The thin market on Monday helped the Canadian dollar maintain its position in tandem with the US currency amid absolutely disastrous data on the growth of the Canadian economy. The bulls could not develop the upward impulse, and after the price jump to around 1.3180, the USD/CAD pair returned home. In addition, the loonie was helped by US data, which was not in favor of the greenback. The semi-empty economic calendar and the pre-holiday mode reinforced the importance of each news, so the pair's traders yesterday reacted violently to both Canadian GDP and the US release of data on the volume of orders for durable goods. The published figures put pressure on both the loonie and the dollar, so in the end the pair actually remained in place.

But it is worth noting here that the US Durable Goods Orders indicator has a rather short-term effect on dollar pairs, and only the thin market factor focused investors on this release. Meanwhile, Canadian figures will remind themselves more than once: at least at the beginning of next year, when the Bank of Canada will decide the future fate of monetary policy. This is far from a passing release, which could remain in the shadow of subsequent publications. By and large, this is a time bomb, which can explode as soon as the market returns to operating mode.

Data was recently published on the growth of the Canadian economy in October. According to the general forecast, this indicator was expected to marginally grow on a monthly basis (+0.1%) and slightly slow down in annual terms (+ 1.4%) after a two-month growth. But the real numbers were much worse. On a monthly basis, the key indicator fell into the negative area (for the first time in eight months), reaching -0.1%. In annual terms, the indicator slowed down more than expected - up to 1.2%. The release structure suggests that 13 out of 20 sectors of the economy showed negative dynamics. In particular, the production of durable goods decreased to -2.3%. Slowdown of this component is recorded for the fourth time in the last six months.

The transport equipment manufacturing sector showed the strongest negative dynamics (decline to -2.5%), primarily due to a decrease in the production of cars and auto parts. The decline was recorded in the sphere of non-food goods production (-0.3%), as well as in the sphere of food production (-0.1%). In October, the wholesale sector also slowed down (down to -1.0%). Among the pluses is the growth in traffic and warehousing. This component increased by 0.6% (in particular, the air transportation subcategory showed the strongest growth over the past year and a half). The non-residential building and other construction sector has also grown, but residential construction has declined. It is also worth noting that the September GDP growth indicator (in annual terms) was revised downward, to 1.5%.

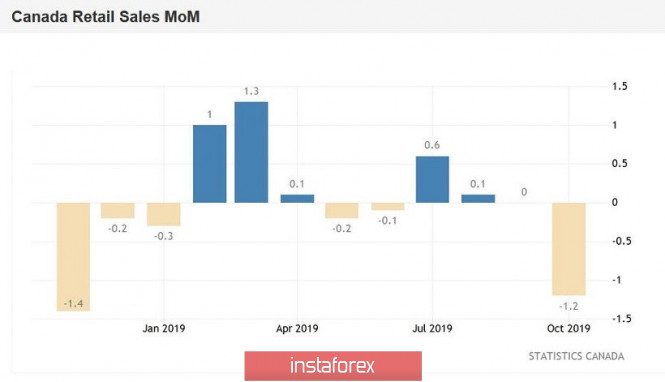

In other words, the numbers released yesterday only exacerbated the negative effect of data on retail sales growth in Canada released last week. Contrary to positive forecasts (growth up to 0.5%), this indicator crashed to -1.2% - this is the weakest result for several months (to be more precise, since November 2018). Such dynamics cannot be ignored by members of the Canadian central bank.

Let me remind you that the last meeting of the Bank of Canada ended in a positive way: according to regulator members, the global economy is showing "signs of stabilization," although global trade conflicts remain the main risk factor for forecasts. The central bank also indicated a decrease in recession risks and a significant increase in investment spending in the third quarter. In addition, the regulator optimistically commented on the price dynamics of the commodity market (including the oil market), while noting that the Canadian dollar rate maintains "relative stability". These findings made it possible for the loonie to strengthen to the base of the 31st figure. However, recent releases indicate that at a January meeting, the Bank of Canada could soften its rhetoric, and possibly even announce a reduction in interest rates. According to some analysts, the Canadian central bank will resort to monetary easing in the first half of next year, although this reduction in interest rates will be preventive.

Thus, the October GDP growth data is still "waiting in the wings": the market, although it did not ignore it, did not fully win back, given the possible consequences. All this suggests that the USD/CAD pair retains the potential for its growth - at least to the level of 1.3200 (the lower boundary of the Kumo cloud, which coincides with the middle line of the Bollinger Bands indicator on the daily chart).

The material has been provided by InstaForex Company - www.instaforex.com