Economic calendar (Universal time)

The following events can be noted and tracked in the economic calendar today:

9:30 composite index and index of business activity in the service sector (UK);

10:00 retail sales (eurozone);

13:15 change in the number of people employed in the non-agricultural sector (USA);

15:00 Index of Purchasing Managers in the Non-Productive Sphere (USA);

15:30 crude oil reserves (USA).

EUR / USD

The euro continues its victorious upward movement, not stopping either for pauses or for correction. The current result is closing above the daily cloud and testing the lower boundary of the weekly Ichimoku cloud. The main task in this situation is to consolidate in the weekly cloud (1.1147) and the ability to update the maximum extremum of the previous weekly and monthly upward correction (1.1240). Among the nearest supports that can be noted now are 1.1111 (daily cloud), 1.1063-75 (weekly Fibo Kijun + monthly Tenkan) and a wide zone 1.1010-1.0955 (weekly and daily crosses Ichimoku + historical levels).

The main advantage in the lower halves continues to remain on the side of players to increase. The upward reference points within the day are the resistance of the classic Pivot levels 1.1224 - 1.1279 - 1.1343. Moreover, on H1, we have been witnessing recently the emergence of a downward correction. The current corrective decline has already led to the fact that most of the analyzed technical indicators are ready to support the further strengthening of the bears. In addition, the players to decline have started testing support for the central Pivot level of the day (1.1160). Now, consolidation below the level will allow us to consider the further development of the correction. The main reference point of which will be the weekly long-term trend (1.1030), while intermediate support for today can be noted on S1 (1.1105).

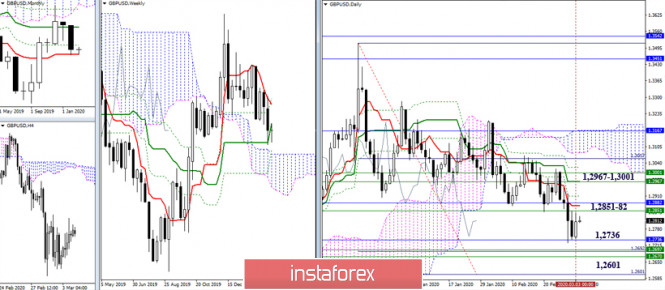

GBP / USD

After meeting with strong support for the area of weekly Kijun (1.2736) and monthly Tenkan (1.2736), inhibition is observed. The closest bearish benchmarks continue to remain at 1.2670-97 (the first target of the daily target + weekly Senkou Span B and Fibo Kijun) and 1.2601 (the level of 100% working out of the target for the breakdown of the daily Ichimoku cloud). At the same time, the associations of important resistance levels from different time intervals today also remain in their places - 1.2851-82 and 1.2967-1.3001.

On the other hand, prolonged inhibition of the higher halves contributed to the fact that in the lower halves, players to increase managed to gain a foothold above the central Pivot level of the day and are now close to testing the weekly long-term trend (1.2843). Now, consolidation above the moving average (1.2843), as well as overcoming the closest strong resistance of the upper time intervals (1.2851-82) will help change the balance of forces and further strengthen the players to increase. Meanwhile, returning to the central Pivot (1.2797) and further updating of the correction minimum (1.2725) may lead to testing of new bearish benchmarks located now at 1.2670-97.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com