GBP/USD 1H

There has been an openly downward trend for the GBP/USD pair in the last few days on the hourly chart. Bears attack very strongly, bulls have nothing to oppose. However, traders met a barrier in the form of a support area of 1.2198 - 1.2216 on their way down, which formed on April 3-7. Thus, a high probability of a new price rebound from this area. At the same time, overcoming this support area will support the bears in technical terms, and they will be able to continue their movement to two support levels of 1.2164 and 1.2062. A downward channel unambiguously indicates a downward trend, in addition to it there is a downward trend line with three pivots at once. Both of these patterns support sellers and are ready to signal the completion of a downward movement if quotes go above them.

GBP/USD 15M.

We have two linear regression channels on the 15-minute timeframe, which are also directed downwards and signal a downward trend. However, there is also a CCI indicator entering the "-200" area, which is a signal to turn up. Together with a possible rebound from the area of 1.2198 - 1.2216 on the hourly timeframe, we can get a strong signal to complete the downward trend. In fact, this signal has already been formed. It remains only to understand whether it is false. This is relatively easy to do. If the quotes update yesterday's low, then most likely the signal will be recognized as false, and the CCI indicator will form a divergence (it will increase with a further fall in the pair quotes).

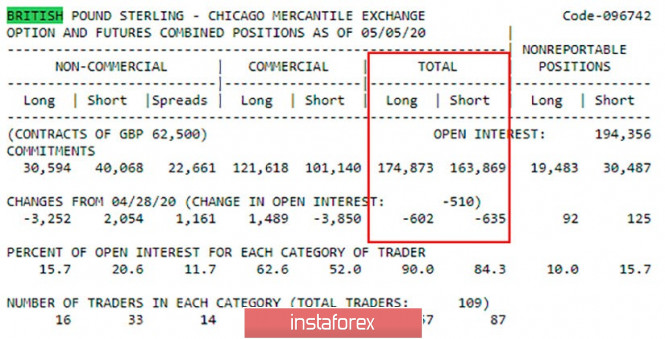

COT report.

The latest COT report for May 5 shows that the total number of buy and sell transactions among large traders per week decreased by 1200. Thus, the general mood has not changed and remains "moderately upward" despite the fact that the pound has become cheaper in the last few days. However, the pound is getting cheaper in the short term, and COT reports published once a week are more relevant to the long term.

No macroeconomic publications in the UK on Thursday are planned. Consequently, the macroeconomic background for the pound/dollar pair will be reduced only to a report on applications for unemployment benefits in the United States (primary and secondary). We believe that the next and an additional several million unemployed in the United States could create little pressure on the US dollar's position. However, we should not forget that traders are ignoring almost all the data that is at their disposal. Thus, technical factors will have a higher priority in determining the further dynamics of the pair. We have two main options for the development of the event on May 14:

1) The initiative for the pound/dollar pair remains in the hands of the bears, since the price is located inside the downward channel. However, a rebound from the 1.2198 - 1.2216 area is a strong signal to turn up, especially in conjunction with the CCI signal on the 15-minute timeframe. Thus, we recommend working out this signal with targets at the level of 1.2283, the Kijun-sen line (1.2337) and the Senkou Span B line (1.2453). A price rebound from any of these targets, or from a downward trend line, or from the upper border of the channel can serve as a signal for manual closing of buy-positions. Take Profit will be about 60 points in the first case, 110 points in the second and 230 points if the pair gets to the third goal.

2) Sellers will be able to continue moving down if they manage to overcome the strong support area 1.2198 - 1.2216. Then we recommend continuing sales or staying in them with goals 1.2164 and 1.2062. In these cases, Take Profit can range from 30 to 130 points.

The material has been provided by InstaForex Company - www.instaforex.com