The euro-dollar pair continues to show negative dynamics. Buyers made a weak attempt at corrective growth during the Asian session on Monday, but these efforts did not bring any results - the pair continues to be under pressure from the dollar, amid a general increase in anti-risk sentiment. Coronavirus continues to walk the planet, instilling fear not only with ordinary people, but also with market participants. At the moment, more than two thousand people have already been infected with the new virus, while the death toll has exceeded fifty. Obviously, the main theme of the current week will be the fight against new misfortune - if the pace of the epidemic spreads, the defensive instruments as well as the dollar will gain momentum along the way, regardless of the dynamics of other fundamental factors. Although the macroeconomic calendar of the last week of January is eventful.

If we ignore the Coronavirus theme, then the central event of the week for the EUR/USD pair is the January meeting of the Federal Reserve, which will be held this Wednesday. Let me remind you that the outcome of the December meeting was mixed. On the one hand, the members of the Fed removed the phrase "uncertainty regarding further forecasts" from the text of the accompanying statement. In addition, all members of the Committee voted to maintain the status quo unanimously - there has not been such cohesion in the Committee since May last year. Regulator members also focused on the positive aspects of the US economy: they noted the "strength" of the US labor market and moderate economic growth, while expressing confidence that inflation will reach the target two percent level in 2020. All other aspects of the December meeting were negative in one way or another. Firstly, the regulator stated that consumption growth has significantly slowed, while the decline in investment has significantly intensified. Company investments and exports remain weak. Inflation also inherited. Jerome Powell stated that inflation remains below the target two percent level, and if this trend continues, this may lead to an "unhealthy dynamics" in the country's economy.

Macroeconomic reports have not supported the dollar since the last meeting. The release of data on inflation growth was controversial, but Nonfarm disappointed, especially the inflation component. The average hourly wage was at around 0.1% on a monthly basis - this is the worst result since last September, when it dropped to zero. In annual terms, the indicator rose by only 2.9% - this is the weakest growth rate since July 2018.

Such trends may alarm Fed members. But in light of recent events, the Fed may be worried about a possible slowdown in the global economy. By the way, Beijing has already recognized that the 2019-nCoV virus epidemic will become "a serious obstacle to economic growth". China already suffers significant losses - for example, the total volume of traffic within the country decreased by almost 30% compared to last year. Other sectors of the economy that are somehow related to tourism and passenger traffic also suffer. Given these events, Fed members may shift their focus. But here it is necessary to understand that the dovish theses of the US regulator in the current circumstances can only foster interest in the dollar, amid increasing panic. Therefore, playing against the greenback is dangerous today - there are too many uncertainties in this equation.

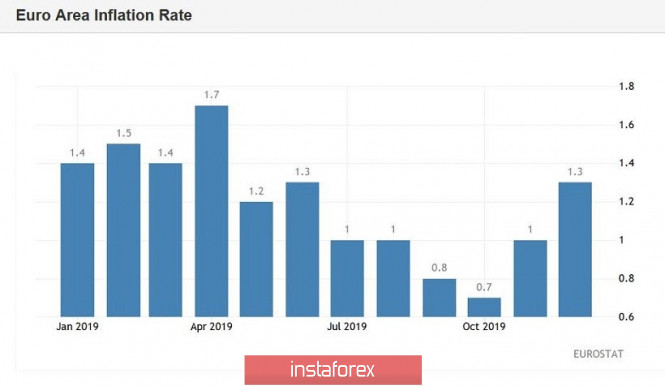

If we talk about macroeconomic statistics, then EUR/USD traders will focus their attention on two reports - data on US GDP growth (Thursday, January 30) and data on growth of European inflation (Friday, January 31). According to the general consensus forecast, the US economy should show positive dynamics in the fourth quarter, rising to 2.1% (whereas in the third quarter, the GDP indicator rose to a two percent level). In turn, European inflation should please the single currency - according to general forecasts, this key indicator for the ECB should rise to 1.4% (the strongest growth rate since April last year). Core inflation may slightly slow down - up to 1.2%. In addition, data on GDP growth in the eurozone will be released this week. According to general expectations, the indicator in the fourth quarter will be released at the same level as in the third.

Less important, but no less significant for EUR/USD macroeconomic data will be published on other days of the week. So, on January 28, we will find out the significance of the US indicator of consumer confidence and the volume of orders for durable goods; January 29 - preliminary assessment of the balance of international trade in goods (the Fed meeting will be held on the same day); January 30 - data on the labor market in Germany and the entire eurozone (inflation indicators will also be published in Germany); January 31 - in addition to data on the growth of European inflation, we will find out the US index of expenditures on personal consumption. In addition, the Chinese PMI for the manufacturing sector will be published on Friday, which may also affect the dynamics of the pair (especially with strong deviations from the forecast values).

But in general, the theme of the spread of the Coronavirus will be the "red thread" of the current week. Most likely, the anti-risk sentiment will only intensify in the coming days. This will make it possible for the bears to push the EUR/USD price into the ninth figure area. The support level now stands at 1.0940 - this is the bottom line of the Bollinger Bands indicator on the weekly chart.

The material has been provided by InstaForex Company - www.instaforex.com