Analysis of previous deals:

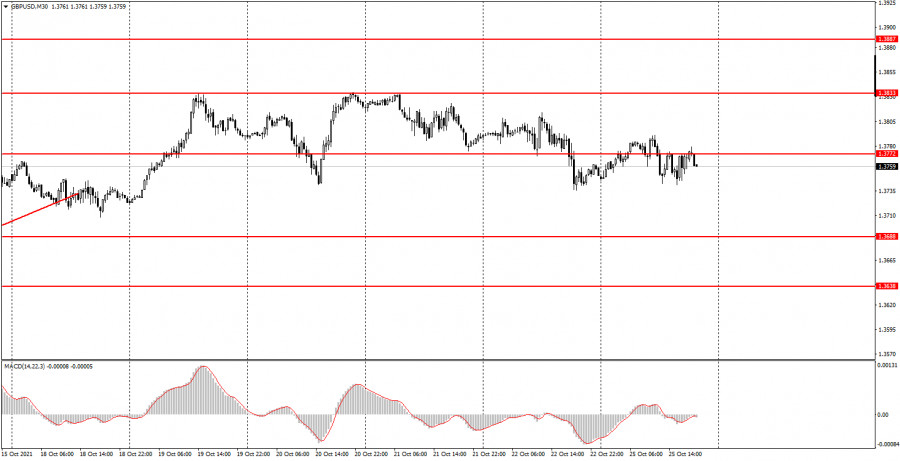

30M chart of the GBP/USD pair

The GBP/USD pair was trading in absolute flat on the 30-minute timeframe on Monday, which is not very similar to it. Usually, recently, the euro/dollar pair has been mainly moving in a horizontal channel, while the pound has shown a more or less trendy movement. However, today it was the other way around. The euro/dollar pair was moving in a trend, while the pound/dollar was in a flat. However, you can clearly see what we are talking about on the 30-minute timeframe. In the last five trading days, the pair has also been in a horizontal channel, about 90 points wide. However, during the day, it was in an even narrower channel, which is clearly visible on the lower TF. Thus, there is no trend at the 30-minute TF, which means that signals from the MACD indicator should still not be considered. There was no major report or other event in either the UK or the US during the first trading day of the week. Therefore, a flat, on the one hand, is justified. On the other hand, if the pair was trading flat every time the event calendar was empty, then it would be completely impossible to trade.

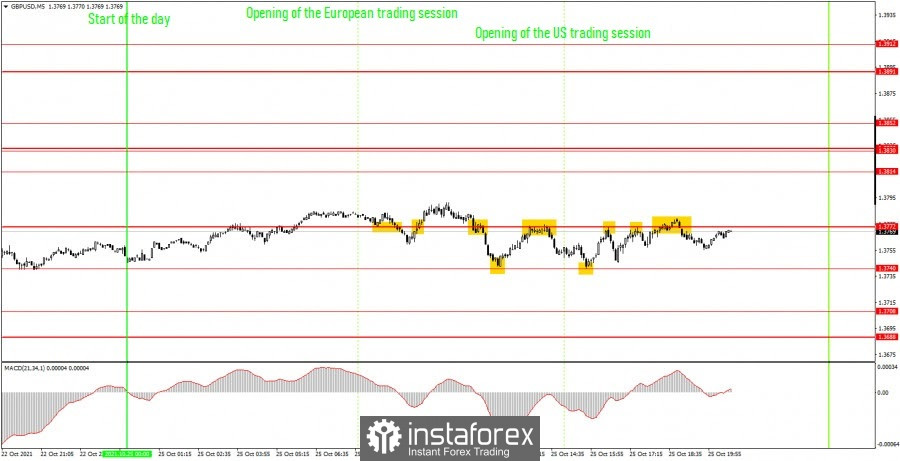

5M chart of the GBP/USD pair

The technical picture looks quite eloquent on the 5-minute timeframe. Quotes have been between the levels of 1.3740 and 1.3772 for most of the day, reaching each of these lines many times. Thus, a lot of signals were generated today, and most of them were not even false, but what profit can be expected if the distance between these two levels is 32 points? Moreover, the pair crossed the 1.3772 level at the beginning of the European trading session several times, thus forming two false signals around it. The first is to sell, the second is to buy. Unfortunately, novice traders could get a loss of 25 points for these deals. Nevertheless, there were also several profitable trades that made it possible to level losses due to false trading signals. Two buy signals around the level of 1.3740 helped in this. Both times the pair bounced off this level (the first time the error was 1 point). And each time later it grew to the level of 1.3772, where it was necessary to take profit on long positions. One could earn about 30 points of profit on these two trades, thus, in total, the day was completed even with a few points of profit. All trading signals near the level of 1.3772 after the first two should not have been considered, since the first were false. In general, beginners could clearly see what trading signals and in what quantity can be generated if the market is flat.

How to trade on Tuesday:

At this time, there is no trend on the 30-minute timeframe, and volatility is low again. Since there is no trend at this time, we do not advise beginners to track signals for the MACD indicator for some time. The important levels on the 5-minute timeframe are 1.3708, 1.3740, 1.3814, 1.3830. We recommend trading on them on Tuesday. The price can bounce off them or overcome them. As before, we set Take Profit at a distance of 40-50 points. At the 5M TF, you can use all the nearest levels as targets, but then you need to take profit, taking into account the strength of the movement. When passing 20 points in the right direction, we recommend setting Stop Loss to breakeven. On October 26, the only highlight of the day will be the US consumer confidence report. However, it is unlikely to have a serious impact on the pair's movement.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.com