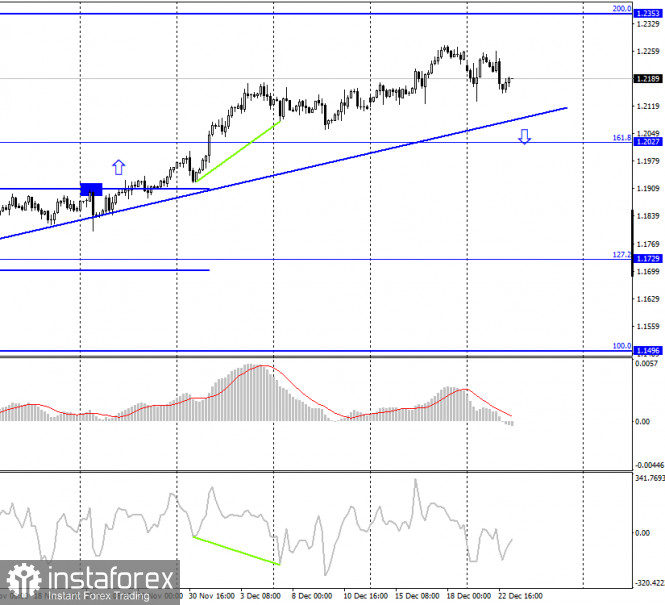

EUR/USD - 1H.

On December 22, the EUR/USD pair performed a new fall, however, it was less strong than the day before. However, this fall allowed the formation of a new upward trend line, which now works in pair with the downward one and forms a narrowing triangle with it. Just a few hours ago, the pair's quotes performed a rebound from the lower line, so now I am counting on the process of growth to the upper trend line, that is, to the level of 1.2220. Fixing the pair's rate under the upward trend line will increase the probability of further decline and over the downward trend line - the probability of further growth. Meanwhile, the information background at this time is very strange. At the very least, it is extremely difficult to write it down in the asset of a particular currency. At the beginning of the week, the US dollar rose significantly on news of a new strain of coronavirus in the UK, but on the same day, traders calmed down and took into account the fact that this is not the first new strain. A little later, the companies involved in the production of the vaccine against COVID-2019 said that their drugs are likely to cope with the new strain, and if not, the process of creating a new vaccine based on the existing one will not take much time. Thus, the panic associated with the new wave of the epidemic was somewhat premature. After that, the US currency received support from the report on GDP for the third quarter in the US, which unexpectedly turned out to be even higher than previously predicted. But at the same time, I can't tell everyone that the upward trend is over, and the US dollar will finally begin to show growth.

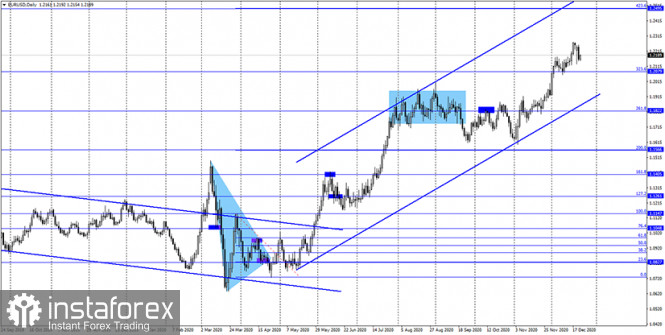

EUR/USD - 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the European currency, but in general, they are trading between the corrective level of 200.0% (1.2353) and the upward trend line, which keeps the current mood of traders "bullish". Thus, on this chart, it is not even possible to conclude the end of the upward trend. I believe that it is better now to pay more attention to the hourly schedule, where you can track changes more quickly.

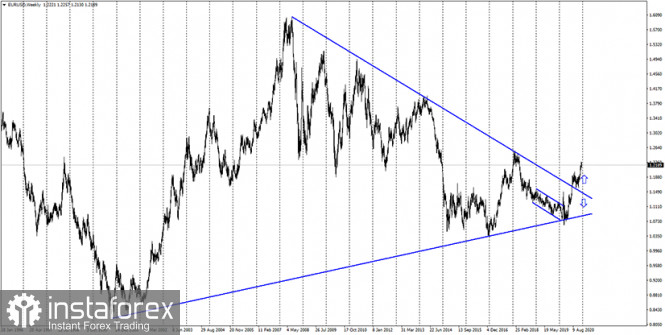

EUR/USD - Daily.

On the daily chart, the quotes of the EUR/USD pair continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair performs consolidation under the level of 323.6%, there are still high chances of growth.

EUR/USD-Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 22, the US released a report on GDP for the third quarter, which showed an increase of 33.4% compared to the second quarter and with lower expectations of traders. But the consumer confidence indicator was very low – 88.6, traders expected at least 97.1.

News calendar for the United States and the European Union:

US - change in the volume of orders for long-term goods (13:30 GMT).

US - number of initial and repeated applications for unemployment benefits (13:30 GMT).

On December 23, reports on orders for durable goods and applications for unemployment benefits will be released in America. The information background will be present on this day.

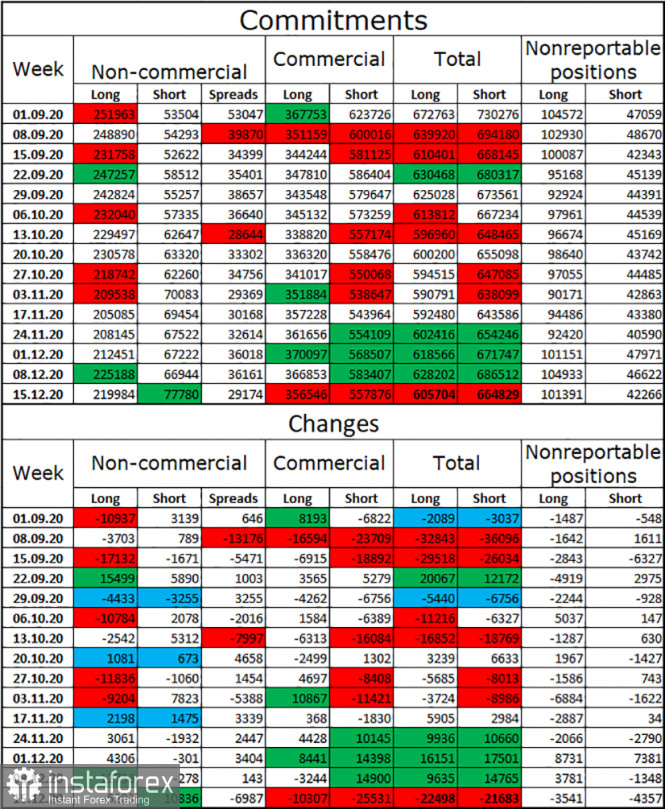

COT (Commitments of Traders) report:

For four weeks in a row, the mood of the "Non-commercial" category of traders became more "bullish". This was stated by COT reports and it coincided with what was happening on the euro/dollar pair. However, in the reporting week, speculators opened as many as 11 thousand new short-contracts, and also closed 5,200 long-contracts. Thus, they significantly weakened their bullish mood. And despite this, the euro continues to show growth. However, a sharp change in the mood of the "Non-commercial" category of traders does not mean that the euro currency should immediately fall. The latest COT report shows that speculators are once again preparing for a fall in the euro currency, or at least for the end of its growth.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro currency with the nearest goals, if the rebound from the level of 261.8% (1.2201), from the upper trend line or fixing under the lower trend line is performed. New purchases of the pair can be opened with a target of 1.2308 when the quotes are fixed above the descending trend line on the hourly chart.

Term:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com