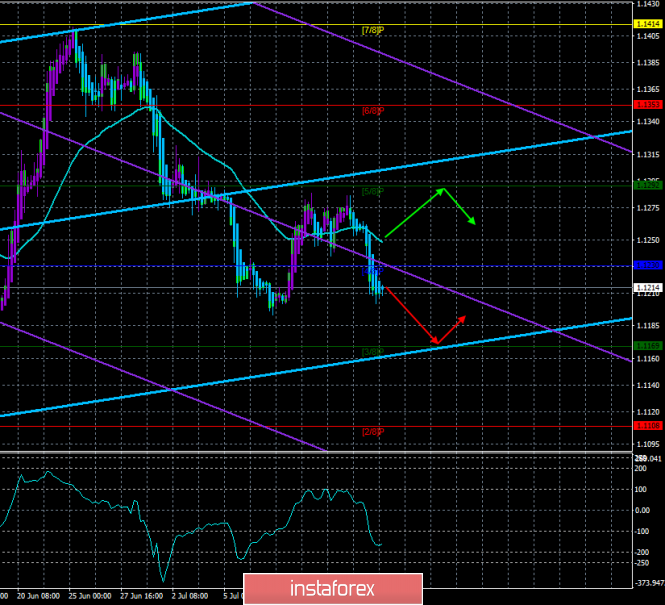

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – up.

The lower channel of linear regression: direction – down.

The moving average (20; smoothed) – down.

CCI: -164.6272

During the second trading day of the week, the EUR/USD pair ended with a significant decrease, although in general, the volatility remains not too high. However, it is now possible to declare that the market participants are ready for new sales of the euro. On July 17, the publication of the consumer price index in Europe for June is planned. Recall that in recent months, inflation in the EU slowed to 1.2%. If the slowdown continues, the reasons for the ECB to lower the rate and start pouring fresh money into the economy will become more, and the pressure on the euro will increase. It so happened that in recent weeks, low inflation in the US and a possible reduction in the key rate was not discussed. However, we continue to insist that the States still remain in the lead in the balance of power between the US and the EU. Inflation is higher, the labor market is stronger, and the rate is much higher. And even if there is a recession in the economy, it is still much less tangible than in the European Union. And it is still Trump that has not started a full-scale trade war with the European Union. A similar war with China has led to a slowdown in China's GDP to a minimum value for 27 years. What will happen to the EU economy in this case, if the European regulator is already thinking about easing monetary policy despite the fact that the current rate is 0.0%?

Nearest support levels:

S1 – 1.1169

S2 – 1.1108

S3 – 1.1047

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1292

R3 – 1.1353

Trading recommendations:

The EUR/USD pair is fixed below the moving average line. Now, therefore, it is recommended to sell the euro/dollar pair with a target of 1.1169 before the reversal of the Heiken Ashi indicator to the top.

It is recommended to buy the euro after the bulls consolidate back above the moving average line, which will change the trend to the upward one, and the targets, in this case, will be the levels of 1.1292 and 1.1353.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

The material has been provided by InstaForex Company - www.instaforex.com