Forecast for June 16:

Analytical review of currency pairs on the scale of H1:

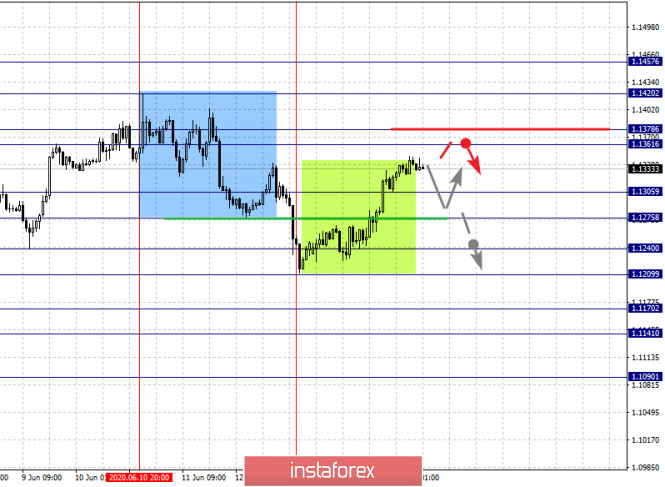

The key levels for the euro / dollar pair on the H1 scale are: 1.1457, 1.1420, 1.1378, 1.1361, 1.1305, 1.1275, 1.1240, 1.1209, 1.1170, 1.1141 and 1.1090. Here, the situation is in equilibrium: the descending structure of June 10 and the formation of the potential for the top of June 12. The development of the downward movement is expected to be cancelled after the price passes the noise range 1.1361 - 1.1378. In this case, the target is 1.1420. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.1457. We expect consolidation, as well as a pullback to the bottom upon reaching this level.

A short-term downward movement is possible in the range of 1.1305 - 1.1275. The breakdown of the last level will lead to a deeper correction. Here, the target is 1.1240. This is a key support level for the upward structure and its breakdown will begin to develop a downward trend from June 10. In this case, the first goal is 1.1209.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.1378 Take profit: 1.1420

Buy: 1.1423 Take profit: 1.1455

Sell: 1.1305 Take profit: 1.1277

Sell: 1.1274 Take profit: 1.1240

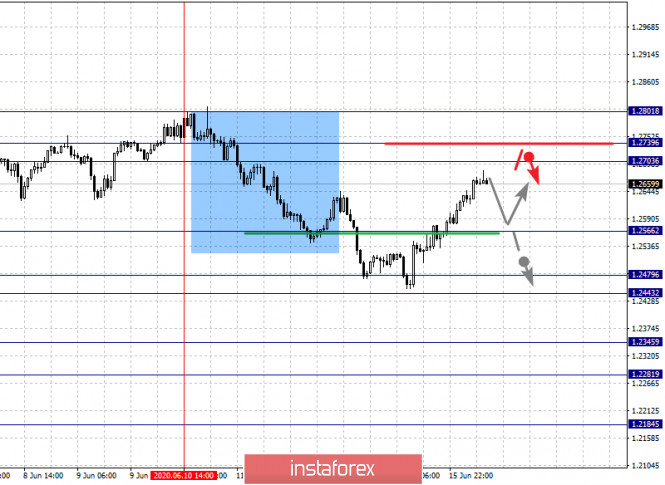

The key levels for the pound / dollar pair on the H1 scale are: 1.2801, 1.2739, 1.2703, 1.2566, 1.2479, 1.2443, 1.2345, 1.2281 and 1.2184. Here, the price is in deep correction from the downward formation on June 10. The cancellation of this formation is expected after the price passes the noise range 1.2703 - 1.2739. In this case, the target is 1.2801. Price consolidation is near this level.

The continuation of the development of the downward trend is possible after the breakdown of the level of 1.2566. In this case, the first target is 1.2479. The price overcoming the noise range 1.2479 - 1.2443 should be accompanied by a pronounced downward movement. Here, the goal is 1.2345. Short-term downward movement, as well as consolidation are in the range of 1.2345 - 1.2281. We are still considering the level of 1.2184 for the potential level for the bottom.

The main trend is the descending structure of June 10, the stage of deep correction

Trading recommendations:

Buy: 1.2740 Take profit: 1.2800

Buy: Take profit:

Sell: 1.2566 Take profit: 1.2480

Sell: 1.2440 Take profit: 1.2347

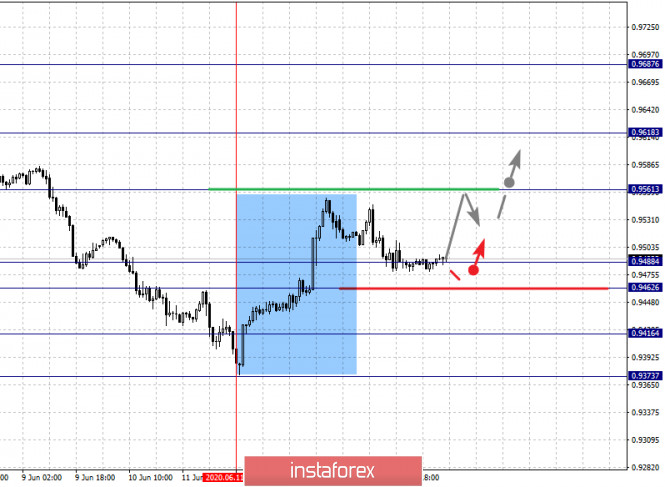

The key levels for the dollar / franc pair on the H1 scale are: 0.9687, 0.9618, 0.9561, 0.9488, 0.9462, 0.9416 and 0.9373. Here, the price forms expressed initial conditions for the top of June 11th. Further upward movement is expected after the breakdown of the level of 0.9561. In this case, the target is 0.9618. Price consolidation is near this level. The breakdown of the level of 0.9618 will lead to a pronounced movement to the potential target - 0.9687. We expect a downward pullback from this level.

A short-term downward movement is expected in the range of 0.9488 - 0.9462. The breakdown of the last level will lead to deeper movement. Here, the target is 0.9416. This is the key support level for the top.

The main trend is the upward structure of June 11

Trading recommendations:

Buy : 0.9561 Take profit: 0.9615

Buy : 0.9620 Take profit: 0.9685

Sell: 0.9488 Take profit: 0.9464

Sell: 0.9460 Take profit: 0.9418

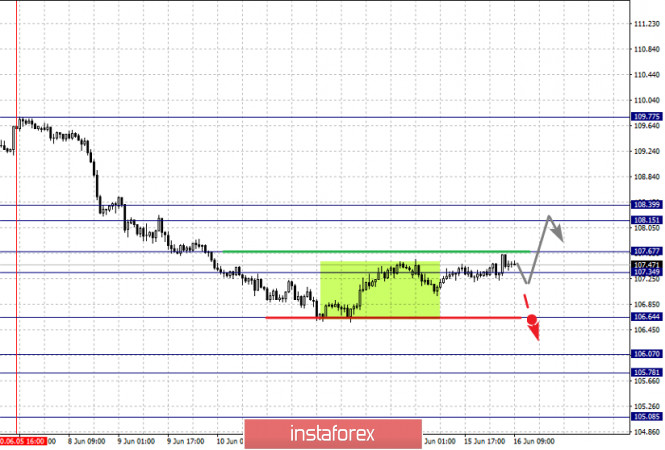

The key levels for the dollar / yen pair on the scale are : 108.39, 108.15, 107.67, 107.34, 106.64, 106.07, 105.78 and 105.08. Here, we are following the development of the descending structure of June 5th. The continuation of the downward movement is expected after the breakdown of the level of 106.64. In this case, the target is 106.07. A short-term downward movement, as well as consolidation are in the range of 106.07 - 105.78. We consider the level of 105.08 to be a potential value for the downward trend. We expect an upward pullback upon reaching this level.

A short-term upward movement is possible in the range of 107.34 - 107.67. The breakdown of the last level will lead to a deeper correction. Here, the target is 108.15. We expect the initial conditions for the upward cycle to be formed before the noise range of 108.15 - 108.39.

The main trend is the downward cycle of June 5

Trading recommendations:

Buy: Take profit:

Buy : 107.69 Take profit: 108.15

Sell: 106.64 Take profit: 106.07

Sell: 105.76 Take profit: 105.10

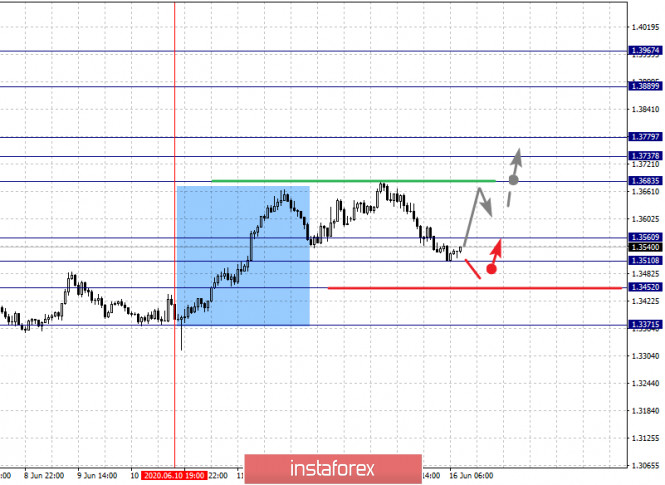

The key levels for the Canadian dollar / US dollar pair on the H1 scale are: 1.3967, 1.3889, 1.3779, 1.3737, 1.3683, 1.3560, 1.3510 and 1.3452. Here, we are following the ascending structure of June 10th. The continuation of the upward movement is expected after the breakdown of the level of 1.3683. In this case, the target is 1.3737. Price consolidation is near this level. The price passing the noise range of 1.3737 - 1.3779 should be accompanied by a pronounced upward movement. Here, the target is 1.3889. For the potential value for the top, we consider the level of 1.3967. We expect a downward pullback upon reaching which.

A consolidated movement is possible in the range of 1.3560 - 1.3510. The breakdown of the last level will lead to the development of a deeper correction. Here, the goal is 1.3452. This is a key support level for the top and its breakdown will allow you to count on movement to the level of 1.3371.

The main trend is the upward structure of June 10

Trading recommendations:

Buy: 1.3683 Take profit: 1.3737

Buy : 1.3780 Take profit: 1.3888

Sell: 1.3508 Take profit: 1.3452

Sell: 1.3450 Take profit: 1.3371

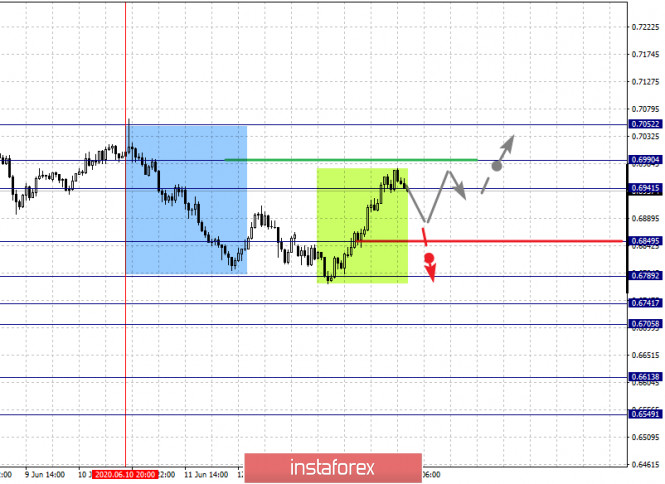

The key levels for the Australian dollar / US dollar pair on the H1 scale are: 0.7052, 0.6990, 0.6941, 0.6849, 0.6789, 0.6741, 0.6705. 0.6613 and 0.6549.Here, the price is in a deep correction from the downward structure on June 10th. We expect a short-term upward movement in the range of 0.6941 - 0.6990. The breakdown of the level of 0.6990 will lead to the cancellation of the downward trend. In this case, the first target is 0.7052. The resumption of the development of the downward trend is possible after the breakdown of the level of 0.6849. Here, the first goal is 0.6789. The breakdown of which, in turn, will allow us to rely on the movement to 0.6741. The price passing the noise range 0.6741 - 0.6705 will lead to a pronounced downward movement. Here, the target is 0.6613. For the potential value for the downward trend, we consider the level of 0.6549. We expect a pullback to the top upon reaching level.

The main trend is the descending structure of June 10, a deep correction

Trading recommendations:

Buy: 0.6943 Take profit: 0.6988

Buy: 0.6992 Take profit: 0.7050

Sell : 0.6849 Take profit : 0.6790

Sell: 0.6787 Take profit: 0.6741

The key levels for the euro / yen pair on the H1 scale are: 123.46, 122.77, 122.22, 121.39, 120.96, 120.31, 119.94, 119.13 and 118.68. Here, we are watching the downward structure from June 5. At the moment, the price is in correction and forms the potential for the top from June 15. A short-term upward movement is expected in the range of 122.22 - 122.77. The breakdown of the last level will lead to the development of an upward cycle. Here, the goal is 123.46. Price consolidation is near this level.

A short-term downward movement is expected in the range of 121.39 - 120.96. The breakdown of the last level will have the downward trend of June 5. In this case, the target is 120.31. The price passing the noise range 120.31 - 119.94 should be accompanied by a pronounced downward movement. Here, the goal is 119.13. For the potential value for the bottom, we consider the level of 118.68. We expect consolidation upon reaching which.

The main trend is the downward cycle of June 5, the correction stage

Trading recommendations:

Buy: 122.22 Take profit: 122.75

Buy: 122.78 Take profit: 123.44

Sell: 121.39 Take profit: 121.00

Sell: 120.94 Take profit: 120.35

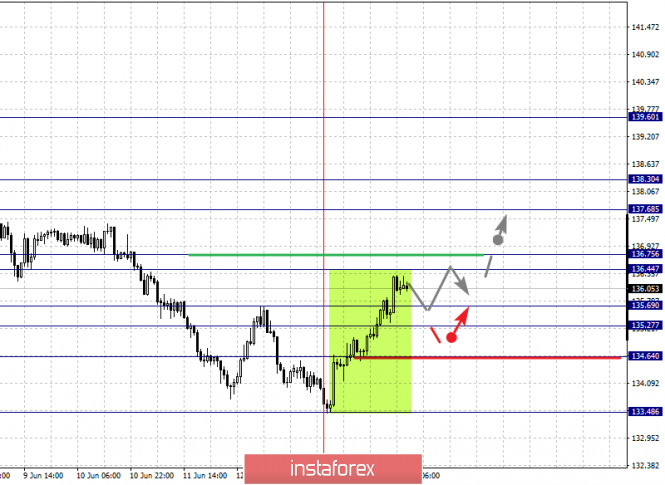

For the pound / yen pair, the key levels on the H1 scale are : 138.30, 137.68, 136.75, 136.44, 135.69, 135.27, 134.64 and 133.48. Here, we are following the development of the downward structure from June 5. At the moment, the price is in correction and forms a pronounced potential for the upward movement from June 15. The continuation of the upward movement is expected after the price passes the noise range 136.44 - 136.75. In this case, the target is 137.68. For the potential value for the top, we consider the level of 138.30. We expect consolidation, as well as a pullback to the bottom upon reaching this level.

A short-term downward movement is possible in the range of 135.69 - 135.27. The breakdown of the last value will lead to a deeper correction. Here, the target is 134.64. This level is a key support for the upward structure and its breakdown will continue the development of the downward trend of June 5. In this case, the potential target is 133.48.

The main trend is the descending structure of June 5, the correction stage

Trading recommendations:

Buy: 136.75 Take profit: 137.68

Buy: 137.70 Take profit: 138.30

Sell: 135.69 Take profit: 135.28

Sell: 135.25 Take profit: 134.66

The material has been provided by InstaForex Company - www.instaforex.com