Hello, dear traders!

Following the results of trading last week, the British pound became the leader among all major currencies that fell in price against the US dollar. In the last five days of trading, the pound/dollar currency pair declined by 1.43%. The main influence on the downward dynamics of the British currency was the results of the Bank of England meeting. Let me remind you that the British Central Bank kept the key rate at 0.10%, but increased the asset purchase program (QE) from 645 to 745 billion pounds. Although the decision of the Bank of England coincided with the expectations of market participants, investors considered it too soft and started selling the "British". On the last trading day of last week, the decline in the pound/dollar pair continued, and as a result, the pair ended trading on June 15-19 at the level of 1.2344.

Last Friday, Federal Reserve Chairman Jerome Powell reiterated the rather difficult and slow recovery of the world's leading economy after COVID-19. Let me remind you that the United States has become one of the most affected countries by the coronavirus, which has caused about 119,000 deaths. Naturally, in this situation, we had to introduce several restrictive measures that caused quite serious damage to the American economy. However, as the head of the Fed said, the latest data on employment and consumer spending look encouraging. Once again, I would like to draw your attention to the large-scale assistance for three trillion dollars that the US Congress has allocated for economic recovery.

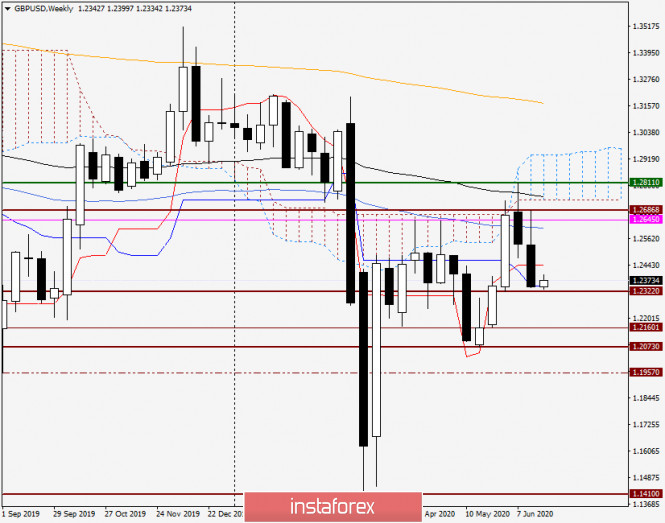

Weekly

As you can see, the last week ended with the formation of a bearish candle with a long upper shadow. It is worth noting that the trading was quite volatile. At first, the pound strengthened quite strongly, reaching 1.2686. However, after that, the ardor of the bulls for the pound finally dried up, and they rather weakly gave the reins of the market for GBP/USD to their opponents.

As a result, the pair came close to the support level of 1.2222, the breakdown of which will open the way to the next marks: 1.2300, 1.2200, and 1.2160. A true breakout of the last level will send the pair to the May lows near 1.2070.

If the price zone of 1.2325-1.2300 can contain the pressure of sellers and turn the course up, and the final closing price of weekly trading will be above the Tenkan line (1.2442), the bears will have to wait with their plans until better times.

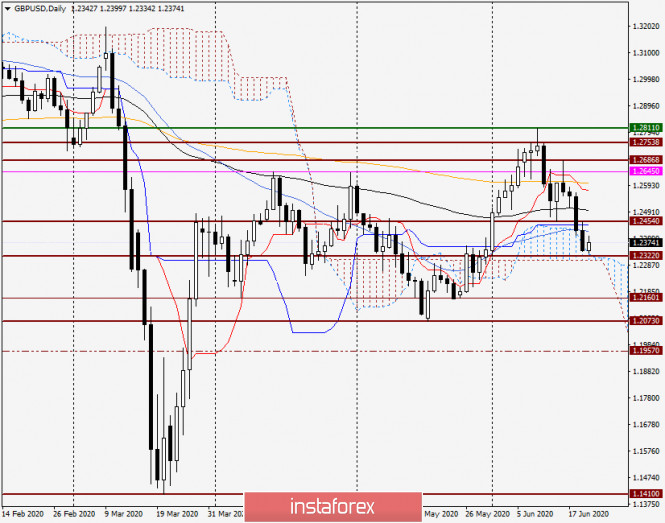

Daily

If we go to the technical picture that appears on the pound/dollar currency pair on the daily chart, it has acquired even more obvious bearish outlines. Following the breakdown of the 89 exponential moving average and the Kijun line of the Ichimoku indicator, last week the quote fell below the 50 simple moving average, and trading closed under the important technical level of 1.2400. Moreover, the closing of the last five-day period took place within the cloud of the Ichimoku indicator, which makes the most likely subsequent movement to its lower border, which passes at 1.2305. Fixing the rate below 1.2300 will only confirm the strength of the bears in the pound and determine the next goals in the area of 1.2200-1.2160.

Conclusion and trading recommendations for GBP/USD:

Given the fears of the second wave of COVID-19, which strengthens the demand for the US dollar, the gradual recovery of the US economy, as well as the technical picture for this currency pair, the most relevant trading idea for the pound/dollar pair is sales.

I recommend that you take a closer look at opening short positions on the pound/dollar pair after rising to the price zone of 1.2400-1.2440. At the same time, the confirmation signal for opening sales for the pound will be characteristic candle signals that will appear in the selected zone on the daily, four-hour, and hourly timeframes.

Good luck!

The material has been provided by InstaForex Company - www.instaforex.com