To open long positions on GBPUSD, you need:

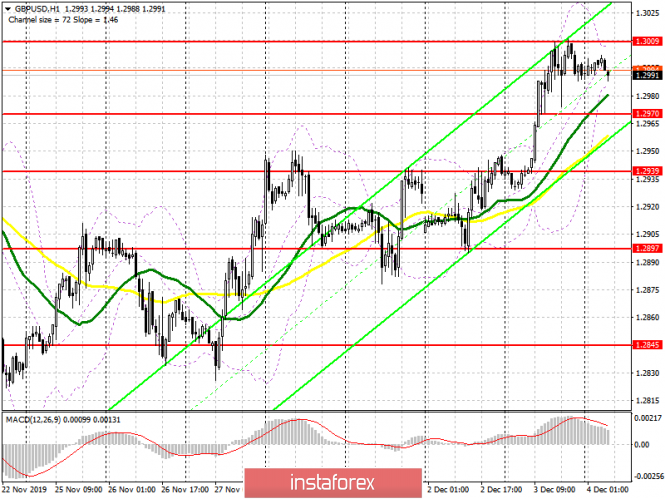

Look at the graph. The October upward trend was stopped in the resistance area of 1.3010, to which the buyers of the pound have gradually returned. Further growth will depend directly on the results of opinion polls and elections, which are only a short time away. The breakthrough of the maximum of 1.3010 will lead to the demolition of several stop orders of bears and a powerful upward momentum in the area of 1.3039 and 1.3074, where I recommend taking the profits. If weak fundamental data on the UK services sector are released today, the pressure on the pound will return, and only the formation of a false breakout in the support area of 1.2970 will be a signal to buy GBP/USD. I recommend opening long positions immediately for a rebound only after updating the minimum of 1.2939.

To open short positions on GBPUSD, you need:

Sellers are still hoping for a weak report on the services sector, which will lead to the formation of a false breakout in the resistance area of 1.3009 and a decrease in the pound under the support of 1.2970. Only a real consolidation below this minimum will increase the pressure on the pair, which will push the pair even lower to the area of 1.2939 and 1.2896, where I recommend taking the profits. If sellers fail to hold the level of 1.3009 after the data, it is best to return to short positions only after the highs of 1.3039 and 1.3074 are updated.

Indicator signals:

Moving Averages

Trading is just above the 30 and 50 moving averages, which keeps the probability of the pound rising in the short term.

Bollinger Bands

Breaking the upper limit of the indicator around 1.3009 will lead to a more powerful bullish impulse.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.