GBP/USD 1H

If the EUR/USD currency pair continued its downward movement yesterday, then the GBP/USD currency pair stayed in one place almost the entire day - in the support area of 1.2403-1.2423, having failed to overcome it. Thus, a further hike down is delayed until the bears manage to overcome this area. The overall technical picture looks unambiguously in favor of sellers, since the price is below the Kijun-sen and Senkou Span B lines. However, a few days earlier, the pair's quotes also left the descending channel, which made market participants think about possibly forming an upward trend. The upward trend has not begun, but the general picture of the state of affairs has become confused. Yesterday, even quite strong macroeconomic statistics from overseas could not affect the pound/dollar.

GBP/USD 15M

The lowest linear regression channel turned sideways on the 15-minute timeframe, which, in principle, is not surprising, given that the whole pair was trading in a narrow price range. So far, there is no talk of an upward correction.

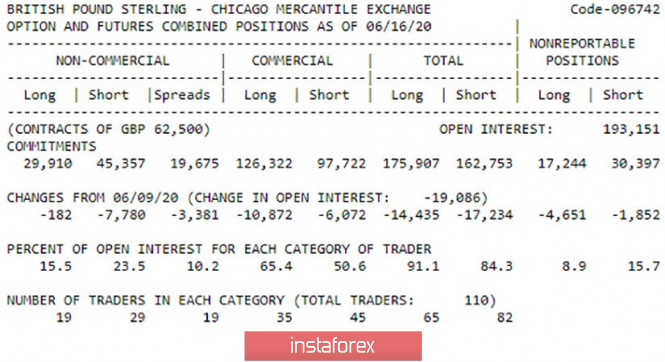

COT report

The latest COT report, which covers the dates June 10-16, shows that during this time period, professional market players were busy closing sales contracts. That is, the picture for the reporting week was observed exactly the same as for the euro. Demand increased during the indicated period, but not because the pound or the euro became more expensive. On the contrary, demand for the dollar decreased, and traders closed Sell contracts, which led to the growth of European currencies. This is precisely what we told traders to focus their attention on earlier, since there were simply no special reasons to buy the euro and the pound in recent weeks. Nevertheless, both currencies rose. It is also worth noting that, during the reporting week, speculators also closed purchase contracts, hedgers closed both types of contracts, and in general, the pound lost about 32,000 more contracts. Thus, banks, large companies, investment funds and others were engaged in closing all types of transactions during the reporting week, rather than opening contracts. The current week is very controversial. At first, the pound rose in price, then it became cheaper, and yesterday it just stood still. A new COT report could show minimal changes.

The fundamental background for the GBP/USD pair has not changed at all on Thursday, since the UK still does not receive any important information. Macroeconomic statistics from across the ocean have simply been ignored, so traders have no choice but to trade under the conditions that already exist. As we have mentioned more than once, fundamental and macroeconomic backgrounds are not only contradictory, traders simply could not work them out or are openly ignored. Thus, first of all, you need to look at the technique. Buyers continue to expect positive information about the progress of negotiations between London and Brussels, but no one knows when they will receive it. In 2020, the pound is able to stay afloat because of the global pandemic, which has hit all countries of the world in the same way, somewhat levelling them. However, quarantines are over, economies are restarting, and the British economy continues to stall, and it could get stuck even more in the Brexit swamp in 2021 if there is no trade agreement between Brussels and London.

There are two main scenarios as of June 26:

1) The initiative for the pound/dollar pair passed into the hands of buyers, but they do not want to take the opportunity. Therefore, it will be possible to resume downward trading after overcoming the support area of 1.2403-1.2423, which can happen in the next few hours. The target in this case will be the support level of 1.2229. Potential Take Profit in this case will be about 150 points.

2) But now, buyers again need to wait until they consolidate above the Kijun-sen line, which will give them a chance to resume moving upward with targets at the resistance level of 1.2573, resistance area of 1.2719-1.2759. Overcoming each target will allow traders to stay in buy positions. Potential Take Profit in this case will be from 125 to 270 points. At the same time, the Kijun-sen line is very close to the price and overcoming it can be a false signal to buy. Therefore, you are advised to treat long positions with caution.

The material has been provided by InstaForex Company - www.instaforex.com