4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -26.6721

The British pound fixed below the moving average line on Friday. However, it became clear on Monday that the downward movement will not continue, at least for now. The fact is that the pair stood in one place for the entire European session, and in the American session it jumped up. At the same time, there were no objective reasons for another fall in the US currency. More precisely, there were no immediate, point-based reasons that caused the dollar to fall on Monday. In general, the situation continues to be not in favor of the US currency. We have repeatedly written about the "4 American crises", which continue to put strong pressure on the dollar's position. It is so strong that the bears simply do not risk selling the euro/dollar pair now. And what else can you expect from market participants, if even in difficult times for the country, when GDP losses in the second quarter amounted to a record 33%, the government cannot come to a common opinion and agree on the next package of economic assistance? And this is not to mention the measures that should have been taken to stop the spread of the COVID-2019 virus. But no, the US President is concerned only with his political ratings, the Democrats - the issue of waging war against Donald Trump, and the whole world is divided into two camps: the first supports Trump, because he believes that he will successfully destroy America, the second – against Trump, since it is impossible to agree with him at the international level on any issue. So the result is a situation in which the dollar has long been expected to start growing elementary for technical reasons, but instead risks going to a new stage of a long fall.

The most interesting thing is that there is still no important or even interesting news coming from the UK. Only tomorrow and the day after tomorrow will there be some really important macroeconomic reports from the Foggy Albion. The main one is the GDP report for the second quarter. But while the British pound is waiting for news, the US dollar receives it daily. As recently as this weekend, some American publications started talking about a new type of crisis that the United States may face in the near future or rather in the final stage of 2020. Earlier, we have repeatedly written that Donald Trump is unlikely to give up without a fight in the election. If he loses them, he will challenge the results through the courts and try to cancel the results of the vote. During the election itself, he will try to block access to the polls of Americans in those cities where Biden's victory is most likely. Formally, he can even simply refuse to leave the White House, since there is no legal article that would determine the process of the President's resignation at the end of his presidential term. And this is not our speculation, this is what many American media write about. This is what the Americans themselves fear. So, some media outlets started talking this weekend about a full-scale "constitutional crisis" that could begin on November 3 (if Trump loses the election) and end no earlier than January 2021, when Trump will have to leave the White House (if he loses the election). According to American political scientists, the problem of fraud and deception in the elections themselves is not the most serious problem possible. Also, experts are not too afraid that Trump will simply refuse to leave his residence. But the fact that the US President has the full right to use the forces of the national guard, army and other security agencies is really very frightening. Theoretically, Donald Trump can bring all the country's military forces to the streets of US cities to prevent a change of power in the country. Of course, this is one of the most unlikely options, however, what did Trump want to do when rallies and protests began in many cities as part of the "Black Lives Matter" movement? That's right, to suppress rallies with the help of the regular army, which shocked absolutely all politicians and the Pentagon. Thus, there are no prohibited techniques for Trump. At any moment, he might unearth a law from 1812 that no other President would have thought of using. Experts also fear that Trump will try to transfer federal funds to his companies, pardon a number of individuals, including himself, thus protecting himself from possible future proceedings related to his activities during the presidential term. Experts also fear that Trump may go on principle and refuse to hand over many important files to Biden, simply destroying them. Roughly speaking, Trump can leave an unsightly legacy behind to criticize President Biden in the future. In general, the end of 2020 will definitely be fun, at least for America.

On Tuesday, the UK will publish data on average wages, applications for unemployment benefits, and the unemployment rate for June or July. According to experts' forecasts, it is not worth waiting for good data on wages. Both with and without bonuses, a reduction is expected. The unemployment rate may rise from 3.9% to 4.2% in June, and the number of applications for benefits will increase by 5-10 thousand. Thus, all three reports may be quite weak. However, will this help the US currency? No important planned information is expected from overseas. However, what is happening in America now gives us guarantees of getting important and interesting data almost every day. And about the nature of this data, you can not even talk. With a 99% probability, they will be negative for the US currency. Thus, the US dollar may start falling again against the weak British pound. With this solely because of its own "issuer". Not the Fed, but the US, whose government continues to completely fail 2020.

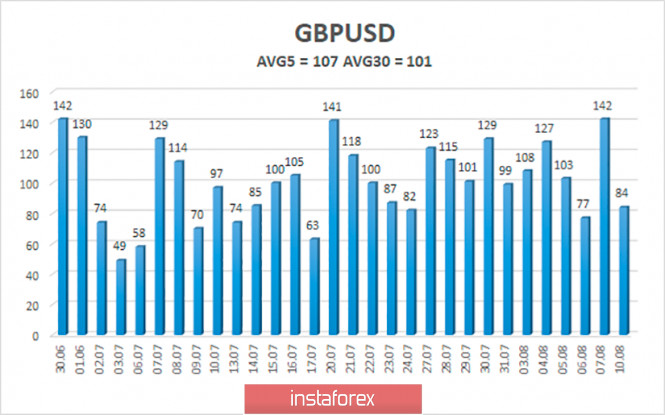

The average volatility of the GBP/USD pair continues to remain stable and is currently 107 points per day. For the pound/dollar pair, this value is "high". On Tuesday, August 11, thus, we expect movement within the channel, limited by the levels of 1.2969 and 1.3183. Turning the Heiken Ashi indicator downward will indicate a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.3062

S2 – 1.3000

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3123

R2 – 1.3184

R3 – 1.3245

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe began a round of upward correction, which may end with the resumption of the upward trend. Thus, today it is recommended to open short positions with the goals of 1.3000 and 1.2969, if the price is again fixed below the moving average. Buy orders are recommended to be considered with the goals of 1.3123 and 1.3158, if the pair remains above the moving average line, and the Heiken Ashi indicator will color the bars purple.

The material has been provided by InstaForex Company - www.instaforex.com