The GBP/USD pair moved upwards after the recent decline which pushed the daily close below the 1.3000-50 area. This week's FOMC and NFP reports are expected to provide support to the US dollar. Therefore, the British pound is likely to give in to its American rival.

The 6-month delay of Brexit gives Britain's central bankers space to take a broader view of the economy. However, they are not likely to raise interest rates in the coming months due to ongoing uncertainty around the UK's exit from the European Union. An average forecast is for a rate to rise in the first quarter of the next year when Governor Mark Carney will hand power over to a successor. Some analysts do not expect rates to be raised at all this or next year, financial market pricing said.

Unlike the European Central Bank, the Bank of England is dealing with inflation that is likely to rise above target soon. Also, in contrast to the US Federal Reserve, it has only raised its rates twice in the current economic cycle, in August 2018. Moreover, Retailers are weighed down by Britain's uncertainty, while households pulled back from the big purchases and the Gfk Consumer Sentiment report showed a negative result. Tomorrow 's UK Manufacturing PMI report is anticipated to reflect a decrease to 53.2 from the previous figure of 55.1, and the Net Lending to Individuals is expected to decrease to 4.5B from the previous figure of 4.6B.

Additionally, on Thursday, the Bank of England Inflation report, Monetary Policy Summary, and Official Bank Rate of UK are going to be published. The central bank's rate is forecast to remain at 0.75%.

On the other hand, the strong US GDP excelled the estimates and provided support for USD. The annual pace of the GDP growth turned out to be 3.2 percent in the first three months of the year, comparable to last year's pace. The 3 percent growth achieved in 2018 surprised many at the central bank, and, in their March statement, officials said they thought the economy had slowed in the first weeks of the year.

On Friday, the Nonfarm Payrolls report for April tops the list of this week's data releases. Economists expect to see a gain of 181,000 jobs, while the unemployment rate is forecast to hold steady at 3.8%. The US economy added 196,000 jobs in March, rebounding after a gain of just 33,000 jobs in the previous month. Moreover, by evaluating the recent data, today's consumer confidence is expected to be boosted to 126.2 from the previous figure of 124.1. This will be underlined by another decent rise in payrolls and a renewed uptick in wage growth after the last month's surprising dip. Additionally, Pending Home Sales are expected to increase to 1.1% from the previous value of -1.0%, while Chicago PMI is forecast to grow to 59.1 from the previous figure of 58.7.

On Wednesday, the FOMC Meeting and the Federal Funds Rate report are going to be published. The rate is to remain unchanged at 2.50%. Additionally, Fed Chair Jerome Powell will hold a press conference following the meeting, investors await his insights on the policy outlook.

As of the current scenario, the US dollar is quite firm amid the upcoming economic reports, even though the expectations are not that great. As the UK struggles with issues like BREXIT and mixed economic results, the pound is likely to be sluggish against the greenback in the coming days.

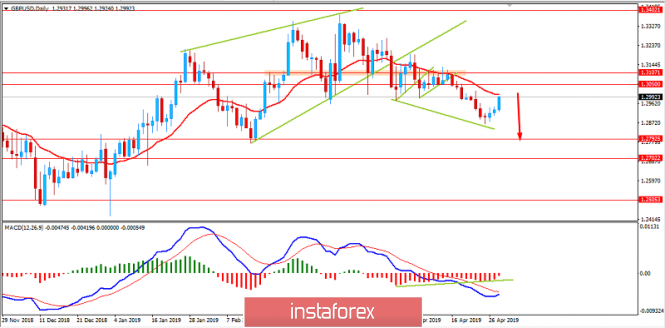

Now, let us look at the technical view. The price managed to move higher towards the 1.30 area after a Bullish Divergence lead the price to the edge of the dynamic level of 20 EMA. As for the current trend, the price is expected to drop towards the 1.2700-1.2800 support area as it remains below the 1.3050-1.3100 area with a daily close.