Trading recommendations for the EUR/USD pair on July 22

EUR/USD

Analysis of transactions

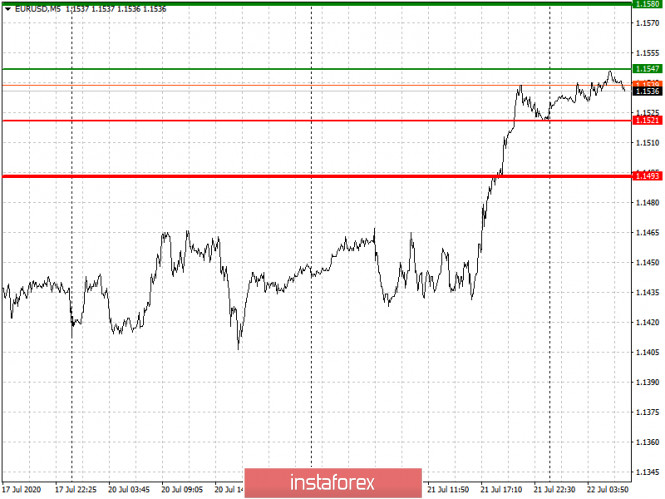

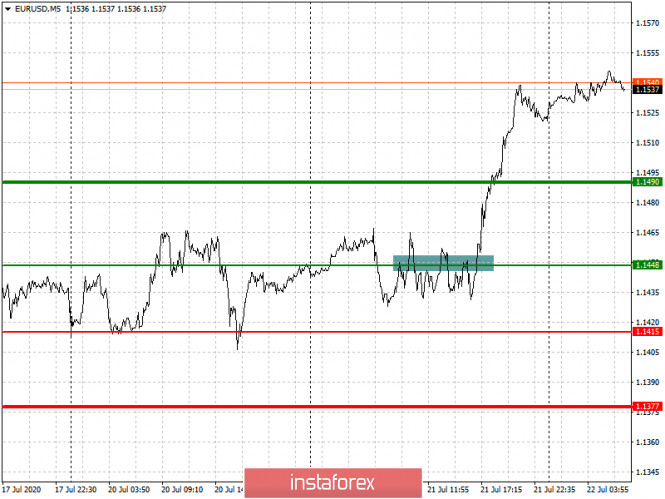

The "buy" signal presented for the European currency worked perfectly. An entry point was formed in the market, after the quote tested the value 1.1448 (green rectangle in the chart). Such led to a 15-point growth in the euro, after which it rose even more due to the news on coronavirus vaccine. Traders began to open long positions, which led to the test of the daily target 1.1490.

The euro will continue to rise today because traders are confident amid the approval of the 750-billion assistance package of the European Union. In addition, there were good nes on the development of the coronavirus vaccine, which will continue to fuel a rapid economic recovery. Today, a speech by ECB head Christine Lagarde is scheduled, which may support the euro.

Thus:

- Buy positions when the quote reaches the level of 1.1547 (green line on the chart), targeting the level of 1.1580. The rise may occur after ECB president ECB Christine Lagarde delivers her speech on the state of the European economy. Exit the market when the quote reaches a value of 1.1547.

- Sell positions when the quote reaches the level of 1.1521 (red line on the chart), targeting the level of 1.1493. This is because the pressure on the euro may increase if the ECB President announces poor prospects for economic recovery after the pandemic. Exit the market when the quote reaches 1.1493.