4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - down.

CCI: -129.5954

For the EUR/USD pair, the third trading day of the week starts from the same point as the previous 16 days, with a downward movement that does not stop. Over the past day, the pair's quotes managed to work out the Murray level of "1/8"-1.0803, however, there was no hint of a rebound from this level. The Heiken Ashi indicator remains directed downward, which also indicates that there is no correction. Several minor publications on Tuesday failed to change the mood of market participants, so a fairly strong downward trend remains, and the downward movement may continue for a long time. The longer the euro falls, the more we get the feeling that the market is looking for a certain level at which large deferred purchases are located. It is from this level that a rebound can follow with the beginning of a correction, which will later be picked up by the bulls. We would like to assume that some fundamental event may trigger a correction, however, the chances are too small, given the fact that macroeconomic statistics from the European Union continue to fail from time to time, while in the United States, on the contrary, continues to strengthen.

The case for the impeachment of Donald Trump is closed, however, the Democrats continue to exert all sorts of pressure on the US President. For example, the Speaker of the House of Representatives, Nancy Pelosi, who is remembered for tearing up the text of Donald Trump's speech right behind his back and generally showed all sorts of hostility to the odious leader, said that she could not imagine a situation in which Trump would be re-elected for a second term. According to Pelosi, the impeachment of Donald Trump has been announced and the president will not be able to wash away this stigma. Formally, Trump is acquitted. However, Pelosi said it was only because the Senate refused to call new witnesses in the process of considering the case, who could and would have provided new documents and evidence of the US President's guilt. "You can't justify anyone if there is no trial. And you can't have a trial if you don't have witnesses and documents. He (Donald Trump) can say that he was acquitted and the headlines in the press can say "acquitted", however, he was impeached and this mark will remain on him forever," the Speaker of the Lower House said. Nancy Pelosi also called on party members to show "unity" and make every effort to prevent Trump from being re-elected for a second term. "I can't imagine a situation where he was re-elected. We (Democrats) have our own vision of the future. We must be united in order to prevent him from being elected for a second term," Pelosi concluded.

Thus, the point in the confrontation between the Democrats and the Republicans, which, under the presidency of Donald Trump, reached its zenith and clearly no longer fits into the term "fair competition," is still early. Recall that in November 2020, the US presidential election will be held, in which Trump expects to win. His political ratings continue to grow according to various sociological studies, however, he still loses to almost any candidate from the Democratic Party. By the way, have you noticed how abruptly Trump stopped making loud statements via Twitter, how the topic of trade negotiations with China came to naught? After all, negotiations on the "second phase" of the trade agreement should already begin right now. However, there is no information about this, although both Steven Mnuchin and Donald Trump regularly made statements during the entire period of the "first phase" negotiations. We believe that the US President decided in the last months of the election race to put himself in the most attractive light before the Americans. To this end, he no longer wants to make high-profile statements that may be negatively perceived by some segments of the US population. Especially if these layers are still in doubt about who to support in the upcoming elections.

Meanwhile, the Chinese Ministry of Finance has published a list of nearly 700 American products that will be exempt from the duties imposed earlier. This list includes agricultural products and energy resources. According to the agreement, which the parties signed on January 15, China should increase the purchase of agricultural products in the United States to $200 billion over the next two years, as well as increase the purchase of raw materials to $95 billion. Thus, it is logical that these goods, which China will now have to buy without fail, should be excluded from the list of sanctions.

From a technical point of view, the downward movement continues. All trend indicators continue to be directed downward. Today, neither the European Union nor the United States has any significant publications planned, so the impact of fundamental factors on the mood of market participants will be minimal.

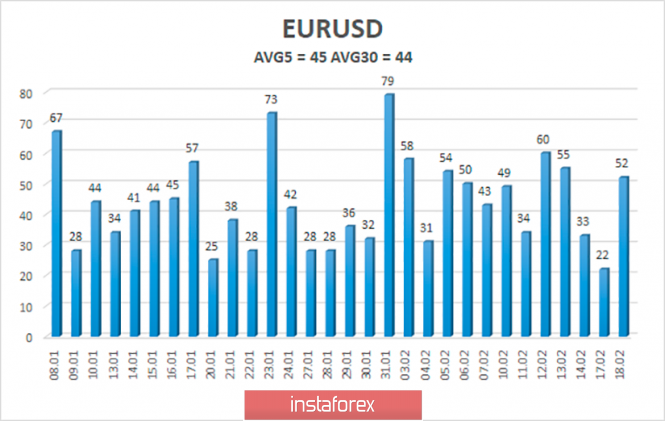

The average volatility of the euro/dollar currency pair has increased slightly and is now 45 points. However, on average, the pair continues to pass 40-50 points a day, and this indicator does not change. On Wednesday, we expect movement between the borders of the volatility corridor of 1.0745-1.0835. The fundamental background will be extremely weak again, and the Heiken Ashi indicator will announce the possible start of correction by turning up.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.1047

Trading recommendations:

The euro/dollar pair continues to move downwards calmly. Thus, sales of the euro with the targets of 1.0745 and 1.0681 remain relevant now, which can be kept open until the Heiken Ashi indicator turns up. It is recommended to buy the EUR/USD pair no earlier than the bulls cross the moving average line with the first target of 1.0925.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com