The situation in the currency market fully reflects the overall picture in the financial markets. The recent economic data from the US, Asia and Europe inspires optimism in investors that economic recovery will be more strong in the second half of the year.

On Monday, data on consumer inflation in China was released, which showed its acceleration amid economic growth after the impact of the coronavirus pandemic. In addition, news that the pressure of the COVID-19 pandemic is easing in America supports demand for shares of companies that have previously experienced significant pressure. The local strengthening of the dollar stopped on this wave. At the end of Monday trading, it rose against the yen and the Swiss franc, tried to rise to the euro, and was also helped by a strong technical overbought of the European currency. However, it declined against commodity and raw material currencies, as well as the pound.

Meanwhile, Increasing demand for risky assets, primarily for US companies ' shares, as well as the high probability of reaching a compromise between the Democratic majority in Congress and Government D. Trump on new measures to support Americans and business will definitely put downward pressure on the dollar. We expect that in the wake of the rally in the stock market, as well as the resumption of the decline in Treasury yields, the US currency rate will start to weaken again. And pairs where the dollar is present will end the consolidation period and resume growth against it.

Another negative moment for the dollar exchange rate on Monday was the publication of data on the number of open vacancies in the labor market (JOLTS). The number of which rose sharply to 5.889 million against 5.371 million. In fact, the indicator demonstrates a positive trend for the second month in a row, the persistence of which will become an important factor in supporting the demand for risky assets with a simultaneous increase in pressure on the US currency rate.

Assessing the overall picture, we believe that we should expect a resumption of the dollar's fall in the currency market this week.

Today, the focus of the markets will be the publication of the economic sentiment index from the ZEW for the euro zone and Germany, as well as the current conditions for Germany. If the values of the indicators do not rise and turn out to be, even if not much, but higher than expected, the euro/dollar pair should be expected to turn upwards with the prospect of exiting the period of consolidation.

In addition, the numbers of manufacturing inflation in America will be presented today. An increase in performance is expected. How can this news affect the dollar rate?

We believe that their growth will not affect the overall dynamics of the dollar exchange rate. On the contrary, they will be perceived by investors as confirmation of the improvement in the situation in the country's economy, which will only strengthen the trend in demand for risky assets with a simultaneous weakening of the dollar.

In the meantime, it is also supported by the factor of growing tensions between Washington and Beijing. We believe that as soon as it weakens, the dollar will decline.

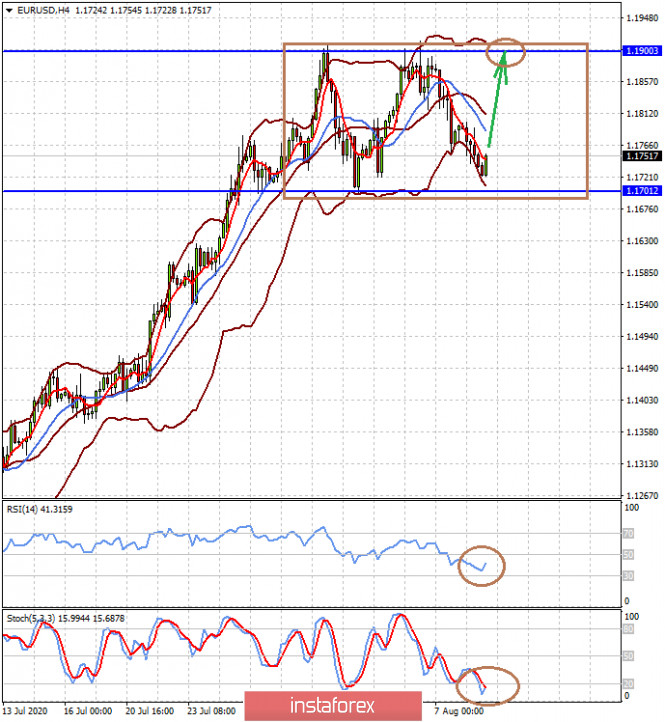

Forecast of the day:

The EUR/USD pair is consolidating in anticipation of the publication of data on the economy of Germany and the eurozone, which will be released today. If they turn out to be above expectations, the pair will rush to 1.1900.

The USD/CAD pair remains in a short-term downward trend. A consolidation below 1.3335 on the wave of continued growth in oil prices will be the basis for a fall in prices first to 1.3235, and then to 1.3200.