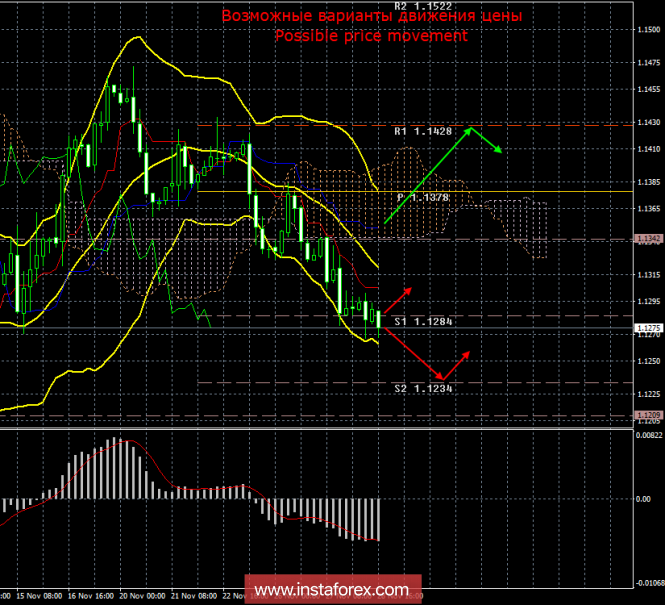

4 hour timeframe

The amplitude of the last 5 days (high-low): 61p - 54p - 93p - 59p - 67p.

Average amplitude for the last 5 days: 67p (76p).

The currency pair EUR / USD on Wednesday, November 28, continues its downward movement even against the background of the complete absence of important macroeconomic information from Europe, even against the background of inconclusive macroeconomic reports from the United States.

The growth of the dollar during the day was small, but it also means that there was no correction.In America today, the index of expenditure on personal consumption for the third quarter (preliminary value) was published, which was worse than the forecast.Also, data on GDP for the third quarter were published (also a preliminary value), but everything was without surprises.The forecast and the real value coincided - 3.5%. Chairman of the United States of America Jerome Powell. Market participants believe that Powell will touch up monetary tightening and confirm or refute the information that the Fed will be ready to complete a rate hike rate in 2019. Powell is being pushed back by Donald Trump, who has been criticizing him for more than a month. The fact is that the Fed is not controlled by Trump, so he cannot influence this organization. Nevertheless, it should be recognized that the huge public debt of the United States really becomes more difficult to service, the more often the Fed raises the rate, provoking new infusions into the US economy and, accordingly, the purchase of the dollar. From a technical point of view, the situation has not changed over the past 24 hours. The pair seeks to overcome the support level of 1,1284, which had a slight hitch.

The next target for the downward movement is the second support level of 1,1234.

Trading recommendations:

The pair EUR / USD continues the downward trend. Thus, short positions remain relevant with the goal of 1,1234. A turn of the MACD indicator to the top serves as a signal to manually close the shorts. In the evening - all attention was focused on the performance of Jerome Powell.

Buy orders are recommended to open no earlier than the bulls to overcome the critical line. In this case, the tendency for the instrument to change to ascending, while the targets for longs will be the level of 1.1428 in small lots.

In addition to the technical picture, you should also consider the fundamental data and the time of their release.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen - the red line.

Kijun-sen - the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dotted line.

Chinkou Span - green line.

Bollinger Bands indicator:

3 yellow lines.

MACD Indicator:

Red line and histogram with white bars in the indicator window.

The material has been provided by InstaForex Company - www.instaforex.com