EUR/USD has been quite impulsive amid the bearish pressure recently which led the price to reside below 1.1430 area with a daily close. Despite positive economic data from the US recently, USD failed to gain the expected momentum over EUR that indicates indecision in the market sentiment, which might lead to further corrections and volatility in the pair.

EUR has come under pressure due to Italy's budget deficit which capped further EUR's gains. If it leads to any kind of crisis, the eurozone is currently not prepared to manage it, citing France's Finance Minister Bruno's speech. Moreover, in light of the recent speech by ECB President Draghi, the monetary policy was unchanged despite a slowdown in the economic growth which could cause certain economic distress. Throughout the week, the economic calendar contains a series of macroeconomic reports to be published whereas tomorrow. French Flash GDP is expected to increase to 0.4% from the previous value of 0.2% and German Prelim CPI is expected to decrease to 0.1% from the previous value of 0.4%.

Amid the lingering trade war, the US is getting a bit harder on China which forces some US firms to relocate. This might lead to fallout in the long run. Today US Core PCE Price Index report was published with an increase to 0.2% from the previous value of 0.0% which was expected to be at 0.1%, Personal Spending decreased to 0.4% as expected from the previous value of 0.5% and Personal Income decreased to 0.2% which was expected to be unchanged at 0.4%. Ahead of the NFP this week, the EUR/USD pair is set to trade with higher volatility as analysts have mixed expectations.

Meanwhile, EUR has been hurt by the budget deficit in Italy and mixed expectation for the pending economic reports. On the other hand, the US has published mixed economic data today, leading to more indecision and correction this week. On Friday, thte US Labor Department will present data on employment in the US private sector. Traders will grasp a further bias at the end of the week. Amid the current fundamentals, USD is in a better position than EUR.

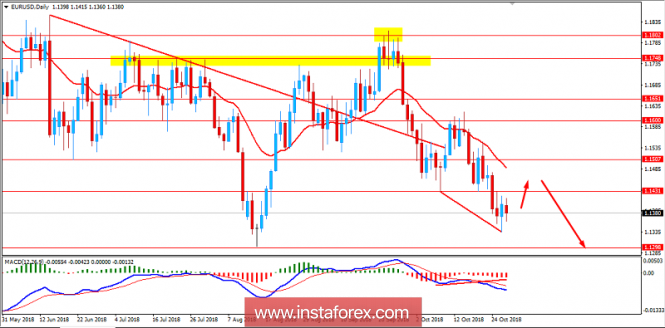

Now let us look at the technical view. The price has formed Bullish Divergence below 1.1430 area while having certain volatility and correction as well. As the price remain indecisive, it is expected to retrace higher towards 1.1500 area before it starts to push lower with a target towards 1.1300 area in the coming days. As the price remains below 1.1500 area, the bearish bias is expected to continue.

SUPPORT: 1.1300

RESISTANCE: 1.1430, 1.1500

BIAS: BEARISH

MOMENTUM: VOLATILE