The US dollar stabilized at yesterday's trading amid a new aggravation in the markets, caused by news of the detection of the COVID-19 virus in one of the wholesale food markets in Beijing. However, it was already under pressure during the American trading session in the wake of news about the Fed's decision to open a new credit line for medium and small businesses in the form of purchases of government bonds in the primary market.

The continuation of decline of equity markets in Asia, Europe and the United States, as well as commodity markets in the wake of increasing fears of the probability of a second wave of the coronavirus pandemic, primarily hit high-yielding currencies. The Australian and New Zealand dollars together with the raw materials – the Norwegian krone and the Canadian dollar were under pressure. The last three were further negatively affected by the local decline in crude oil prices. But, despite such negative dynamics, it is still worth considering this decline as local and only as profit-taking. The market reacted to coronavirus news as an informational guide for taking profit and nothing more.

We continue to expect that large-scale stimulus measures from the world Central Banks, headed by the Federal Reserve, will support financial markets by putting significant financial resources into real sectors of the economy with increasing liquidity in both the dollar and the euro, the yen, etc. Therefore, as soon as the topic of the second wave of the pandemic weakens, and we believe that this probability is more real, the demand for risky assets will increase markedly, which will cause the resumption of sales of the dollar across the entire spectrum of the currency market.

Our expectations on Monday were confirmed. The Fed unexpectedly announced a decision to buy corporate bonds in the primary market, which caused a turn in the markets in favor of demand for risky assets and caused a weakening of the US dollar.

It should also be noted that more and more evidence of the recovery of the Chinese economy is positive for the global economy. Its growth can play the same positive role as it was after the severe crisis of 2008-09. The data published on Monday on industrial production and fixed capital investment in China increased year-on-year, although it did not reach the expected values. According to the data, fixed capital investment increased to -6.3% in May against -10.3% a year earlier, with growth forecast to -5.9%. Industrial production increased to 4.4% from 3.9% in May last year, against expectations of 5.0% growth.

Assessing the general situation in global markets, we continue to consider the current correction as a good reason to open primarily deals against the US dollar in pairs with the Norwegian krone, Canadian, Australian and New Zealand dollars. In addition, it will be interesting to purchase on global stock markets on a corrective decline in the value of assets with excellent medium-term growth prospects.

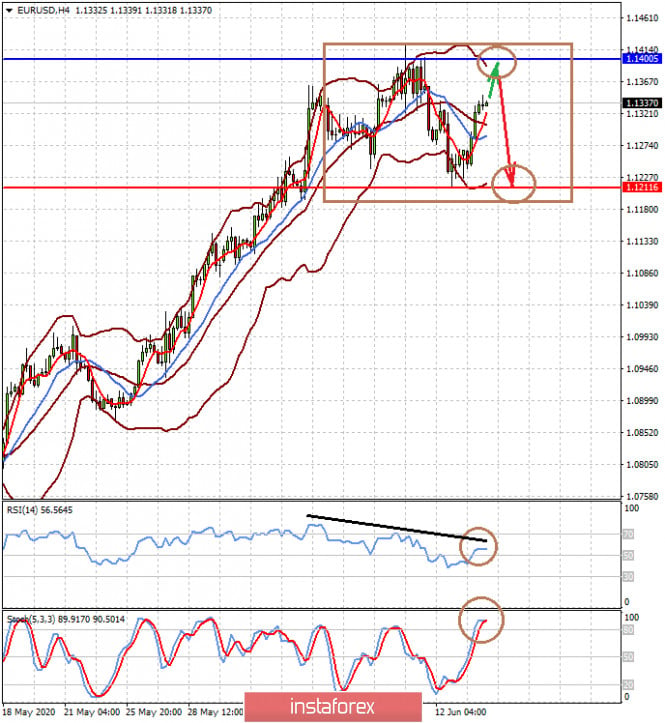

Forecast of the day:

It seems that the EUR/USD pair will be consolidated before the ECB meeting in the range of 1.1210-1.1400. All the same, the single currency is more likely to continue to grow in the future amid further weakening of the dollar due to the Fed's monetary policy.

The USD/CAD pair is in a borderline state in the wake of both the weakness of the US dollar and crude oil prices. From a technical point of view, if the pair declines below the level of 1.3500, it will adjust to 1.3365. At the same time, holding above this level may cause local recovery to 1.3685.