4-hour timeframe

Amplitude of the last 5 days (high-low): 127p - 102p - 157p - 119p - 92p.

Average volatility over the past 5 days: 120p (high).

The EUR/USD currency pair unexpectedly resumed the upward movement on Thursday, March 5. Thus, the correction was of the weakest nature; quotes of the pair were not even able to reach the critical Kijun-sen line. Based on this, we make an unambiguous conclusion: bulls continue to own the initiative in the market, do not want to let the euro go, believe in a further weakening of the US dollar. In general, all the reasons that provoked a strong strengthening of the euro in the last two weeks continue to be in effect. And it does not matter that most of these reasons are completely contrived by traders. Indeed, in fact, only one thing is important - whether market participants will buy (or sell) this or that currency. And why they do this is a secondary issue. Typically, markets are driven by speculators, that is, players who wish to capitalize on exchange rate differences. However, in addition to speculators and traders, there are also other participants on the market who buy this or that currency to conduct their own business, business, conduct international trade operations and settlements. It does not matter to them whether it is advisable at this time to buy the euro in terms of fundamental analysis. If they need the euro then they will buy it. If they need to hedge risks then they are buying the euro for the future. Thus, now the euro/dollar is in such a turbulent trading period, when the foundation has minimal impact on the movement of the pair. And the movement itself is illogical and unreasonable. In this case, more attention should be paid to technical analysis, which just shows the current trend in the market and does not try to predict when the current upward trend will complete. This is exactly what we do not recommend to traders: try to guess when the euro will strengthen and sell the pair in an upward movement. You should trade "in the trend", even if the "foundation" is against.

Meanwhile, markets continue to be in a state of panic. Or if not panic, then in an excited state. After the Fed decided to soften monetary policy immediately by 0.5%, the US stock market began to recover. As of March 4, stock indices rose significantly. The S&P 500 and Dow Jones added more than 4% each. However, as we see, this did not affect the position of the US currency. It did not manage to correct normally after a strong fall, and news about the growth of the US stock market did not lead to an increase in the dollar. Thus, our hypothesis that the stock market did not fall caused the depreciation of the US dollar. In the same way, other "popular" theories of the fall of the US currency do not work in this case. The euro and the dollar are simply not being traded now in accordance with macroeconomic data, which is why there is no point in looking for logic in the behavior of the market.

At the same time, many experts and analysts are almost completely sure that the ECB will be the next central bank to cut the key rate. First, the situation with coronavirus requires the intervention of a European regulator. Secondly, this week it became known that inflation in the European Union began to slow down again and reached only 1.2% y/y. Thus, the recent statements by the EU and Christine Lagarde that "inflation is the key indicator and the ECB will strive to achieve the target level using any monetary instruments" are of particular importance now. Since inflation is falling again, many central banks of the world have already lowered the rate, the ECB will also take this step with a 95% probability. Experts believe that the ECB will again lower the current deposit rate by 0.1% and bring it, thus, to a value of -0.6%. In fact, with negative rates, the ECB wants financial institutions to take out loans rather than place money on deposits. The exact same decision is expected from the Bank of England. It remains for us to understand how the market can react to these events. For example, today no macroeconomic statistics have been published either in the United States or in the European Union. Nevertheless, the currency of the European Union began to rise again. Will it continue to grow if the ECB softens monetary policy even more? In the long run, from our point of view, such a decision by the ECB will negatively affect the position of the euro. However, who is now worried about the future course of the euro or the dollar? In general, the balance of power between the dollar and the euro will not change in this case. Monetary policy in the United States will remain stronger than in Europe. Thus, we do not believe that the euro can continue to grow for a long time. That is, from a technical point of view, growth can continue as long as you like. The only condition for the technique is the presence of corrections (which are also missing now). But the period of illogical movement from the point of view of the foundation will end sooner or later, and then everything will fall into place.

The technical picture now indicates the resumption of an upward trend. The pair once again worked out the resistance level of 1.1209 and can bounce off of it, starting a new round of correction. Overcoming this level will open the way for the pair to move upwards.

Trading recommendations:

The EUR/USD pair retains the same chances for the beginning of the correction, and for the continuation of the upward movement. Thus, new long positions can now be considered with the objectives of 1.1209 and 1.1255, as the MACD has turned up. It will be possible to sell the pair with the first goal of the Senkou Span B line, when traders will be able to gain a foothold back below the critical line.

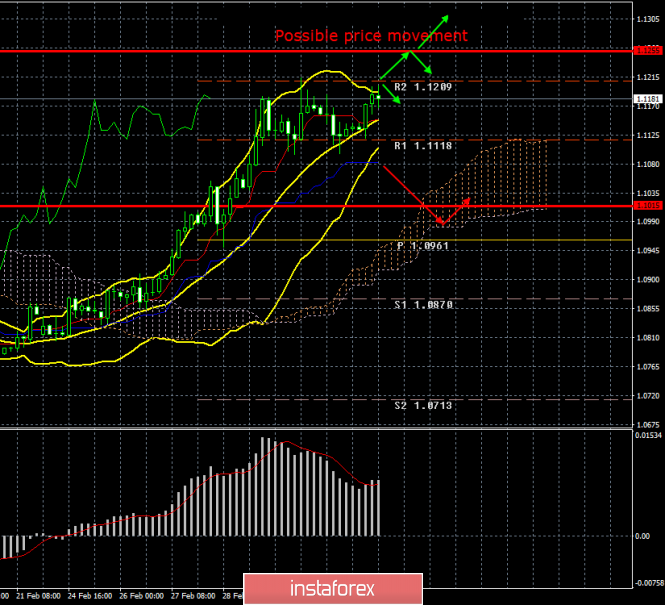

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com