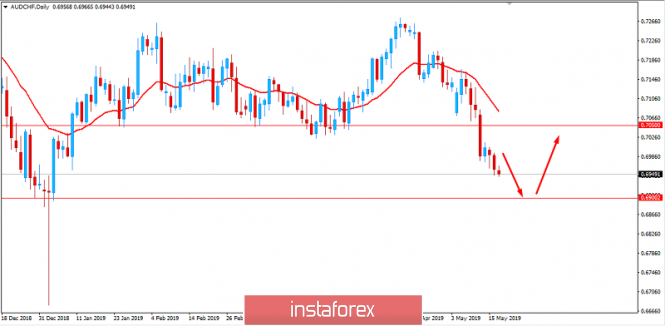

AUD/CHF has been trading in a bearish trend after breaking below 0.7050 support area with a daily close. The worse-than-expected economic reports from Australia put the national currency under pressure. It resulted in further weakness, whereas CHF sustained momentum.

Recently, the Australian employment change report was published with an increase to 28.4k from the previous figure of 27.7k which was expected to decrease significantly to 15.2k. The positive employment change was quite remarkable but it was offset by an increase in the unemployment rate to 5.2% from the previous value of 5.1% and versus the expected level of 5.0%. Furthermore, the average hourly wages excluding bonuses advanced by 0.54% after cyclical adjustments while analysts predicted an increase of 0.6%. Meanwhile, the average wages growth accelerated a little on an annual basis. It came in at 2.34%, up from 2.27% in the December quarter. It was the fastest increase since the last quarter of 2014 while the forecast was 2.4%. The consumer price inflation inched up by just 1.3%, and the real growth over the year stood at respectable 1%. The Australian dollar is seen to be weaker against other major currencies.

Meanwhile, the SNB compares price stability with a rise in the national consumer price index of less than 2% per annum. At the latest meeting, the SNB reduced the inflation target for the current year to 0.3% from 0.5% of the previous year while the expected inflation target for 2020 was set at 0.6% compared to 1.0% for the last quarter of 2021. According to the SNB, the economic indicators are currently signalling moderately positive momentum which makes the bank's experts expect the GDP to expand by around 1.5.

This week, Switzerland's PPI report was published with a decrease to 0.0% from the previous value of 0.3% which was expected to be at 0.2%. However, the consumer price index declined to 0.2% from 0.5% in March on a monthly basis. The unemployment rate was unchanged at 2.4%, whereas the youth unemployment decreased.

As of the current scenario, CHF is expected to maintain momentum ahead of the Australian monetary policy meeting minutes that is scheduled for release next week. The minutes is expected to play a vital role in the dynamics of AUD in the coming days.

Now let us look at the technical view. The price is currently sliding lower quite impulsively towards the support area of 0.6900 after breaking below the support at 0.7050 recently. The price is residing quite far from the dynamic level of 20 EMA so the mean reversion may occur probably. Subsequently, it will lead the price higher towards 0.7050 again. If the price manages to reject off the 0.6900 area with a daily close, the probability of bouncing higher will be quite strong.