Over the past week, Bitcoin has successfully updated its all-time high and plummeted 9% due to fake news. Due to such impulsive market behavior, the coin is busy holding the support zone, rather than a broad upward movement towards the $100,000 forecast level. Despite this, the situation around the first cryptocurrency remains as positive as possible: the crypto attracts new players and investments, and is also preparing for the Taproot upgrade.

As of November 12, Bitcoin is trading in the $64,000 region and is trying to recover above the swing zone to resume the bullish rally. If the news background remains neutral or positive, the asset will be able to break the $65,500 mark by the end of the current trading week.

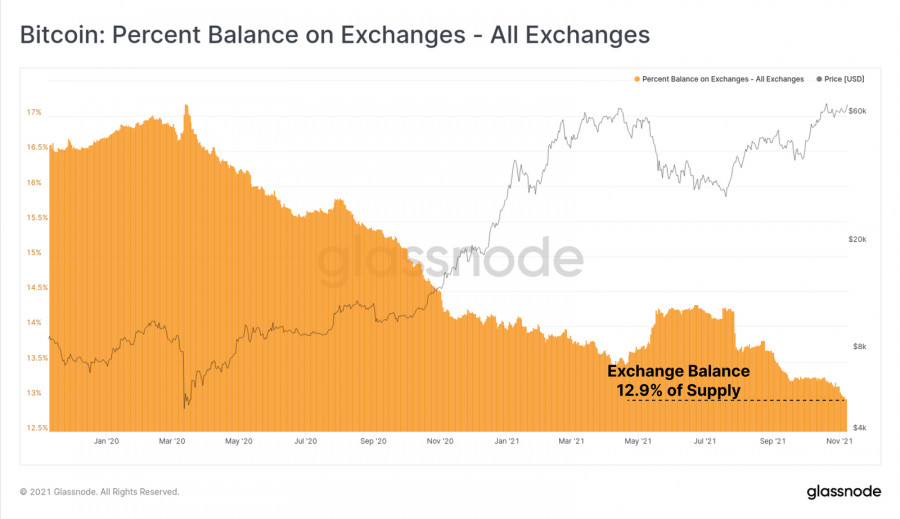

This is directly related to the bullish sentiment of the main crypto audience, which is reflected in the preservation of an important support zone at $63,500. In addition, the recent collapse did not scare investors away from BTC, which is confirmed by Glassnode experts, according to which cryptocurrency exchanges have lost 5,000 BTC over the past few weeks, while only 900 coins were mined.

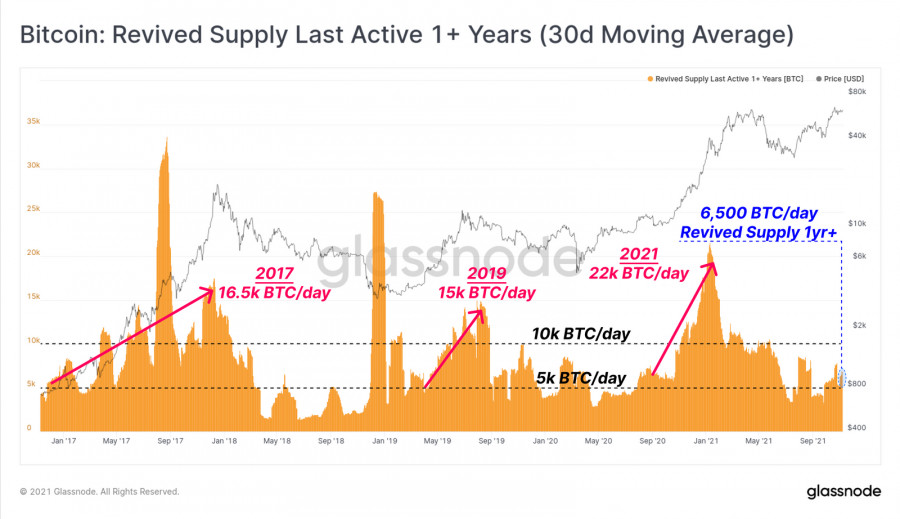

Another important bullish signal for Bitcoin is attracting a fresh audience. It became known that with a Bitcoin price of $53,000 and a capitalization of $1 trillion, the total volume of coins moved was 3.5 million. In other words, more than 18% of the total number of coins in circulation moved at a rate above $53,000, which is direct evidence of an inflow of new capital.

In addition, the recently launched Bitcoin futures ETFs are already generating record investments: exchange-traded funds BITO from Proshares and BTF from Valkyrie received record investment volumes in two weeks. Thanks to this, BITO entered 2% of the largest funds in terms of volume, with a result of $1.4 billion. All this has a positive effect on the psychology of investors and directly on the BTC/USD quotes.

In addition, the market is waiting for two extremely important events that can significantly increase the prospects of Bitcoin in the fourth quarter of 2021.

By the end of this week, the SEC is obliged to consider VanEck's application to launch a spot ETF for Bitcoin. Recall that the CEO of MicroStrategy described the multibillion-dollar prospects of such a financial institution, and therefore the market is waiting with high hopes for a decision from the regulator.

The second important announcement that will contribute to the growth of BTC is the Taproot upgrade, designed to improve the operation of smart contracts in the network of the first crypto asset. With this in mind, PlanB's forecasts of a bitcoin price of around $96,000 by the end of November look very likely.

Meanwhile, Bitcoin managed to defend the $63,500 mark, which increased the likelihood of further upward movement as part of the recovery in quotes. Despite the local positive, the price has already rebounded from the $65,500 resistance zone several times, and therefore the quotes are now moving to retest the $63,500 support zone, and judging by the technical indicators, the probability of its breakdown is growing.

The MACD indicator continues to decline and enters the red zone below the zero mark, which indicates a loss of strength by the upward momentum. At the same time, the stochastic oscillator also goes down and breaks through the lower border of the bullish zone, which indicates an increase in the number of sell orders and market confidence in the breakdown of $63,500.

If the BTC price still breaks through the current purchase level, then further resistance during the decline is formed at $57,700. Further downward movement can significantly worsen the panic and call into question the medium-term upward trend. At the same time, with an adequate market reaction, the rebound from the zone below $57,700 increases significantly, and a key support zone passes at $53,600.