To open long positions on EUR/USD, you need:

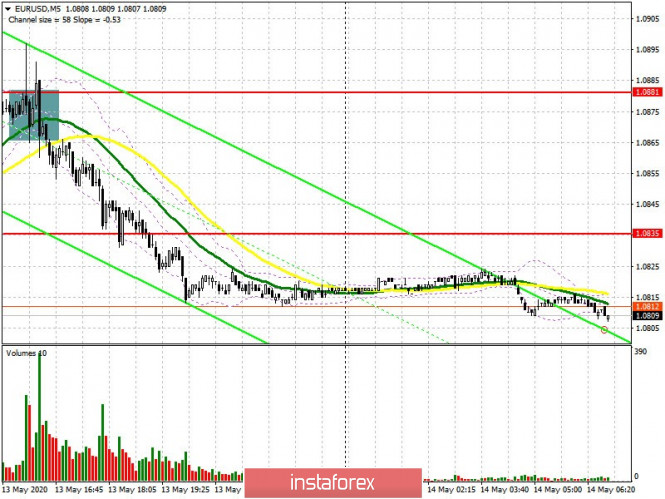

Yesterday's speech by Federal Reserve Chairman Jerome Powell resulted in the euro's fall against the US dollar. If you look at the 5-minute chart, you will see how an unsuccessful attempt to grow above 1.0881 led to forming a false breakout, and then to a sell-off of the euro to the support area of 1.0835, which the bears managed to gain a foothold below in the afternoon, which kept the market on their side. Currently, euro buyers need to concentrate on maintaining support at 1.0787, since forming a false breakout in this range will be the first signal to open long positions, which can lead to an upward correction in the area of the middle of the side channel of 1.0835. Movement above this level will directly depend on inflation data in Germany and reports on Italy and France. Consolidating at 1.0835 will be an excellent signal to continue the euro's growth in the area of yesterday's high at 1.0881, where I recommend taking profits. In the scenario of EUR/USD decline to the 1.0787 level, it is best to postpone long positions until the test of new local lows near 1.0728 and 1.0636, from which you can buy the pair based on a rebound of 30-35 points within a day.

To open short positions on EUR/USD you need:

Sellers managed to take control of the 1.0835 level yesterday, and the primary task at the European session is to defend it. Forming a false breakout at this level, along with a weak report on German inflation, will be a signal to open short positions in continuing the downward trend. However, a more important goal is to break through and consolidate below support 1.0787. This will increase the pressure on the euro and result in updating lows around 1.0728, and then to the large support test 1.0636, where I recommend taking profits. If active sales after the correction to the 1.0835 level do not follow, it is best to postpone short positions in EUR/USD until the test of a larger high of 1.0881, which is also the upper boundary of the side channel, or sell the euro immediately on the rebound from resistance 1.0923 per correction at 25 -30 points intraday.

I recommend that you familiarize yourself with other forecasts:

Trading plan for the European session on the GBPUSD pair for May 14

Signals of indicators:

Moving averages

Trading is slightly below 30 and 50 moving averages, indicating a bearish attempt to resume a downward trend.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

Growth will be limited by the upper border of the indicator at 1.0881. A break of the lower border around 1.0787 will result in a sharper decline.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.