4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: 10.6656

The British pound has calmed down by the end of 2020. I want to believe that this is not an accident. Tuesday's volatility was lower than usual. However, we would not jump to conclusions that the "high-volatility swing" is complete. They are visible in the illustration. The pair in recent weeks is very fond of passing 300-400 points in different directions in short periods. Thus, it is still very early to talk about the stabilization of the situation. The key point that we can note is the double working out of the Murray level of "7/8"-1.3611, which is the 2.5-year high of the pound. Thus, two price rebounds from this level and allows us to assume the end of the upward trend. However, in recent months, there have been situations in which we expected the end of the upward trend, and the pound continues to grow as if nothing had happened. Thus, this time the upward movement may continue, given the unprecedented low demand for the US currency.

Traders, analysts, and experts continue to talk about the prospects of the British economy while the pound continues to rise in price in the long term. According to many, at the end of 2020 (the fourth quarter) and the beginning of 2021 (the first quarter), the British economy will again lose 1-3% of GDP, which means that there will be no question of any economic recovery after the pandemic and crisis in these periods. Therefore, it is still extremely difficult for us to find reasons why the British currency may become more expensive in the near future. Especially because the US economy in the fourth quarter of 2020 is likely to gain a couple of percent compared to the third quarter, according to forecasts. Thus, we get that the American economy will continue to recover, and the British economy will continue to fall. It is still not clear why the pound is still growing. But the reasons may be the same as we listed in the article on the euro/dollar. Speculative growth and actions of major market players. And so the British currency can rise in price for as long as you want, although there are no fundamental reasons for this. Thus, traders just need to keep in mind that the pound can start a strong fall at any time or at least stop growing. We still recommend trading up as long as the upward trend continues, as trying to predict a downward trend reversal is a thankless task. It should be remembered that in 2008, oil broke all records of value, and in 2007, the pound was worth more than $ 2. After reaching these peak values, long falls of both instruments followed.

At the same time, the media got an internal document of the British government, which describes the victory in the negotiations between London and Brussels. This document states that the UK won on 28 points, reached a compromise solution on 26 points, and only conceded to the European Union on 11 points. British politicians and economists now rejoice and celebrate their victory, European ones – their own, and independent experts assure that such an agreement (clearly not without disadvantages for both sides) is still better than the absence of it. Thus, the European Union and Britain in any case benefited from the fact that they managed to jump literally into the last car. But the consequences of this agreement will be visible in the first two quarters of the new year. We can only closely monitor the situation and hope that the unjustified growth of the British currency will stop soon.

It should also be noted that no important information is currently published in the UK or the States. Markets, if not yet celebrating the New Year, are preparing for it with might and main. Thus, trading and forecasting become especially difficult these days. The fundamental background is empty, there is no macroeconomic data, there is nothing to react to.

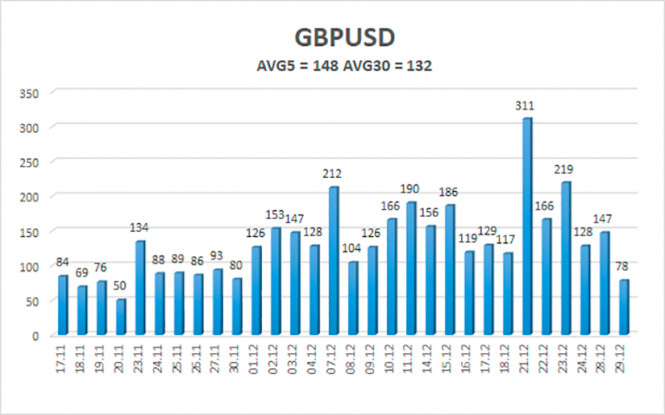

The average volatility of the GBP/USD pair is currently 148 points per day. For the pound/dollar pair, this value is "high". On Wednesday, December 30, thus, we expect movement inside the channel, limited by the levels of 1.3334 and 1.3630. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement within the "swing".

Nearest support levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest resistance levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe is now in a new round of upward movement. Thus, today it is recommended to trade for an increase with the targets of 1.3550 and 1.3611 if the pair remains above the moving average. It is recommended to trade the pair down again with targets of 1.3428 and 1.3367 if the price is fixed below the moving average line. In general, the "swing" continues now. Not a good time to trade.

The material has been provided by InstaForex Company - www.instaforex.com