USD / JPY pair

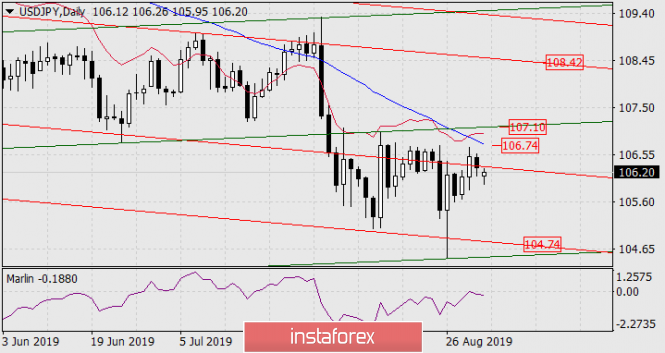

The economic indicators released in Japan were a little disappointing this morning. As a result, the dollar was weak against the yen and a new week opened with a falling gap. The index of business activity worsened from 49.5 points to 49.3 in August, while the volume of capital investments showed an increase of only 1.9% in the 2nd quarter against 6.1% in the 1st quarter. On the daily chart of the currency pair, the signal line of the Marlin oscillator did not go into the zone of positive numbers but there is a slight hitch with growth.

On the four-hour chart, the price stayed on the lines of balance and MACD, and the Marlin oscillator remains in the growth zone. The opening of the market with a gap speaks in favor of its subsequent closure and continued growth in prices. To develop a negative scenario, the price needs to gain a foothold below the low of the Asian session at 105.9. However, below this level, there is quite strong support on August 27-28 at an average price of 105.68. Only after consolidation below would it be possible to consider the goal of 104.74 as the support for the red lowering channel on the daily chart.

In the main scenario, we are waiting for the price at 106.74, which is near the MACD line on the daily chart. The next target will be the resistance line of the rising price channel at 107.10.

The material has been provided by InstaForex Company - www.instaforex.com