To open long positions on GBP/USD you need:

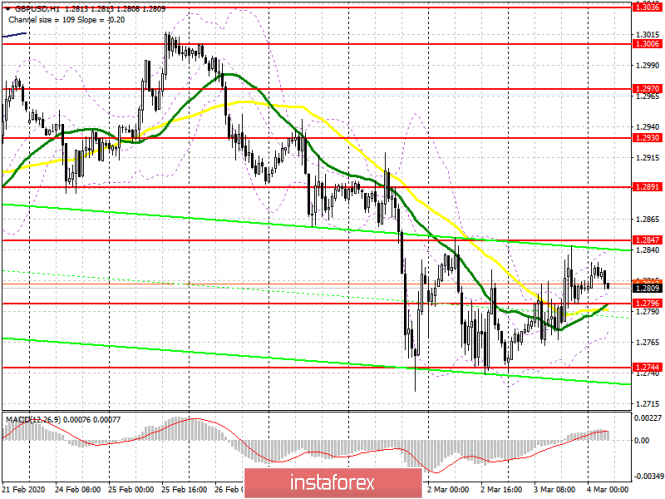

The Federal Reserve's decision to lower interest rates in the United States yesterday helped pound buyers regain resistance at 1.2796, above which the main trade is now taking place, which could save an upward correction. The primary goal of the bulls in the first half of the day is to break and consolidate above the high of 1.2847, which will lead to further growth of the pair and the resistance test of 1.2891, where I recommend taking profits. However, important PMI data for the UK services industry is coming out today that could significantly affect the market. In the event of a decrease in GBP/USD, only the formation of a false breakout in the region of 1.2796 will be a buy signal, while long positions can be opened at the bounce at the low of 1.2744, but with the expectation of a correction of no more than 20-30 points, since a break of 1.2796 increase the likelihood of a resumption of a downward trend.

To open short positions on GBP/USD you need:

The sellers are again faced with the task of returning the level of 1.2796 to themselves, consolidating below this range will raise the pressure on the pound and lead to a repeated update of the low in the area of 1.2744, and most likely, to its breakout and then it would pull down GBP/USD to 1.2707 and 1.2664, where I recommend taking profits. If the data indicates a decrease in the PMI index for the UK services sector, and most likely it will due to the impact of the coronavirus, then the formation of a false breakout in the region of 1.2847 will signal the opening of short positions. Otherwise, it is best to sell the pound only after testing the highs of 1.2891 and 1.2930.

Signals of indicators:

Moving averages

Trading is conducted slightly above 30 and 50 moving average, which indicates the likely continuation of the upward correction of the pair.

Bollinger bands

A break of the upper boundary of the indicator at 1.2834 will lead to an upward correction of the pound. A break of the lower boundary at 1.2780 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20