4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -42.0018

For the euro/dollar currency pair, the fourth trading day of the week was in a downward movement. Thus, everything would have been perfectly beautiful if the pair had not performed a rather unreasonable growth towards the upper line of the Ichimoku cloud a few days earlier, which confused all the cards, and at the same time made us assume that the bulls were back at work and preparing for a new upward trend. However, as it turned out in practice, the upward movement was again an accident. On Thursday, traders resumed selling the euro and buying the US dollar, which led to a new fall in the euro/dollar currency pair. We believe that in the current circumstances, it is a further drop in quotes that is the most logical and reasonable option. The fact is that we have listed the problems of the United States many times recently. And we remain of our opinion that in the long term, the US dollar has lost its advantage, which means that in the next year or two, the euro is unlikely to fall much in price, provided there are no shocks. Thus, our assumptions about the need for dollar growth are based solely on the unreasonableness of the previous growth of the euro currency. From our point of view, there were no reasons to strengthen the euro. If we leave aside all non-economic topics, the situation in the EU and the US is approximately the same. Yes, it is America that is causing more concern now, because it is across the ocean that the epidemic continues to spread as if there were no quarantine, lockdown, or restrictions. There is no second wave now in the US, the first lingering wave continues. However, this is not critical for the American economy. It has already declined quite significantly, unemployment is high, and the labor market is weak. Therefore, the fact that the "coronavirus" continues to collect more victims does not particularly worsen the state of the US economy. On the contrary, with the lifting of restrictive measures, the economy began to recover, because it was the quarantine that caused its severe decline, and not the "coronavirus" at all. "Coronavirus" at this time is a human question, a question of life and death, a question of the health of all nations. It has little impact on the world economy. The economy is greatly affected by government actions to combat the epidemic, border closures, supply disruptions, and the inability to move freely. The same applies to mass protests and rallies in the United States. This is a purely social issue. As well as the health of the nation, since it was after the start of mass protests that the growth rate of COVID-2019 began to accelerate. These protests do not have a significant impact on the economy. And the same applies to the political crisis. The future of this country, peace on the world stage, as well as foreign policy and relations with China and the European Union depend on who will become the next US President. However, "here and now", the absurd actions of Trump and his funny and regular comments and interviews, which are trusted only by his ardent fans, do not have any impact on economic indicators. And the same picture in the confrontation between China and the United States. The fact that the relationship is heating up does not concern traders and investors. The US dollar remains the number one currency in the world, the currency in which the absolute majority of all international payments take place. Therefore, a new trade or "cold" war between these giants will affect their economies, and only through the economy will the exchange rate of national monetary units change. Thus, all these topics are certainly very important and interesting, and they should not be overlooked since they will play a role in the medium and long term. But they do not affect the dollar exchange rate "here and now".

The key factors that are extremely important for the euro/dollar pair remain the same and approximately equal. The economies of both regions have shrunk, the rates of both central banks have been reduced "to zero or below", and both regions are currently unable to agree and accept new aid packages for their economies. Thus, we believe that the US dollar should recoup all the losses of recent weeks in pair with the euro currency, after which the pair should be traded in a wide (as for small time frames like 4-hour) side channel.

Yesterday, a lot of important and significant information was published in the United States. First of all, this is the report on GDP for the first quarter, which a month ago predicted a reduction of 4.8%, but now it is equal to -5%. On Thursday, this figure was confirmed. A new report on applications for unemployment benefits showed that the number of primary applications increased by almost 1.5 million during the reporting week, while the number of secondary applications remained almost unchanged at 19.5 million. These 19.5 million can be considered the number of Americans who lost their jobs during the pandemic and crisis of recent months. Given the fact that the economically active population in the United States is now about 160-165 million, 20 million of them are 12.5%. Plus, you should consider those Americans who do not work and do not apply for benefits. Thus, the real unemployment in the United States is now at least 12.5%, and most likely more. The report on orders for durable goods is also quite important. The main indicator was +15.8% in May, the indicator excluding defense orders was +15.5%, excluding transport orders - +4%, excluding defense and aviation - +2.3%. All four indicators significantly exceeded their forecast values. In total, the entire package of macroeconomic statistics can be called quite positive, or at least not negative. Thus, it could provide support for the US currency, even though it was in high demand in the morning when paired with the euro and without it. And, for example, the British pound during the past day almost did not fall in price.

On the last trading day of the week in the US, only frankly secondary reports on changes in the volume of personal income and spending of the American population are planned. Personal income is expected to fall by 6% at the end of May, while expenses will grow by 9%. However, these figures are now completely disconnected from reality and are unlikely to interest market participants. There are no major events planned in the European Union today.

Thus, since the euro/dollar pair is fixed below the moving average line, the downward movement should continue. However, we believe that the pair can form a kind of side-channel right now. And in this case, after reaching the mark of 1.1170, a rebound will occur and a new round of upward movement will begin. In any case, as before, we recommend that you first pay attention to technical factors and trade strictly on the trend.

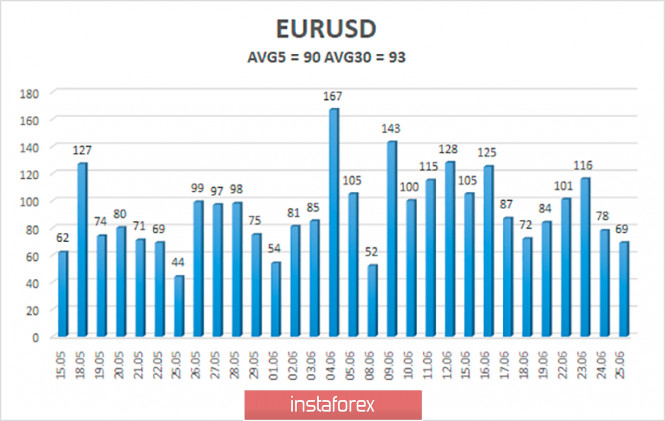

The average volatility of the euro/dollar currency pair as of June 26 is 90 points and now the value of the indicator is characterized as "average", but in general, the volatility continues to decrease. We expect the pair to move between the levels of 1.1140 and 1.1320 today. The reversal of the Heiken Ashi indicator upward may signal about a possible new cycle of an upward trend.

Nearest support levels:

S1 – 1.1108

S2 – 1.0986

S3 – 1.0864

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1353

R3 – 1.1475

Trading recommendations:

The euro/dollar pair changed its direction again and settled below the moving average line. Thus, at this time, short positions with the goals of 1.1140 and 1.1108 are relevant, which it is recommended to keep open until the MACD indicator turns up. It is recommended to return to buying the pair not before fixing the price above the moving average with the first goals of 1.1320 and 1.1353.

The material has been provided by InstaForex Company - www.instaforex.com