The yen paired with the dollar retreated from local highs – the impulse growth of the price brought it to the middle of the 112th figure, however, the bulls could not hold their positions at this height. During the spring of last year, the Japanese currency was so cheap. However, even then, buyers of USD/JPY did not break above the mark 112.44. At the moment, the pair has consolidated at the border of 110 and 111 figures, after a sharp price pullback. The yen cannot determine the direction of its further movement – on the one hand, panic sentiment in the markets is growing (as is the demand for protective instruments). On the other hand, the Japanese currency is under pressure from its own problems. Extremely weak data on Japanese GDP growth for the fourth quarter forced traders to reconsider their attitude to the yen, despite the continued appetite for "safe haven" instruments. Still, the market cannot finally determine the role of the Japanese currency in this situation. The fact that the USD/JPY pair did not gain a foothold on the price heights it won indicates the indecision of the bulls – therefore, long positions now look risky. But short trading positions are also questionable, as the prospects for growth of the Japanese economy in the first quarter of 2020 look bleak.

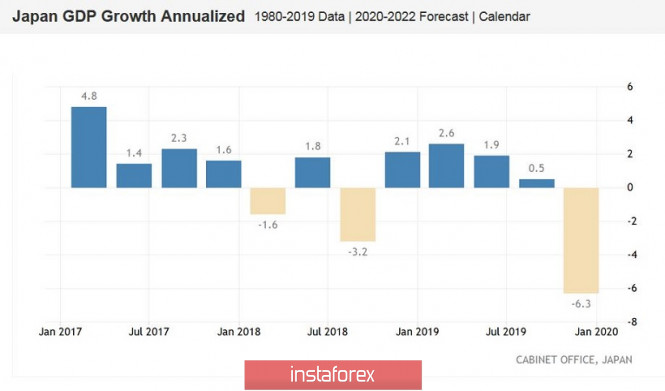

Let me remind you that the volume of Japan's GDP in the last quarter of last year decreased at the highest rate in the last six years, following the increase in the consumption tax in the country. The indicator came out at -6.3% compared to the same period in 2018. The key indicator fell into negative territory for the first time since the third quarter of the year before last. And here, it is worth emphasizing that the Japanese economy showed a negative result in the 4th quarter of 2019, that is, when almost nothing was known about the coronavirus. In other words, this factor has not yet had any impact on economic processes, either on a local or global scale. Among the main reasons for the slowdown in economic growth, experts say the fact of increasing the sales tax, the consequences of the devastating typhoon "Hagibis" and weak global demand. After the sales tax was raised in Japan, consumer spending immediately collapsed by 2.9%. Business investment also declined significantly – this figure fell by 3.7% with a projected decline of 1.6%. Exports similarly showed weak dynamics against the backdrop of the ongoing trade war between the United States and China.

In the first quarter of this year, all the above circumstances will be joined by the factor of coronavirus. Therefore, according to most experts, the Japanese economy will show negative dynamics in the period of January-March, indicating the reality of a technical recession. It is noteworthy that the Japanese authorities are not in a hurry to consider the option of fiscal stimulus – according to Japanese Finance Minister Taro Aso, his office "closely monitors the situation in the currency and other markets", but does not yet consider the introduction of additional measures to support the economy.

The head of the Bank of Japan is also in no hurry to answer the question – will the Japanese regulator respond to the current situation? The yen collapsed across the market precisely because of the prospects for monetary policy easing – in response to the increased risks of a technical recession. But Haruhiko Kuroda did not give a clear answer about the Central Bank's intentions and expressed confidence that the country's economy will begin to recover "in the near future." He said that the Central Bank's forecast that Japan's main economic indicators will recover gradually and steadily is still valid. In response to a clarifying question about the prospects for monetary policy, Kuroda repeated his standard phrase that the regulator is "ready to act if necessary", adding that he does not see any need for such a decision today.

After this performance, the yen paired with the dollar turned 180 degrees and returned to the 110th figure. The market is clearly puzzled by the current situation, so the pair is currently fluctuating in a relatively narrow price range.

If the probability of retaliation by the Japanese regulator decreases (at least in the context of the March 19 meeting), the yen will again be used by the market as a protective asset. And given the fact that the coronavirus still keeps financial markets at bay, the prospects for the USD/JPY pair looks bearish. This week (Thursday), Bank of Japan representatives Masayoshi Amamiya and Goushi Kataoka are expected to speak. If they confirm the probability of maintaining the status quo at the March meeting, the yen will again "spread its wings". The nearest support level for USD/JPY is 110.00, which is the average line of the Bollinger Bands indicator on the daily chart. The next "stop" is at 108.90 (the lower limit of the Kumo cloud on the same timeframe).

The material has been provided by InstaForex Company - www.instaforex.com