4-hour timeframe

Amplitude of the last 5 days (high-low): 45p - 74p - 28p - 19p - 33p.

Average volatility over the past 5 days: 40p (low).

The EUR/USD currency pair continues a completely non-initiative movement on the penultimate trading day of the week. If a few days ago, although with low volatility, a trend movement was still observed, now there is no such movement. Traders seem to have left the market in full force, and the volatility of today is as much as 20 points. Is it worth it to pay attention to the technical picture in such a situation? How to tear off traffic in as many as 20 points per day? What to expect from a pair that shows such volatility? We believe that everything is to blame for the same paradoxical situation that we are talking about in almost every review, as that is now the key reason for what happens with the currency pair. We still believe that the bears simply refuse to continue selling the euro, being around 2-year lows for no good reason. We have already said that in order for the downward trend to resume, we need reasons like lowering the key interest rate by the European Central Bank or entering a major player on the foreign exchange market. Until this moment, such a movement can be maintained and nothing can be done about it.

Today, November 28, the entire fundamental background came down to the publication of the preliminary November consumer price index in Germany. Experts expected to see inflation accelerate to 1.3% YOY, but in monthly terms allowed a loss of as much as 0.6%. Real numbers turned out to be much worse than forecasts. Inflation remains at the level of 1.1% YOY, while it immediately loses 0.8% in monthly terms. Thus, when a similar report on the European Union will be published tomorrow, we can also expect numbers worse than forecasted values, and the previous value of +0.7% YOY is unlikely to be exceeded. Well, what kind of growth of the European currency can be discussed if the ECB drove the deposit rate already at the level of -0.5% and revived the quantitative easing program with a monthly redemption worth 20 billion euros, and this is still not enough for the EU economy to stop showing signs of a slowdown? What else remains for the European regulator, except how to further lower the rate and expand the QE program? They can still apply the policy of helicopter money, but this is likely an extreme measure.

Meanwhile, China made an official statement regarding Donald Trump signing the Hong Kong Democracy and Human Rights bills. "The signing by the US side of the so-called Hong Kong Democracy and Human Rights Law is a serious interference in Hong Kong's affairs and in China's internal affairs, a serious violation of international law and the basic norms of international relations. The government and people of China strongly protest," the report stated. What countermeasures Beijing will take is still unknown, but from our point of view, this step by Donald Trump could significantly complicate the process of further negotiations on a trade agreement and further aggravate the conflict between Beijing and Washington. There is no doubt that Beijing will answer Washington.

Therefore, all news received by traders is potentially a negative for the European currency. An even greater slowdown in inflation, or not acceleration, will clearly not add optimism to euro buyers. The escalation of the trade conflict between China and the United States, which also affects the economy of the European Union, will not increase the demand for the euro. Thus, the fundamental background remains completely the same - a negative for the euro currency, but they still do not want to extract any dividends from the bears.

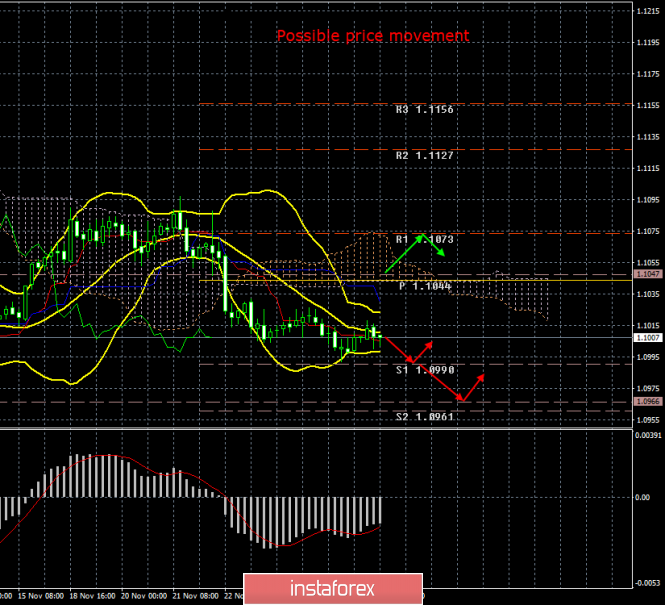

As for the technical picture of the euro/dollar pair, everything is very simple at this time. The pair almost completed the first support level of 1.0990 and began a new round of correctional movement. Overcoming the level of 1.0990 can trigger a new downward movement, however, it is unlikely to be stronger than 20-30 points per day, and even such a downward movement will now require fundamental factors. And only if traders do not ignore them again. One single important report will be released tomorrow - preliminary inflation in the EU. Most likely, either the report will be ignored, or its value will not cause any emotions among market participants.

Trading recommendations:

The EUR/USD pair began a new round of correction against the downward trend, and the volatility in trading remains extremely low on Thursday. Thus, it is now recommended to wait until the correction is complete and sell the euro/dollar pair again with targets at 1.0990 and 1.0966. It is recommended to consider buying the euro no earlier than the reverse consolidation of traders above the critical Kijun-sen line and the level of 1.1047 with the first target resistance level of 1.1073.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com