Today, the attention of the investors will be focused to the publication of data on the American economy, as well as to statements by members of the ECB, RBA and Fed.

Market participants are trying to move away from the topic of US-Chinese negotiations, which are so tired of their unpredictability of the result, but most importantly, their strong influence on decisions on monetary policies of leading Central Banks, as well as a general dominance over the desire of investors to buy risky assets. Here, after a slight optimism that spread over the markets last week, it is already in a very dissolved form again this week, in the wake of the existing serious contradictions between the parties to the negotiation process.

The stumbling block which is on the Chinese side is the desire for the Americans to abolish previously established high duties on Chinese imports. Washington, in turn, demands a concrete agreement on food imports by China. So far, it seems that the parties are unable to agree, which causes waves of discontent both from D. Trump personally and from representatives of Beijing.

It can be said with great confidence that the persistence of these problems will have a swinging effect on financial markets, contributing to a high level of volatility.

Moreover, today, the markets will carefully listen to the speeches of the head of the RBA Lowe and his deputy Debell. They want to hear from them the regulator's plans for the foreseeable future, which could have a significant impact on the Australian currency. In addition, comments by ECB representatives Kere and De Saguin are also expected. It will be interesting since they will be the first to go after the last speech of the ECB President C. Lagarde. Therefore, investors will be interested in the topic of the monetary policy of the regulator for the coming year. On the American side, a speech by Fed member Brainard is expected.

From the important economic data, we highlight the publication of the Conference Board consumer confidence index and the value of new home sales in the United States. Consumer confidence is expected to rise in November to 127.0 points from 125.9 points. At the same time, sales of new housing is expected to also increase to 709,000 from 701,000. It can be assumed that if the values do not disappoint, this will provide local support for the US dollar and cause a new wave of growth in demand for risky assets in the States.

Forecast of the day:

EUR/USD remains under pressure amid strong data on the US economy and the uncertainty of the ECB's future monetary policy. We consider it possible to resume selling the pair in its local recovery, if it holds below the level of 1.1015 with a likely target of 1.0975.

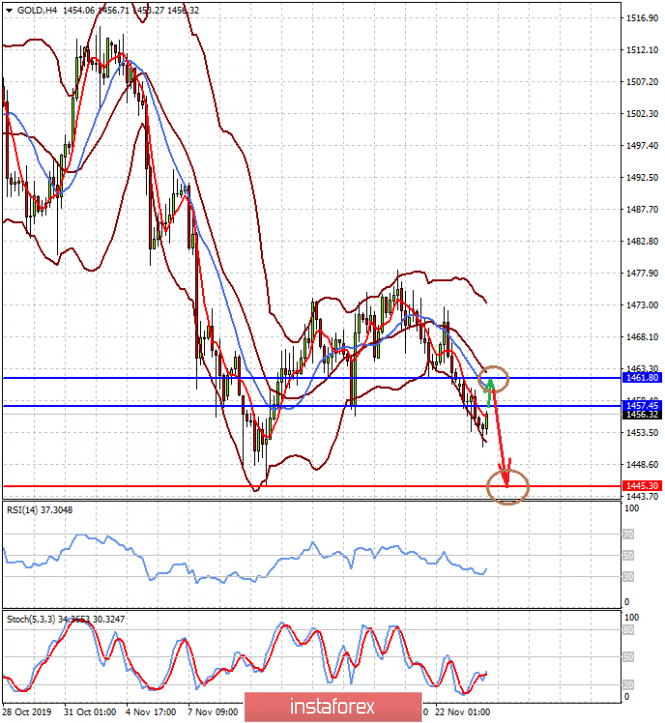

The price of gold is correcting upward in the wake of the continuing contradictions in trade between the United States and China. Quotes of the "yellow metal" can recover to 1461.80 if they break the level of 1457.45. More so, we consider it possible to resume its sales from the level of 1461.80 with a local target of 1445.30.