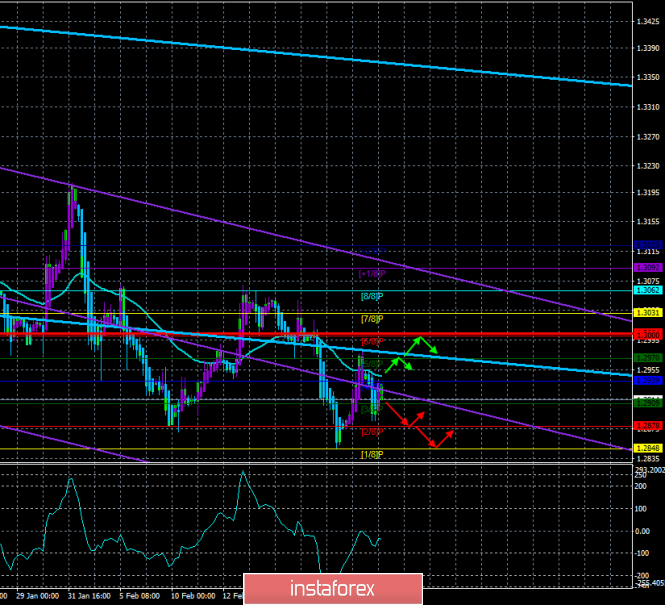

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - down.

CCI: -31.420

On February 25, the GBP/USD currency pair starts with a new round of corrective movement against the downward trend. On Friday last week, the pair's quotes had the opportunity to gain a foothold above the moving average line, however, it did not take advantage. The new trading week opened with a gap down, which led to the resumption of the downward trend. However, at the same time, bears do not find new reasons for selling the British currency or buying the US dollar. The macroeconomic background this week will be extremely poor, so traders can only count on speeches by top officials of the UK, the European Union, or the United States on topics related to London's trade negotiations with Washington or Brussels. Only this information can trigger serious exchange rate changes in the pound/dollar pair.

A hearing on the inflation report is scheduled for today in the UK. An event with a "high-profile" name that is unlikely to have any impact on the currency market. Also in the UK today, the CBI report on retail sales – sales volume for February, which is also frankly secondary. In the United States, the housing price index and the index of business activity in the manufacturing sector of the Federal Reserve of Richmond will be published. All data from overseas is also secondary. Thus, on February 25, traders will have nothing to pay attention to. If the euro has a strong technical correction factor, then the British currency does not have such a factor. Thus, it is unlikely that we will see a resumption of the downward trend and strong depreciation of the pound in the coming days.

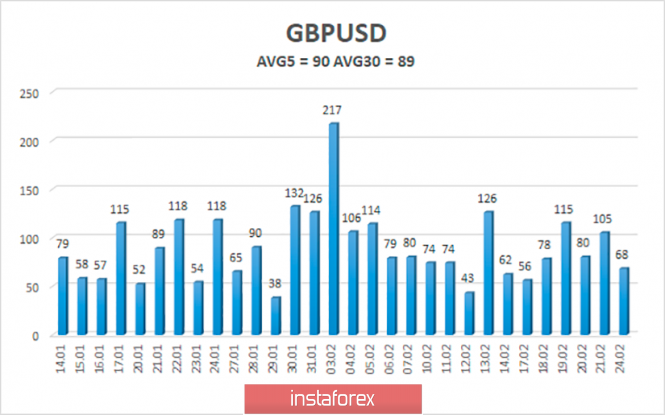

The average volatility of the pound/dollar pair over the past 5 days is 90 points and is characterized as "average" in strength with a downward trend. According to the current level of volatility, the working channel on February 25 will be limited to the levels of 1.2824 and 1.3004. A new downward reversal of the Heiken Ashi indicator will indicate a possible resumption of the downward movement, however, it is difficult to count on a trend movement when the macroeconomic background is almost empty.

Nearest support levels:

S1 - 1.2909

S2 - 1.2878

S3 - 1.2848

Nearest resistance levels:

R1 - 1.2939

R2 - 1.2970

R3 - 1.3000

Trading recommendations:

The GBP/USD pair is adjusted again. Thus, it is recommended to resume selling the pound with the targets of 1.2878 and 1.2848 if the pair rebounds from the moving average or the Heiken Ashi indicator turns down again. It is recommended to buy the British currency not earlier than traders have passed the moving average line with the first targets of 1.2970 and 1.3000 since the fundamental factors remain on the side of the US currency.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com