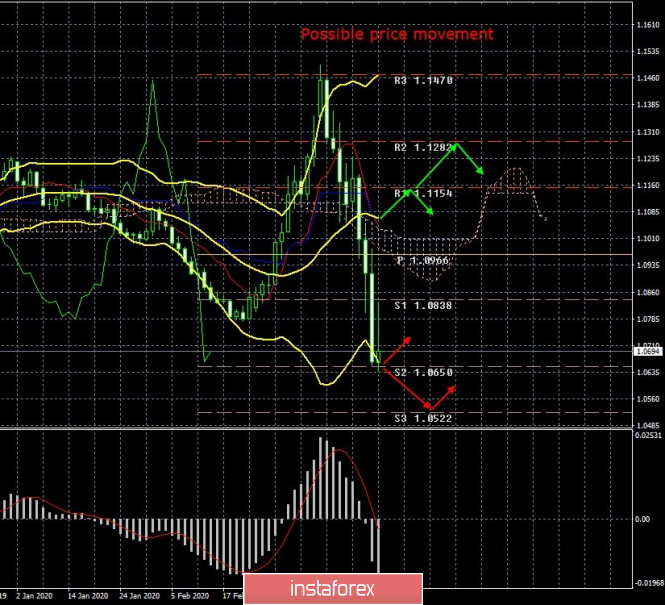

24-hour timeframe

The currency pair has fallen by 400 points over the past trading week. In the current conditions, this figure does not seem to be the lower limit of losses for the European currency. On the 24-hour chart, the pair's quotes fell to the second support level of 1.0650 and it even failed to overcome this level on Friday. Thus, there are some hopes for the beginning of a corrective movement. Although we can say that on Friday most of them were dispelled, as in the afternoon, the bears again began to attack the euro. Thus, the downward trend movement is maintained. The highest volatility of the pair is maintained. And the worst thing is that the rate of spread of the coronavirus across the planet continues. At the moment, according to official information, more than 300,000 people around the world have been infected. However, we are all well aware that the real figure is much higher. 171 countries are already considered infected, and the largest centers of infection are now located in Italy, the United States, Spain, Germany, Iran, and France. Thus, the situation with the global epidemic is not yet resolved. Accordingly, the panic does not leave the currency market, the stock market, or the commodity market. Despite the fall in demand for oil and the next oil war, the price of the world's number one energy carrier cannot remain below or even slightly above its cost price for a long time. According to some experts in this field, US shale oil will have to leave the world market. However, from our point of view, this will not happen and, rather, it will end in another world conflict. Commercial at best. It is unlikely that US oil companies will simply shut down their production until better times. This is not in the interests of either the companies themselves or the US government. Even now, threats to the key culprits of the sharp decline in oil prices are being heard from across the ocean. Saudi Arabia and Russia are blamed for the collapse of the oil market, and the Saudis are also accused of dumping prices. That is, unfair competition. Thus, we believe that oil prices can recover only if the conflict between OPEC and Russia is resolved and a new one is not initiated.

So far, all these details have an indirect meaning for the currency market. We still cannot say that the collapse of European currencies is influenced by any specific factors from the European Union or the United States. Thus, most likely there is an influence of all factors combined, or a banal panic in which market participants trade based on their personal considerations and do not follow the market at all.

Unfortunately, the coronavirus is still the number one topic for the whole world. At least it's because no macroeconomic statistics currently affect the movement of currency pairs. The actions of central banks and governments do not affect either. Traders remain in a state of panic, as the epidemic has a strong impact on all areas of activity almost around the world. While the United States came out in third place with the most number of infected with the Chinese virus in the world, Donald Trump continues to make promises for an early victory over the epidemic. "It can be done sooner than many think," said the leader of the offensive of the United States. However, official statistics and statements from representatives of the medical sphere suggest the opposite. More precisely, the number of infected people in the United States has increased to 26 thousand and almost half of them are in New York. All states of the country have been quarantined. For example, the so-called full lockdown quarantine mode has been introduced in California. It means that citizens are forbidden to go outside for no apparent reason, only to a bank, grocery store, or pharmacy. There is no longer any panic in the stores. It was noted only at the very beginning of the epidemic, but now most citizens have calmed down and are sitting at home without panic.

But in Italy, which is the leader in the number of cases in Europe, a strict quarantine is introduced, which means stopping the work of all industries except the vital ones. Any physical or sporting activity on the street is prohibited. All construction projects are stopped, and all entrepreneurs must suspend the activities of their companies, with the exception of the areas of food and medicine supply. These measures mainly concern the region of Lombardy. The situation is not much better in Germany, where more than 20,000 people have been infected with the coronavirus. There are not so many people who died from the virus, about 70 people, and more than 200 have recovered. The country is also under quarantine.

The strongest downward movement continues from a technical point of view. But just as we said before the crisis, the euro and the pound often grow against the dollar unreasonably, so now we can say that the dollar does not deserve such a sharp strengthening. However, the US currency's growth may continue next week, and could be followed by a reversal upward and no less strong weakening of the US currency. Anything is possible. Markets in a state of panic are out of control. It is impossible to predict where a particular currency will move. The best thing to do is to follow the trend based on the indications of technical indicators.

Recommendations for short positions:

Sales of the euro remain relevant in the 24-hour timeframe, since all indicators are directed downward. The target is 1.0522. Turning the MACD indicator up may indicate the beginning of a correction, but it can also be very late with the reaction.

Recommendations for long positions:

Euro currency purchases with a target of resistance level 1.1282 can be considered no earlier than overcoming the Kijun-sen line. However, such a development is not expected in the near future.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

The material has been provided by InstaForex Company - www.instaforex.com