Hello, traders!

Last week, the US dollar was the undisputed favorite in the Forex market. The US currency strengthened against all major competitors, except for the Japanese yen. In particular, the main currency pair EUR/USD lost 0.60% in trading on June 15-19.

The US dollar received additional demand amid fears of a second wave of COVID-19. As we remember, during the first wave of the coronavirus pandemic, it was "American" that was in demand by market participants as a safe asset. By the way, in their notes to clients, most analytical departments of the world's largest commercial banks predict a strengthening of the US dollar, at least in the medium term. It is a possible scenario, however, I would not make such far-reaching forecasts. The situation can change at any time, and the exchange rate of the US currency depends on many factors, such as the next steps in the monetary policy of the US Federal Reserve System (FRS). It is likely that soon the Federal Reserve will decide to combine the yield of US Treasury government bonds with the level of inflation. This combination will help reduce the potential risks associated with a new COVID-19 outbreak. But how this might affect the US dollar is still an open question.

If you look at the economic calendar, this week market participants will have to digest a large stream of macroeconomic statistics. For the most part, it will come from the US, and among other things, we can highlight the final data on GDP for the first quarter, orders for durable goods, personal spending and income of Americans, as well as the index of business activity in the manufacturing and services sectors. From European statistics, it is worth paying attention only to similar indices.

Today, a large flow of macroeconomic information is expected, except that investors may be interested in US data on housing sales in the secondary market, which will be published at 15:00 (London).

Weekly

Turning to technical analysis of major currency pairs market Forex, let's start with the results of the last week, namely the consideration of the relevant period.

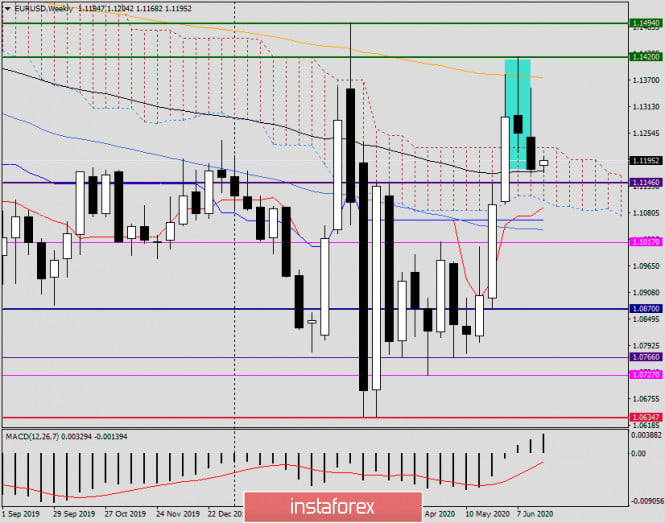

As expected last Monday, the highlighted candle, made in the form of a "shooting star" model, will most likely serve as a signal for a further decline in the quote At the end of the last five days of trading, this assumption was justified as the fact that the news is not going down without a fight and will attempt to resume the rise. This is confirmed by the long upper shadow of the last candle.

And now for the actual closing of the week. First, they closed within the cloud of the Ichimoku indicator, which in itself implies a consolidation within it, followed by a potential decline to the lower border of the cloud, which passes at 1.1107. Secondly, the week closed under the most important level of 1.1200, which for a long time served as a support and prevented further decline. In the previous review for EUR/USD, it was emphasized that closing the week above 1.1300 will indicate the return of large buyers, and the end of the five-day trading period under 1.1200 will further indicate the bearish prospects for the instrument. We have what we have.

H1

Also, in Friday's article on this currency pair, attempts to exit up from the downward channel were assumed, which, as it seemed, would turn out to be false. It was recommended to consider sales on attempts to break the channel's resistance line from the used moving averages (50 MA, 89 EMA, and 200 EMA), which were located above the resistance line. It is gratifying that this option was also correct and worked out.

Conclusion and trading recommendations for EUR/USD:

Given the candlestick patterns on the weekly timeframe, as well as the closing price of the last candle, there is every reason to believe that the downward scenario will continue. At the same time, we can not exclude the activity of buyers who will try to regain control of the market.

Nevertheless, the main trading idea is to sell EUR/USD after rising to the levels of 1.1220, 1.1235, and 1.1250. In this case, the targets can be considered 1.1125, 1.1110, and 1.1100. If signals for purchases appear near these levels, those who wish can try to buy eur / usd, but so far it is better with small goals, in the area of 1.1200. The pair may circle this important mark for some time.

Good luck!

The material has been provided by InstaForex Company - www.instaforex.com