To open long positions on EURUSD you need:

Weak volatility and several unsuccessful attempts of euro buyers to return to the market, even against the backdrop of good reports from Ifo, make us think about the further prospect of an upward correction in the pair. Today, all of the buyer's attention will be focused on the resistance of 1.1031, since only consolidating above this level will lead to a larger upward correction to the areas of 1.1059 and 1.1088, where I recommend profit taking. However, it is hardly possible to count on such growth in the morning, as good news on the eurozone economy is not expected. Under the scenario of further downward movement, the bulls will do their best to cling to the support of 1.1008, however only the formation of a false breakout there will be a buy signal. Otherwise, it is best to open long positions on a rebound from a low of 1.0989.

To open short positions on EURUSD you need:

Yesterday, bears tried to push the support of 1.1008 several times, but this could not be done. Today's speech by Federal Reserve Chairman Jerome Powell also did not allow the resumption of the downward trend in EUR/USD. The main task for the first half of the day is still the level of 1.1008, since only its breakthrough will lead to a new wave of decline in the euro with updating lows in the areas of 1.0989 and 1.0972, where I recommend profit taking. If there is no bearish activity in the morning near the low of 1.1008, it is best to postpone the sale of the euro until a larger resistance of 1.1031 is updated, subject to a false breakout, or open short positions immediately to rebound from a high of 1.1059.

Signals of indicators:

Moving averages

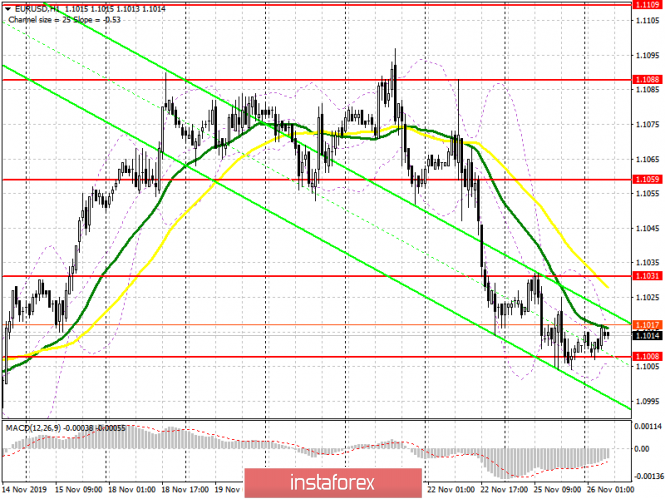

Trading is conducted below 30 and 50 moving averages, which indicates a bearish nature of the market.

Bollinger bands

Only a breakthrough of the lower boundary of the indicator in the region of 1.1005 will provide sellers with the necessary forces, which will lead to another wave of a decline in the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20