The start of the year, which was not optimistic for the global economy, made investors forget about the Federal Reserve for some time.

Today, the regulator will announce the results of the first meeting this year.

Should we expect any surprises from the central bank, whose representatives almost say that the US economy is still on its feet, and monetary policy is in the right place?

The Treasury yield curve for some time went into the red zone for the first time since October last year. The chances of monetary expansion by the Fed until the end of the year are growing by leaps and bounds. It gives market participants food for thought.

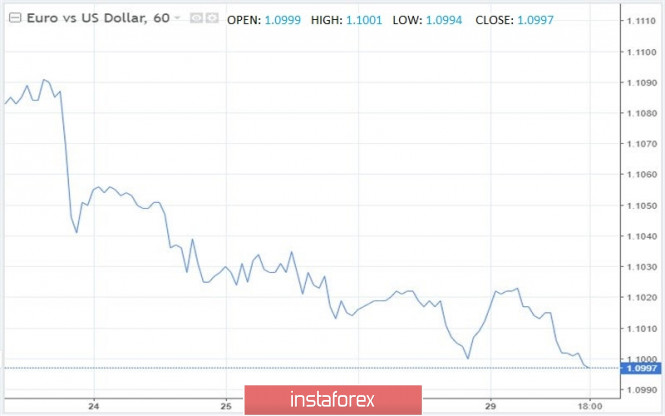

Short-term consolidation of the EUR/USD pair near the psychological mark of 1.1000 resembles the calm before the storm. Apparently, the US central bank managed to return attention to its person.

The fact that the Fed will keep the interest rate at 1.75% at the end of the January meeting is practically beyond doubt among investors. However, the issue of reducing the balance of the regulator seriously worries them.

In order to stabilize the situation in the US money market, the Fed began buying short-term promissory notes worth $60 billion every month, as a result of which the portfolio of assets of the central bank increased from $3.8 trillion to $4.1 trillion.

Fed Chairman Jerome Powell prefers not to call buying assets QE, and it is understandable: at one time, hints of curtailing asset purchases provoked negative sentiment in the financial markets. Obviously, the US central bank does not want to get on the same rake. Therefore, the regulator is unlikely to change anything in January.

Reducing the balance of the Fed would increase the cost of borrowing. This is not good news for a country whose budget deficit is expected to grow by $1 trillion annually over the next few years. In addition, according to estimates of the Congressional Budget Office, the volume of public debt to national GDP will expand from 81% (in 2020) to 98% (in 2030).

Do not forget about the correction of the S&P 500 index associated with the outbreak of coronavirus in China. There is an opinion on the market that stock indices are growing primarily due to the support of the Fed. If the central bank begins to tighten monetary policy, then US stocks will lose an important growth driver.

The inversion of the Treasury yield curve, which in the recent past forced the Fed to take on preventive monetary expansion, the pullback of the S&P 500 index, as well as increased international risks, makes it possible to count on the dovish tone of statements by Powell following the results of the next FOMC meeting. If this happens, then the EUR/USD pair will be able to cling to an important level of 1.1000.

The main currency pair's downwards path is largely due to the epidemic of coronavirus in China. The point is not only its negative impact on the global economy, but also the decline in oil prices and the associated peak in European five-year inflation expectations from 1.33% noted at the beginning of the year to 1.26%. As a result, the chances of easing the ECB's monetary policy in 2020 began to grow.

Thus, only the Fed can stop the fall of EUR/USD.

As for the medium-term prospects of the main currency pair, they will depend on how quickly the Chinese authorities manage to deal with the coronavirus and whether a new trade war breaks out - between the United States and the European Union. Getting answers to these questions will clarify the fate of not only the global economy, but also the euro.

The material has been provided by InstaForex Company - www.instaforex.com