It would seem that the policy of Donald trump is getting results. Stock markets are breaking records, the US population is close to full employment and getting richer, and China has signed the first phase of the deal on conditions that are humiliating for itself. However, something in this all reminds me of a TV show beloved by Americans. Indeed, what the American president has definitely succeeded in is creating external effects; in all other respects, experts have many doubts and questions.

It is one thing when these questions are raised by a well-known narrow-minded analyst who does not have public authority, and quite another when questions to Trump's economy arise among the luminaries of American economic thought. I follow a number of well-known economists close to the Democrat camp on Twitter, such as David Rosenberg, Nassim Taleb, Nuriel Rubini, Joseph Stiglitz. This saves me a lot of time in searching for information, and reading the opinion of Nobel laureates in economics is more useful than listening to the profane from every iron. So, even taking into account the democrats' dislike for Trump as an extrasystemic politician and anti-liberal, their opinion on "trumponomics" is unambiguous – Trump's economy is an information bubble, only partially supported by real results.

However, the US economy has a direct impact on many financial assets with tremendous liquidity, primarily in the public debt trading sector. The connection between the stock and bond market, gold and the Japanese yen does not need additional advertising, but if you have not heard about it, it looks like this – a decrease in US stock indices is usually accompanied by a decrease in government bond yields, an increase in the dollar and Japanese yen, as well as an increase in the price of gold. Therefore, in the context of this connection, I will analyze the market situation in the EUR/USD pair, which is the antagonist of the US dollar and was actively declining last week, precisely because of the growth of the dollar.

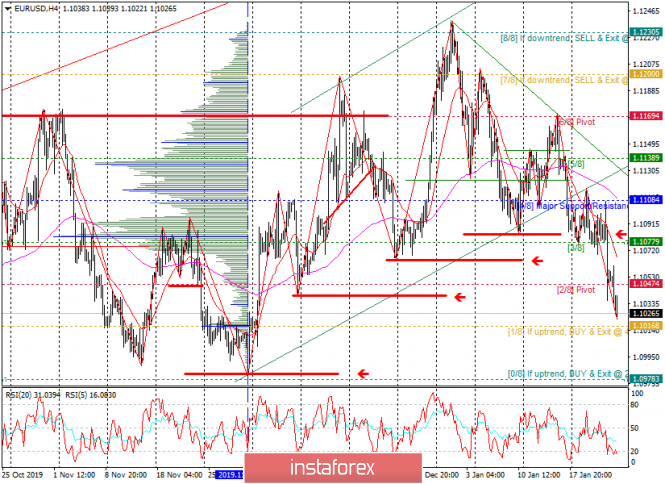

First of all, the technical picture of the European currency exchange rate should be considered. As you can see from the presented chart, the EUR/USD rate in December 2019 formed a local upward trend in the "H-4" time frame, with the base located at 1.0980 and rising lows at the levels of 1.1040, 1.1065 and 1.1085. After which, the euro began to decline having reached a maximum of 1.1240, and it overcame the above-mentioned highs from top to bottom in January 2020, thereby confirming the trend reversal and the beginning of a new trend, but already a tendency to decline. (Fig. 1). Frequent change of direction; this is a normal situation for the band formation, which the EUR/USD formed in 2019.

Due to the traded volumes, the key was the minimum of 1.1080 in the structure of the previous rising trend, for which there was a struggle, and where buyers made an attempt to stop the decline in the EUR/USD pair. However, that took place over the past week after a slight consolidation. This level was broken through and turned from support to resistance, which is a classic of technical analysis.

Fig. 1: Technical picture of the EUR/USD course

As follows from diagram 1, the European currency is no longer holding back anything as it is on the way to lowering to the lows of 1.0975 and 1.0950. In turn, the EUR/USD course is closed at the level of 1.1080 as seen from above, consisting of volume and technical support. Therefore, based on the rules of technical analysis, we should wait for the euro to return to the zone of values of 1.1050 or 1.1075, and after which, we can open EUR/USD sales in the direction of 1.0975 and 1.0950 if there are signals from our trading systems.

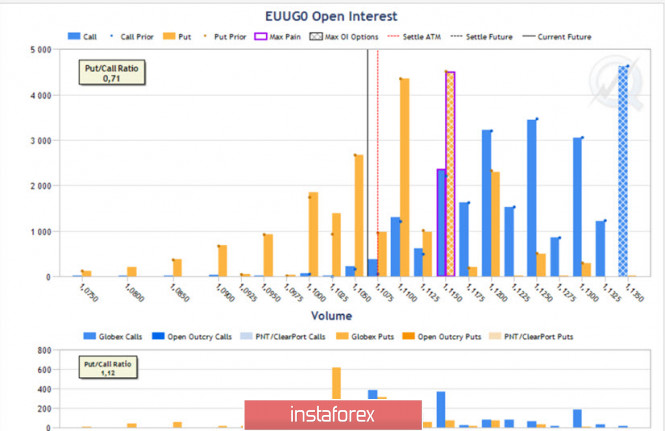

However, we will check our plan for compliance with the levels of optional support, where when considering you should take into account the difference (forward point) of +34 points between the contract in the InstaForex terminal and the futures. As follows from the CME data, at the moment, the price of the futures contract is significantly lower than the maximum pain point for MP options buyers located at 1.1150, the "last '' significant barrier hindering the European currency from freefall.

The current February option contract will be the second of three March futures option contracts, and the significance of this contract is not as high as that of the final EUH0 contract expiring before the futures close. However, the current option contract EUG0 is the most liquid, which makes it an important tool for analyzing the situation.

Figure 2: Open Interest in EU G0 Contract

First of all, the Put / Call Ratio = 0.71 ratio is noteworthy, which means that for 71 Put options, there are 100 Call options. The interpretation of this ratio is that the "crowd" is now counting on the growth of the euro, which means options sellers will not suffer significant losses if the price continues to decline downward. However, despite this, during the close of this contract, which will happen on February 6, option sellers would prefer to see EUR/USD between the values of 1.1125 and 1.1175.

Based on the current situation in the option market, it is quite possible to assume a decrease in the EUR/USD cash rate to the levels of 1.0950 and 1.0925. Thus, we may very well consider the possibility of selling the euro to the above values in the long term from one to four weeks, but whether the euro will be able to overcome them and fall below, while it causes me some skepticism.

It was not for nothing that I started talking about "trumponomics" at the beginning of this article. Relatively high interest rates in the US and negative rates in the eurozone led to currency arbitrage operations in the direction of exchanging euros for dollars, followed by the placement of dollars on the US market. Now, institutional investors have in the purchases of futures of the European currency - 8.8 billion euros of long positions. This does not reflect the general picture of what is happening, but is an absolute historical record.

Therefore, it can be assumed that in the event of a deep decline in the US stock market, investors with a short position in euros will be forced to close this position through purchases of European currency, which will cause demand for EUR/USD. In addition, you can be almost sure that Donald Trump will demand from the Fed a further rate cut, and especially insist on this if the stock markets are under pressure.

According to the CME exchange, 63% of participants now in trading futures for federal funds suggest that the rate will remain unchanged in June 2020, but not the fact that it will. If the Fed decides to lower the rate, then the first hints of a further weakening of monetary policy will be heard in March, during a press conference by Jerome Powell. Perhaps, hints will be made at the next Fed meeting, which will be held on Wednesday, January 29. Although, from my point of view, the head of the US Federal Open Market Committee has no reason to make such statements yet.

What conclusions can be drawn? In the short term, the euro will most likely make attempts to decline to the 1.0925 - 1.0950 zone from one to four weeks, gaining liquidity and trying to form negative moods for traders where speculators will take profits from their sales. The dollar will grow against a basket of foreign currencies. Moreover, statements by the new head of the ECB, Christine Lagarde, are likely to contribute to a further depreciation of the EUR/USD, which will occur against the backdrop of the British exit from the Eurozone. However, it is not yet clear whether the euro will be able to gain a foothold below the value of 1.09.

Then, by the beginning of March, the cash euro will most likely restore its lost positions and return to the zone 1.1125 - 1.1175, after which EUR/USD will begin to grow, which will occur against the backdrop of a decline in the stock market, and there will be statements by Donald Trump and hints of the Fed to further reduce rates. Be careful and follow the rules of money management.

The material has been provided by InstaForex Company - www.instaforex.com