As expected, the Fed's decision on monetary policy, as well as subsequent comments by its leader J. Powell, did not have a significant impact on the market.

The American regulator made the expected decision to maintain the parameters of monetary policy during the first meeting this year. The Central Bank left the target range for federal funds 1.50% -1.75%. At the same time, the interest rate on surplus reserves was also increased, up to 1.6% against 1.55%. The discount interest rate remained at around 2.25%. The decision of the voting members of the Open Market Committee (FOMC) was unanimous.

The regulator's resolution states that he will conduct the purchase of short-term treasury bonds throughout the year, while overnight repo transactions are planned to be maintained until the end of the first quarter. In general, the bank stated that inflation expectations and the hope that it would grow to the target level of 2.0% were maintained. The Bank also made it clear that consumption remains moderate, while exports and imports are weak. The labor market is strong amid moderate growth in the national economy.

On the other hand, Powell's speech did not contain any surprises. He expressed dissatisfaction with the persistently low inflation, which is kept below the 2.0% mark, expressed concern about the situation around the coronavirus and indicated that wages are growing mainly in the low wages segment.

In turn, the markets reacted to the final decision of the Federal Reserve and the speech of its head is restrained and without special emotions. The focus of investors remains the topic of the Chinese coronavirus and Britain's exit from the EU on January 31, as already decided by the local parliament. However, this pathetic event is expected on Friday, and today, the attention of market participants will be focused on the outcome of the meeting of the Bank of England on monetary policy. It is assumed that the regulator will leave all the parameters of monetary policy unchanged. The key interest rate at 0.75%, and the amount of asset repurchase in the amount of 435 billion pounds.

The focus of the market will also be the speech of the head of the Central Bank, M. Carney, from whom forecasts on monetary policy for the near future will be expected.

In our opinion, Carney will try not to rock the economic "boat" of Britain in anticipation of the fact of Brexit. Thus, in general, we do not expect any noticeable and radical changes in the currency exchange market today.

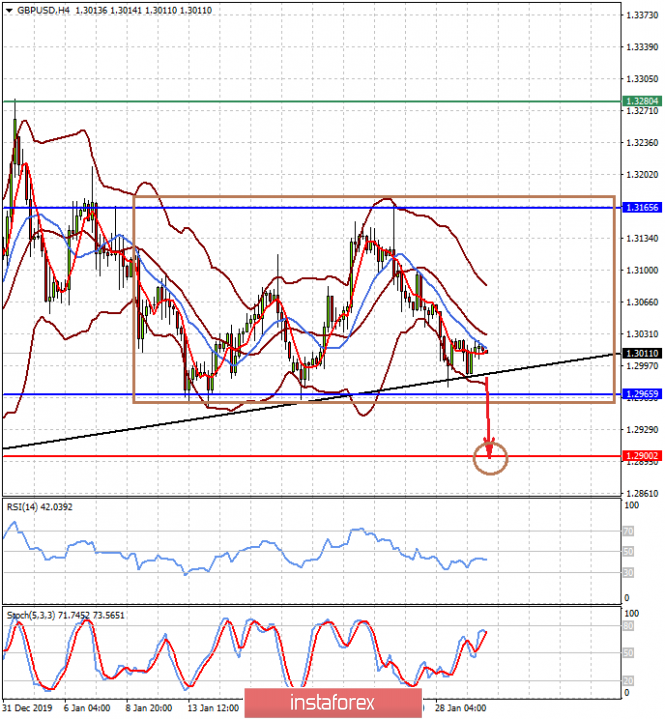

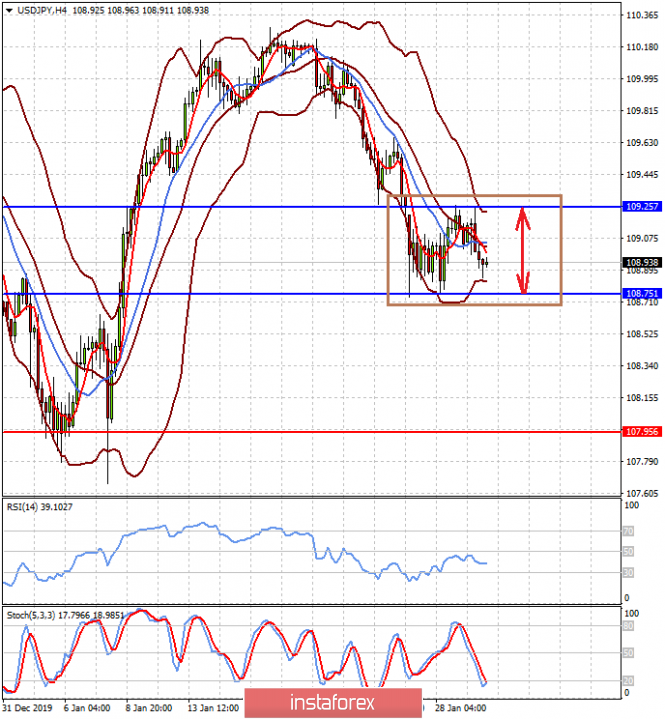

Forecast of the day:

The GBP / USD pair is consolidating in the range 1.2965-1.3165 in anticipation of the final decision of the Bank of England on monetary policy, as well as the fact that Britain will exit the EU, which will take place on January 31. We expect the pair to decline only if the bank unexpectedly decides to lower interest rates or M. Carney makes it clear in his speech. In this case, the droppings fall to 1.2900.

The USD / JPY pair is consolidating in a narrow range of 108.75-109.25 in the wake of reducing the fear that the situation with the coronavirus will turn into a pandemic. It is likely that the pair will consolidate today in this range, unless, of course, another negative with the coronavirus appears again in the news top.