To open long positions on GBP/USD you need:

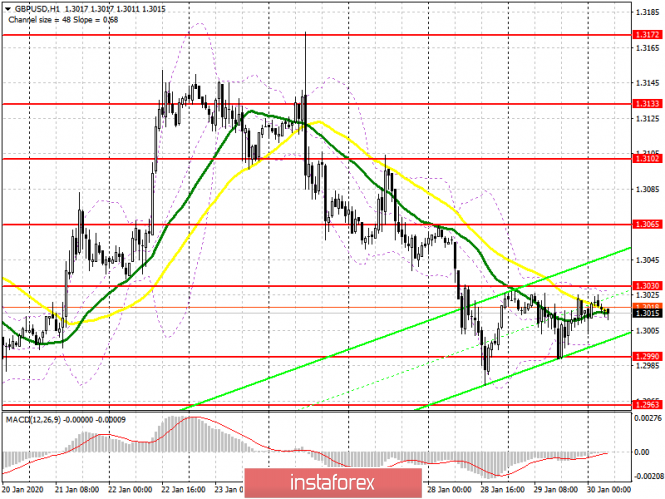

Yesterday, I paid attention to the support level of 1.2990 and said that a new lower boundary of the ascending channel could be formed from it, which, in fact, happened. At the moment, the bulls' primary goal is to break and consolidate above the resistance of 1.3030, which will lead to the demolition of stop orders of sellers and a larger upward correction to the area of highs 1.3065 and 1.3102, where I recommend taking profits. However, this scenario will only be possible after the Bank of England leaves interest rates unchanged. At the same time, a second test of support at 1.2990 cannot be ruled out. If the bulls do not have enough strength to cope with the pressure of sellers in the area of 1.2990, and the English regulator lowers rates, then in this scenario, purchases are best delayed until the lows 1.2963 and 1.2939 are updated, which will mean a bearish trend return.

To open short positions on GBP/USD you need:

Bears still need to form a false breakout around 1.3030, since only in this case the market will again come under their control, which will push the pair to support 1.2990, near which the lower boundary of the new rising channel was formed yesterday. However, the pound's direction today is completely dependent on the BoE's decision, so it is only possible to talk about technical analysis as guidelines. Consolidation below 1.2990 will quickly push GBP/USD to lows 1.2963 and 1.2939, where I recommend taking profits. If there is no pressure from sellers in the area of resistance at 1.3030, and the central bank leaves the rates unchanged, then in this case, short positions are best postponed until the test of highs 1.3065 and 1.3102.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving averages, which indicates market uncertainty before the release of important fundamental statistics.

Bollinger bands

A break of the upper boundary of the indicator at 1.3030 will lead to a surge in pound purchases. A break of the lower boundary at 1.3000 will raise pressure on the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20