The serious concern of investors about the impact of coronavirus on the global economy and the growing likelihood of a weakening Fed monetary policy have become catalysts for falling US Treasury bonds and stock indices. Such an external background is simply a haven for asset seekers. Including the Japanese yen, which managed to strengthen against the US dollar to a 3-week high. If the epidemic in China continues to gain momentum, and Boeing's problems force the US GDP to slow down, the USD/JPY pair has good chances to resume a downward track.

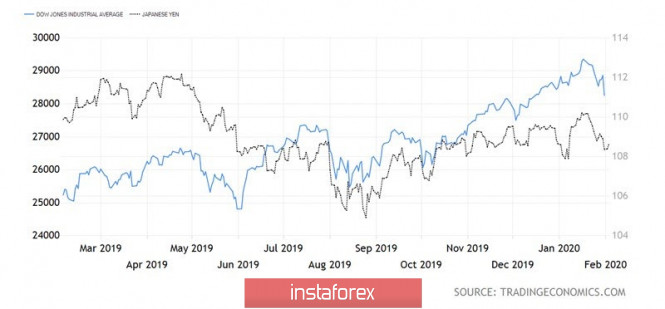

After the Bank of Japan began to target the yield curve, the yen became more dependent on US macroeconomic statistics than on domestic factors. Firstly, the Japanese is the main funding currency, and the S&P 500 rally naturally led to an overflow of capital from Japan to the United States, which contributed to the growth of USD/JPY. As soon as it began to smell fried, Japanese investors returned money to their homeland. There were plenty of such situations in past years. One trade war is worth it. In 2020, cataclysms became more frequent. And while stock indices did not respond to the conflict in the Middle East, fears of a slowdown in Chinese GDP growth to 4.5% in the first quarter forced them to go down.

The dynamics of the Dow Jones and USD/JPY

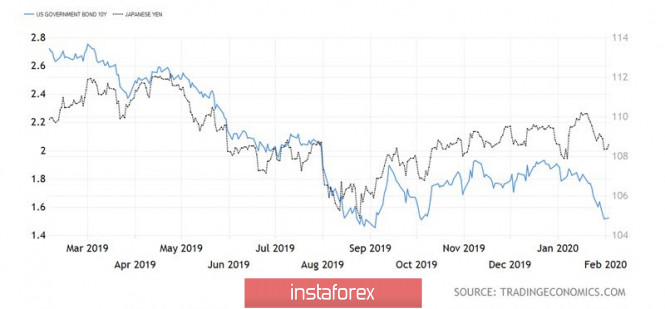

Secondly, fixing the rates of the debt market, BoJ increased the sensitivity of the analyzed pair to macro statistics from the United States. US GDP growth of 2.1% in the fourth quarter did not mislead investors: the economy expanded beyond the light of net exports. Extremely unreliable driver. Domestic demand is weak, and here is Boeing with its 737 MAX. The company planned to sell $30 billion worth of aircraft in 2019, but not only was the operation of a new brand banned, who wants to fly it after several tragedies? The US economy runs the risk of missing 0.5 pp in the first quarter. And this is a serious argument in favor of resuming the cycle of the preventive easing of the monetary policy of the Fed. If at the beginning of the year the derivatives market did not believe in it, and a week ago it talked about November, now it gives a 60% chance that the FOMC will reduce the rate on federal funds in June. It is easy to understand how the US dollar feels in such conditions.

The dynamics of the yield of US bonds and USD/JPY

Given the increased sensitivity of the yen to US statistics and the rich economic calendar for the United States, it is easy to guess which currency claims to be the most interesting one in the week of February 7th. The release of data on business activity in the manufacturing sector, services sector, as well as labor market will allow investors to understand whether the US economy will really lose steam in the first quarter?

Technically, the Expanding Wedge pattern continues to form on the daily USD/JPY chart. To complete the graphic configuration, quotes should fall below support at 107.65. In this situation, the risks of targeting will increase by 88.6% and 113% according to the Shark pattern.

The material has been provided by InstaForex Company - www.instaforex.com