The euro-dollar pair started the trading week with another correction: it returned to the seventh figure during the Asian session, trying to gain a foothold in this price area. The previous attempt, which was made on Friday, was not successful. After taking off at 1.0831, the pair attracted sellers and lost almost 150 points in just a few hours. But on the first trading day, EUR/USD bulls again reminded themselves - partly due to positive news from China and negative news flow from the US. In addition, the dollar swap lines opened by the Federal Reserve with the ECB, the Bank of Japan and the Bank of England and nine other central banks slightly reduced the excitement around the US currency, although the greenback is still the main defensive asset for currency market traders.

Now many experts have asked the question: will the war for the dollar continue, or was the US regulator able to meet the existing demand through swap lines? The example of EUR/USD shows that the bears of the pair feel a certain discomfort, being below the seventh price level. Last week, they tested the sixth figure twice, but could not stay in this price area.

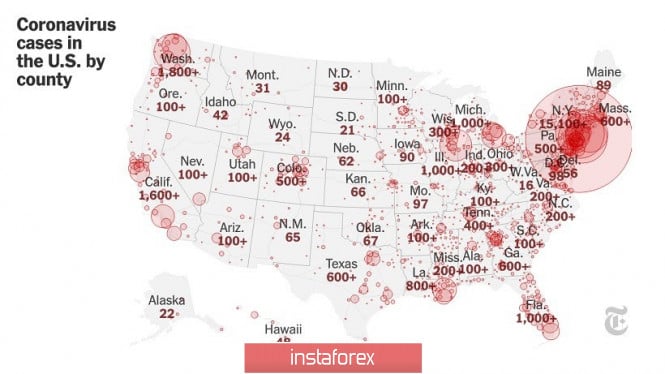

Meanwhile, the number of detected infections in the US is growing "by leaps and bounds" - by several thousand per day. In recent days, this figure has sharply jumped, and not only due to the spread of the epidemic, but also due to an increase in the number of tests conducted (about 200 thousand residents of the US were tested for coronavirus). The country was in the top three of the sad rating, coming in third place in the world in the number of cases - almost 40 thousand (although only about 26 thousand were known to be infected on Saturday). At the same time, the US overtook Spain, leaving only China and Italy ahead. The majority of infections occur in New York state, Washington state, New Jersey, California, Illinois, and Florida. There are fewer than a thousand cases in other states. Almost half of the 411 COVID-related deaths were reported in New York and Washington States.

The situation is particularly difficult in New York, which accounts for about five percent of all infections in the world. Supplies of necessary medicines there are coming to an end: according to the mayor of the city, the shortage will begin to be felt in ten days. In response, Donald Trump approved a declaration of emergency in new York, which will allow the state to allocate billions of dollars in Federal aid. But other states in the country have faced similar problems, or will soon face them – the governors are asking the Federal government to provide the necessary supplies.

It is worth noting that the dollar received some support from Trump at the end of the previous trading week. He stated that he still does not see the need to declare a nationwide quarantine. In addition, there was information on the market that the United States will spend about four trillion dollars to save the economy and pay three thousand dollars to each American family (this information was later confirmed by Steven Mnuchin).

But the rapidly deteriorating epidemiological situation in the US is putting background pressure on the US currency. The dollar index, which is still at a high level (103 points), shows negative dynamics at the start of the new trading week, reflecting the cautious attitude of investors to the greenback. Additional pressure on the currency was also exerted by unofficial data on the labor market, according to which about three million people applied for unemployment benefits last week – this figure is almost four times higher than the record high that was set during the recession in the early 80's of the last century.

Thus, the dollar is currently in limbo. On the one hand, it still retains the status of the most reliable defensive tool. On the other hand, traders are concerned about the events that occur in the United States. If the rate of spread of COVID-19 will increase (and this scenario is very, very likely, given the latest trends), the United States will go to a nationwide quarantine following the example of California. This fact will affect the production sector in particular, and the economy as a whole, despite government stimulus programs.

For example, Tesla has already announced that today it is halting production not only in California, but also at the Buffalo plant, which is located in New York state. In addition to Tesla, production on the American continent is also suspended by General Motors, Ford and Fiat Chrysler. A similar decision was made by the German automobile concern BMW - they announced the cessation of production at their plant in South Carolina, where more than 11 thousand people worked.

In other words, the buzz around the dollar may decline this week. In addition, the US economy does not need an overly expensive currency, since revaluation is ricocheting on financial conditions. After the dollar index exceeded 103 points, the market began to talk about the high probability of the Fed participating in currency interventions. In addition, the option of coordinated actions in this context by the G7 countries (which can organize, for example, a big dollar sell-off) is not ruled out. According to a number of currency strategists, the greenback will cross the red line if the dollar index consolidates in the 104th figure. However, such rumors may become an occasion for profit taking from dollar bulls. This fact will help EUR/USD buyers develop large-scale correction, and at least return to the eighth figure. Otherwise, the pair will again fall into the sixth figure - if, contrary to all, the excitement around the greenback does not subside.

The material has been provided by InstaForex Company - www.instaforex.com