The British pound fell into the abyss after the promising growth that took place last Friday after the UK finally left the EU. Now both parties have entered a transitional period, which will last until the end of this year, and during which the UK and the EU intend to conclude a trade deal. Formal negotiations will begin in March this year.

The reason for the sharp drop in the pound was British Prime Minister Boris Johnson's statement that Britain would refuse to follow the EU rules in a potential trade deal, while the European side, on the contrary, requires unification of legislation. EU chief negotiator Michel Barnier said today that the EU is seeking a very ambitious trade deal with the UK, and in order to get zero duties and no quotas, the UK must guarantee fair competition. Barnier also noted that the deal should cover not only fishing and import and export duties for goods, but a wider range of services. In this case, we are talking about online trading, public procurement, telecommunications, etc. The EU has repeatedly drawn attention to the need to regulate UK financial services that do not meet their standards.

As a result of these statements, the pound lost more than 1.0%, wasting all Friday's growth, returning to support area 1.3060. European Commission President Ursula von der Leyen also warned British Prime Minister Boris Johnson of the futility of his tough stance in the Brexit talks. In her opinion, now there is no concept of free access to a single market. Now the relationship between the UK and the EU will be purely subject to mutual rights and obligations.

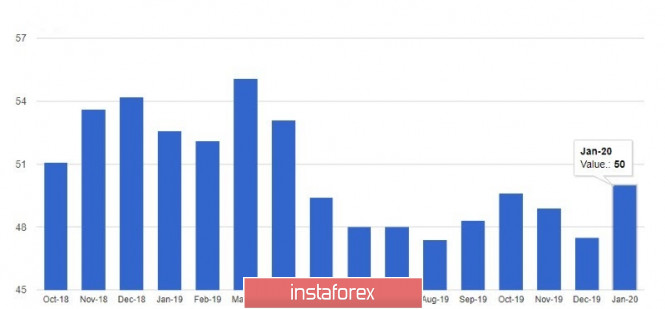

The pound did not help the data on activity in the manufacturing sector, which is again under threat, now due to the spread of coronavirus. According to the IHS Markit report, the PMI for Purchasing Managers Index for the UK manufacturing sector rose to 50.0 points in January this year from 47.5 points in December. An index above 50 points indicates a recovery in activity and signals stabilization in the sector. The preliminary index for January was 49.8 points. However, the worldwide spread of coronavirus again risks putting pressure on the manufacturing sector, which will lead to an increase in inventories and a decrease in demand for new orders, thereby slowing down the investment of companies.

As for the technical picture of the GBPUSD pair at the moment, the collapse and return of the pair to the area of a low at 1.3060 again puts the market participants in limbo, who will guess the trading instrument's further direction. The upward trend, which was formed from January 28-29, has not yet been broken, so after a slight stabilization of the situation, we can expect a return on demand for the pound, but much will depend on the direction in which negotiations between the EU and the UK develop. A break of the 1.3030 low will only increase the pressure on the pair, which will return GBPUSD to the January lows in the areas of 1.2990 and 1.2960.

EURUSD

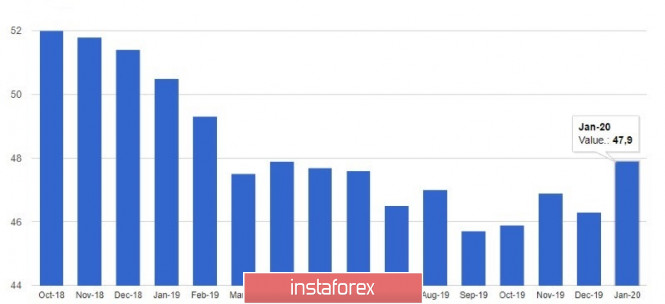

As I noted above, improvements in the manufacturing sector at the beginning of this year may be temporary. Growth was noted in many countries of the eurozone. According to Markit, the PMI Purchasing Managers Index for Italy's manufacturing sector rose to 48.9 points in January against 46.2 points in December with a forecast of growth to 47.3 points. In France, a similar indicator in January reached 51.1 points with a forecast of 51 points and a December figure of 50.4 points.

In the eurozone as a whole, the PMI for the manufacturing sector also moved closer to 50 points in January and amounted to 47.9 points against the forecast of 47.8 points. Back in December, the figure was at the level of 46.3 points. The recovery of the manufacturing sector after the signing of the first phase of the trade deal between the United States and China may continue, but, as I already said, a new threat of the spread of coronavirus has appeared, which will certainly hit the global economy and, first of all, the manufacturing sector, which is already in a very shaky position.

Technical picture of the EURUSD pair remains unchanged. Support is already provided by the area of 1.1060, but larger buyers of risky assets can release the market to a low of 1.1035, where, most likely, a new lower boundary of the current rising channel will form. The bulls return to themselves the resistance of 1.1090 will open a direct path for the pair to grow to the area of highs 1.1115 and 1.1140.

The material has been provided by InstaForex Company - www.instaforex.com