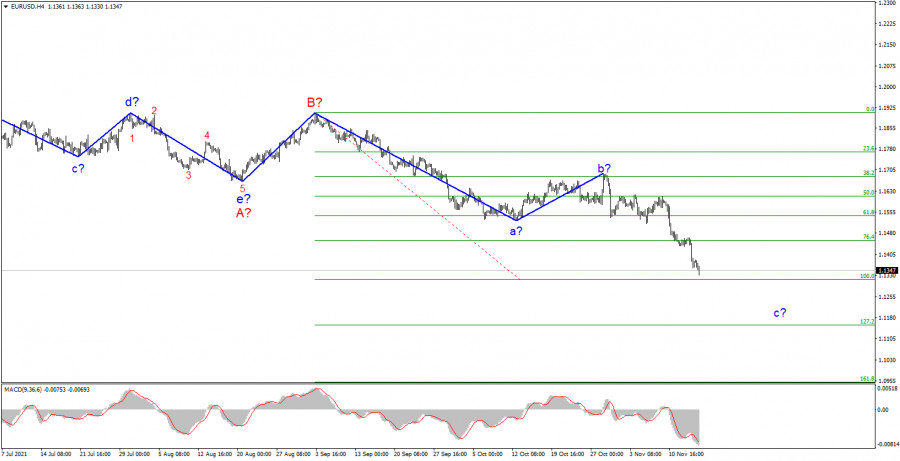

The wave counting of the 4-hour chart for the Euro/Dollar instrument continues to remain integral. The plot a-b-c-d-e, which began to form at the beginning of the year, is interpreted as wave A, and the subsequent increase in the instrument is interpreted as wave B. Thus, the construction of the proposed wave C is now continuing, which can also take a very extended form.

If the current wave counting is correct, then the construction of the proposed wave c in C is now continuing. Its targets are located near the calculated marks of 1.1314 and 1.1153, which corresponds to 100.0% and 127.2% Fibonacci levels.

A successful attempt to break through the 1.1314 mark will indicate the readiness of the markets for further sales of the instrument. An unsuccessful attempt to break through 1.1314 may herald the completion of the construction of wave c in C. However, I still believe that wave c will take a more extended form.

Monday and Tuesday night became decisive.

The news background for the EUR/USD instrument has been very weak in recent days. Last night I wrote that the amplitude of the instrument has been minimal for the last few days, but it was around this time that a strong decline in quotes began.

In total, the European currency lost about 80 basis points on Monday. Thus, yesterday turned out to be far from a day off. On Tuesday, the markets continued to increase demand for the dollar, so the instrument declined by another 20 points, but today the amplitude was already weaker.

The news from the European Union somewhat had significant potential. The GDP report often causes a strong reaction from the markets, but today was not the case. In the second assessment, the indicator did not change and amounted to +2.2% in the third quarter.

However, the most interesting news of the day was US President Joe Biden's signing of the long-suffering infrastructure investment bill. Let me remind you that the discussion of this package was conducted throughout 2021, as soon as Biden became president.

According to Democrats, in order to keep up with China's development, it is necessary to modernize roads, bridges, urban transport systems, and railways. However, initially, the Democrats insisted on investments of $3-4 trillion over the next 10 years. Republicans opposed such huge spending while the US national debt increased by one and a half times during the pandemic, and, oddly enough, they achieved their goal.

The volume of the investment package was reduced by 3 to 4 times, but it was still accepted and approved by congressmen and senators. "America is moving forward again, and your life will change for the better," Biden said today on the lawn of the White House, signing the document.

General conclusions

Based on the analysis, I conclude that the construction of the descending wave C will continue, and its internal corrective wave b has completed its construction. Therefore, now I advise you to continue selling the instrument for each downward signal from the MACD, with targets located near the estimated mark of 1.1314, which corresponds to 100.0% Fibonacci, and below.

The wave counting of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for another month or two until Wave C is fully staffed.

The material has been provided by InstaForex Company - www.instaforex.com