Economic calendar (Universal time)

The economic calendar did not contain important events. Thus, you can only pay attention to statistics from the Eurozone, which was released around 9.00 UTC+00, led by data on the state of the business climate in Germany.

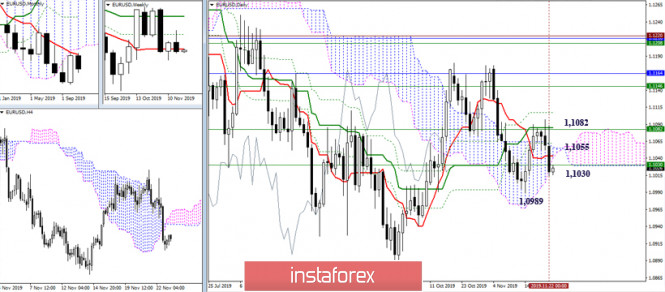

EUR / USD

The players on the downside did not wait for Monday and showed activity already at the end of last week. Now, the pair is in the bearish zone relative to the clouds (daytime and H4), as well as under significant resistance levels of the higher halves. As a result, we can expect that at the close of the current month, the last working week of which began today, the players on the downside will seek to maintain their positions and mood. In the case of the continuation of decline, the interests of players to lower in the near future will be targeted at leaving the zones of corrections, which is limited by the extreme minimum of 1.0989 and 1.0879. On the other hand, a change in the situation and/or a return of uncertainty is possible when the pair consolidates above the nearest resistances, which continue to form a fairly wide zone of 1.1030 (weekly short-term trend) - 1.1055 (daily cloud) - 1.1082 (daily Kijun + weekly Fibo Kijun).

In the lower halves, the long-term trend also belongs to the players downside. The support of the classic pivot levels has designated a fairly wide range of opportunities for the bears - 1.0993 (S1) - 1.0967 (S2) - 1.0919 (S3). With the development of an upward correction, the key resistance levels in the current situation on H1 are 1.1041 (central pivot level) and 1.1064 (weekly long-term trend).

GBP / USD

For the GBP/USD, another test of the weekly cloud failed again. Nevertheless, the players on the downside managed to close the week under all important resistance, clearing their way for a corrective decline to the weekly cross supports (the nearest levels are 1.2606 Tenkan + 1.2609 Fibo Kijun). Thus far, the weekly cross is strengthening the support for the daily cloud, and the monthly short-term trend, which is at 1.2669 in November, can also play a role in this area. The weakening of the bearish positions in the current situation is the proximity of significant levels, since, due to their distance from other benchmarks and high concentration, they provide not only resistance, but also a strong attraction. This is confirmed by the fact that the pair spent almost all of November in the area. The final week of the month has started today, so the nature and potential of the November monthly candle will depend on its result.

In the lower halves, we are currently witnessing the development of an upward correction, which managed to close the last hour above the central pivot level of the day (1.2861) with the active support of technical indicators. Consolidation and development of the correction will allow us to consider the rise to the next significant level in the lower halves - the weekly long-term trend (1.2914). Breaking down this level will return the advantage of the bulls in the lower halves and the general uncertainty in the upper ones. Moreover, the resistance of the upper time intervals 1.2953 and 1.3012 will be relevant in this case. Leaving the correction zone and continuing the decline will also return relevance to the support of the classic pivot levels 1.2793 (S1) - 1.2755 (S2) - 1.2687 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com