USD/JPY has been quite volatile and corrective with the recent bullish momentum which managed to sustain the upward pressure despite the spikes along the way.

According to the minutes of the January policy meeting, the Fed advocates for a patient approach to rate hikes and also flags the end of balance sheet runoff. During the meeting, the policymakers did not express any commitments. As a result, the market is hesitant about trading preferences that makes USD/JPY trade without a clear-cut trend. According to San Francisco FED President Mary Daly, the US economy is facing headwinds. In this context, the Federal Reserve should align its balance sheet policy with the unchanged approach to interest rates. Higher downward pressure, including a slowdown in the global economy, tighter financial conditions, and rising uncertainty over international trade, assures the US central bank to keep rates steady this year.

Today US Durable Goods Orders report is going to be published. Durable goods orders ex transportation are likely to increase to 0.3% from the previous value of -0.4%, Durable Goods Orders are expected to increase to 1.6% from the previous value of 0.7%. Philly Fed Manufacturing Index is expected to decrease to 14.1 from the previous figure of 17.0 and Unemployment Claims are expected to decrease to 228k from the previous figure of 239k.

On the JPY side, the Bank of Japan recently stated its intestion to loosen its ongoing ultra-soft monetary policy as the economy is facing a risk of a slowdown and sluggish consumer inflation. The US-China trade tensions and the upcoming sales tax hike in October are the factors affecting the JPY gains. According to chief economist of JP Morgan Mr. Hiroshi Ugai, if the risk of recession rises then the BOJ might resort to more stimulus measures further. Today Japan's Flash Manufacturing PMI report was published with a decrease to 48.5 from the previous figure of 50.3 which was expected to edge up to 50.4 and All Industry Activity improved to -0.4% from the previous value of -0.5% but failed to meet the expectation of -0.2%. Ahead of National Core CPI report to be published tomorrow which is expected to increase to 0.8% from the previous value of 0.9%, the pair could trade with higher volatility by the end of this week.

Meanwhile, the US has proved its healthy economic conditions. Pending upcoming economic reports could prop up further USD gains. On the other hand, JPY is losing ground due to downbeat economic reports and easing prospects.

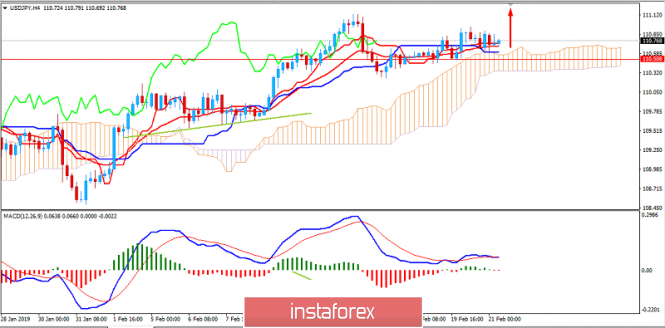

Now let us look at the technical view. The price is being carried higher by the dynamic level of 20 EMA, Tenkan, Kijun, and Kumo Cloud as support which managed to climb above 110.50 area recently. As the price remains above 110.00 area with a daily close, the price is expected to push higher towards 112.00 and later towards 114.50-115.00 area in the future.