Forecast for November 29:

Analytical review of currency pairs on the scale of H1:

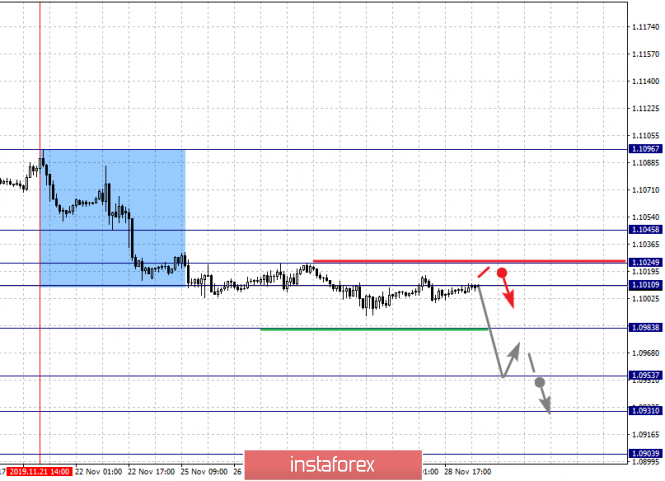

For the euro / dollar pair, the key levels on the H1 scale are: 1.1045, 1.1024, 1.1010, 1.0983, 1.0953 and 1.0931. Here, we continue to monitor the development of the downward structure of November 21. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.0983. In this case, the target is 1.0953. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.0931. Upon reaching this value, we expect a rollback to the top.

Short-term upward movement is expected in the range 1.1010 - 1.1024. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1045. This level is a key support for the downward structure.

The main trend is the downward structure of November 21

Trading recommendations:

Buy: 1.1010 Take profit: 1.1022

Buy: 1.1025 Take profit: 1.1045

Sell: 1.0983 Take profit: 1.0955

Sell: 1.0951 Take profit: 1.0931

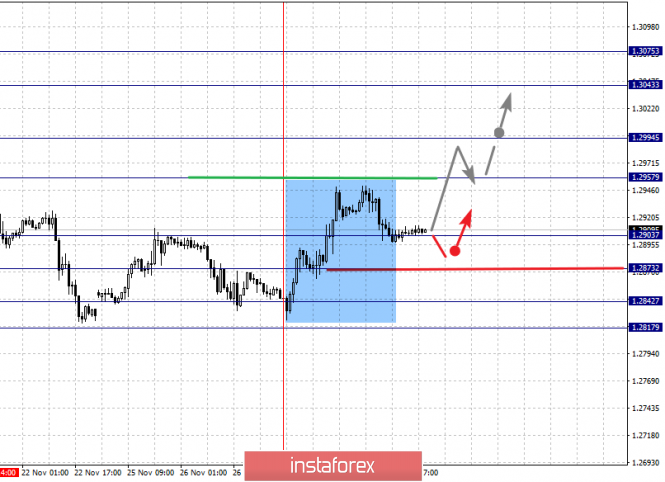

For the pound / dollar pair, the key levels on the H1 scale are: 1.3075, 1.3043, 1.2994, 1.2957, 1.2903, 1.2873, 1.2842 and 1.2817. Here, we are following the formation of the initial conditions for the upward cycle of November 27. The continuation of the movement to the top is expected after the breakdown of the level of 1.2957. In this case, the target is 1.2994. Price consolidation is near this level. The breakdown of the level of 1.2995 should be accompanied by a pronounced upward movement. Here, the target is 1.3043. For the potential value for the top, we consider the level of 1.3075. Upon reaching this level, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 1.2903 - 1.2873. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2842. This level is a key support for the top.

The main trend is the formation of the ascending structure of November 27

Trading recommendations:

Buy: 1.2957 Take profit: 1.2992

Buy: 1.2996 Take profit: 1.3043

Sell: 1.2903 Take profit: 1.2875

Sell: 1.2870 Take profit: 1.2844

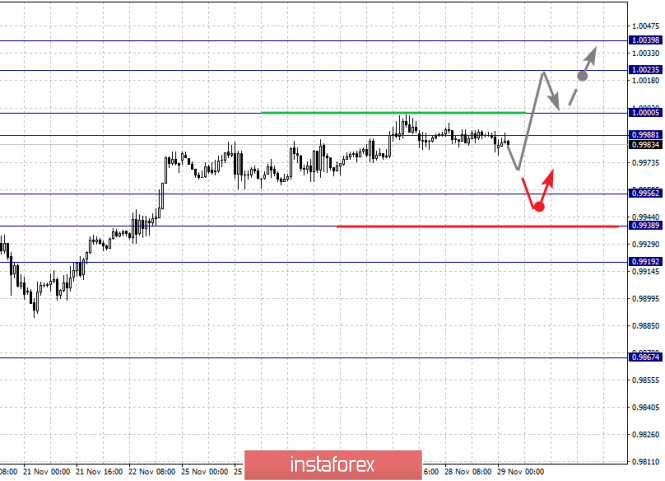

For the dollar / franc pair, the key levels on the H1 scale are: 1.0039, 1.0023, 1.0000, 0.9988, 0.9956, 0.9938 and 0.9919. Here, we are following the development of the ascending structure of November 18. Short-term upward movement is expected in the range 0.9988 - 1.0000. The breakdown of the last value will lead to a pronounced movement. Here, the target is 1.0023. We consider the level of 1.0039 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9956 - 0.9938. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9919.

The main trend is the upward structure of November 18

Trading recommendations:

Buy : 0.9988 Take profit: 1.0000

Buy : 1.0003 Take profit: 1.0023

Sell: 0.9956 Take profit: 0.9940

Sell: 0.9937 Take profit: 0.9920

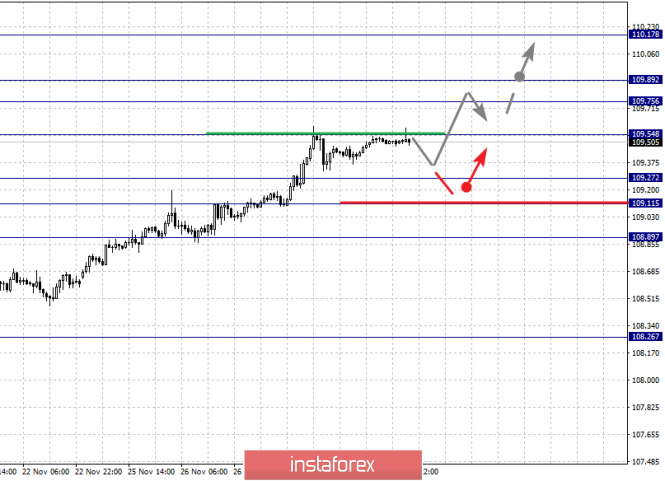

For the dollar / yen pair, the key levels on the scale are : 110.17, 109.89, 109.75, 109.54, 109.27, 109.11 and 108.89. Here, we are following the development of the ascending structure of November 21. The continuation of the movement to the top is expected after the breakdown of the level of 109.54. In this case, the target is 109.75. Short-term upward movement, as well as consolidation is in the range of 109.75 - 109.89. We consider the level 110.17 to be the potential value for the top; we expect movement to this value after the breakdown of the level of 109.90.

Short-term downward movement is expected in the range 109.27 - 109.11. The breakdown of the last value will lead to an in-depth correction. Here, the target is 108.89. This level is a key support for the top.

The main trend: the development of the rising structure of November 21

Trading recommendations:

Buy: 109.55 Take profit: 109.75

Buy : 109.77 Take profit: 109.88

Sell: 109.25 Take profit: 109.13

Sell: 109.08 Take profit: 108.92

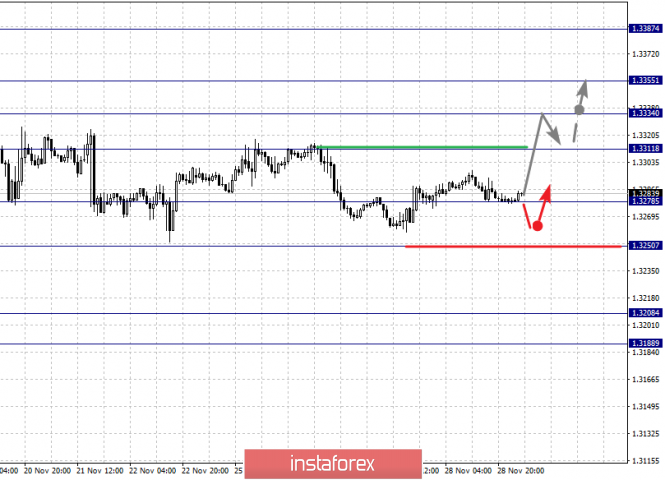

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3404, 1.3387, 1.3355, 1.3334, 1.3311, 1.3298, 1.3278 and 1.3250. Here, we are following the ascending structure of November 19. The continuation of the movement to the top is expected after the breakdown of the level of 1.3311. In this case, the first target 1.3334. We expect short-term upward movement in the range of 1.3334 - 1.3355. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.3387. Price consolidation is in the range of 1.3387 - 1.3404 and from here, we expect a correction.

Short-term downward movement, as well as consolidation are possible in the range of 1.3298 - 1.3278. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3250. This level is a key support for the upward structure.

The main trend is the upward structure of November 19, the correction stage.

Trading recommendations:

Buy: 1.3311 Take profit: 1.3333

Buy : 1.3335 Take profit: 1.3355

Sell: 1.3276 Take profit: 1.3252

Sell: 1.3248 Take profit: 1.3220

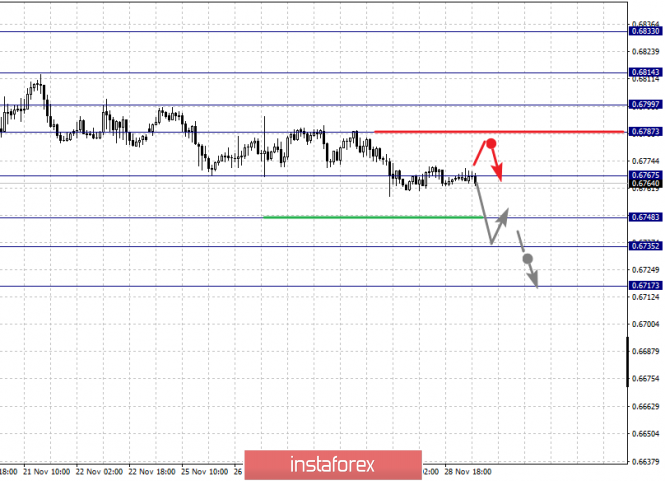

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6833, 0.6814, 0.6799, 0.6787, 0.6767, 0.6748, 0.6735 and 0.6717. Here, we are following the development of the downward structure of November 19. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6765. In this case, we expect a pronounced movement to the level of 0.6748. Price consolidation is in the range of 0.6748 - 0.6735. We consider the level of 0.6717 to be a potential value for the bottom; upon reaching this value, we expect a correction.

Short-term upward movement is expected in the range of 0.6787 - 0.6799. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6814. This level is a key support for the downward trend.

The main trend is a local descending structure of November 19

Trading recommendations:

Buy: 0.6787 Take profit: 0.6797

Buy: 0.6800 Take profit: 0.6814

Sell : 0.6766 Take profit : 0.6750

Sell: 0.6746 Take profit: 0.6736

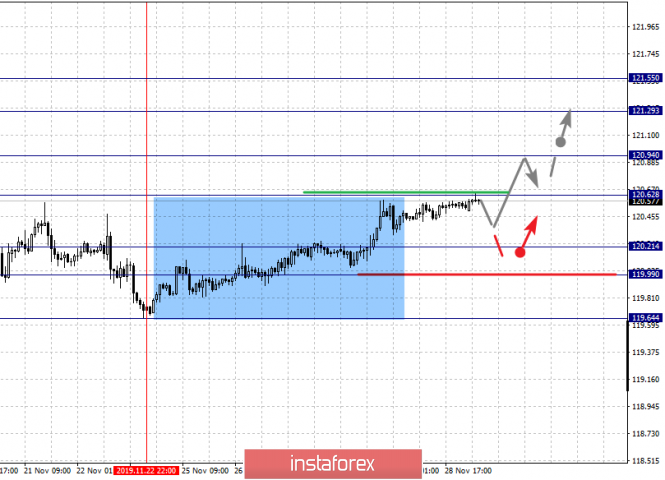

For the euro / yen pair, the key levels on the H1 scale are: 121.55, 121.29, 120.94, 120.62, 120.21, 119.99 and 119.64. Here, we determined the subsequent goals from the local ascending structure of November 22. The continuation of the movement to the top is expected after the breakdown of the level of 120.62. In this case, the target is 120.94. Price consolidation is near this level. The breakdown of the level of 120.95 should be accompanied by a pronounced upward movement. Here, the goal is 121.29. For the potential value for the top, we consider the level of 121.55. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is expected in the range of 120.21 - 119.99. The breakdown of the latter value will have the potential to form a downward movement. Here, the potential target is 119.64.

The main trend is the local ascending structure of November 22

Trading recommendations:

Buy: 120.62 Take profit: 120.92

Buy: 120.96 Take profit: 121.27

Sell: 120.21 Take profit: 120.00

Sell: 119.96 Take profit: 119.66

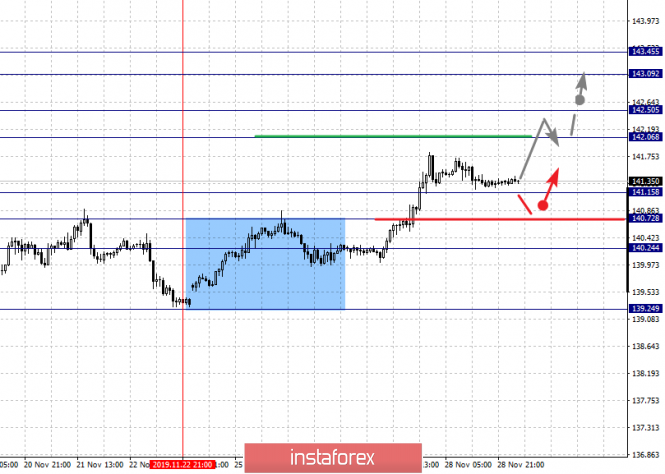

For the pound / yen pair, the key levels on the H1 scale are : 143.45, 143.09, 142.50. 142.06, 141.15, 140.72 and 140.24. Here, we are following the development of the upward cycle of November 22. Short-term upward movement is expected in the range of 142.06 - 142.50. The breakdown of the last value will lead to a pronounced movement. Here, the goal is 143.09. For the potential value for the top, we consider the level of 143.45. Upon reaching this level, we expect a departure in the correction.

Short-term downward movement is possibly in the range of 141.15 - 140.72. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 140.24. This level is a key support for the top.

The main trend is the upward structure of November 22.

Trading recommendations:

Buy: 142.06 Take profit: 142.50

Buy: 142.52 Take profit: 143.07

Sell: 141.15 Take profit: 140.74

Sell: 140.70 Take profit: 140.26

The material has been provided by InstaForex Company - www.instaforex.com