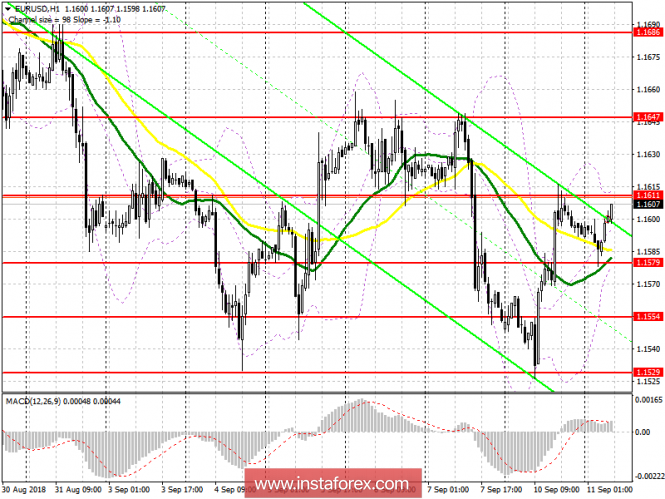

EUR / USD

To open long positions for EUR / USD, you need:

The euro rose after the pound against the backdrop of the latest Brexit news. To maintain the upward trend, buyers need a breakthrough and consolidation above the resistance level of 1.1611, which leads to a new wave of growth in the area of the high at 1.1647, with an update to the level of 1.1686, where I recommend fixing the profits. In the case of a decline in the euro in the morning, opening long positions is best when forming a false breakout in the area of 1.1579 or a rebound from 1.1554.

To open short positions for EUR / USD, you need:

Bears today need to form a false breakdown at the level of 1.1611. This will be the first signal to maintain the downward trend, formed at the end of last week. The main task of the sellers will be a breakthrough and consolidation under the level of 1.1579, which will quickly push the euro into the support areas of 1.1554 and 1.1529, where I recommend fixing the profits. If EUR / USD rises above 1.1611, selling in the first half of the day can be on the rebound from resistance 1.1647.

Indicator signals:

The 30-day moving average pierces from the bottom up. The 50-day moving average is a buy.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

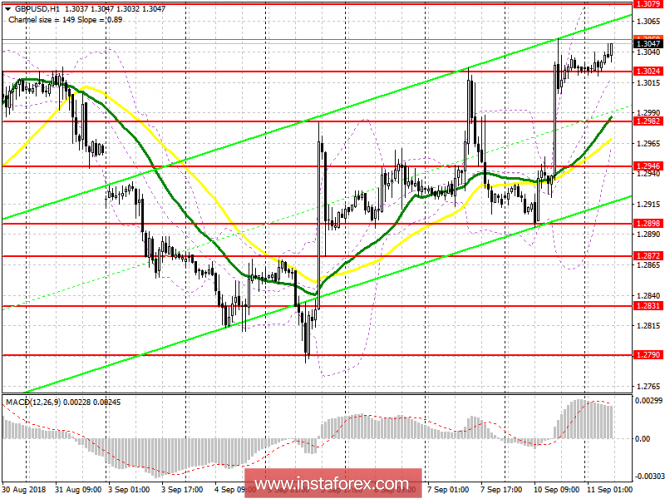

GBP / USD

To open long positions for GBP / USD, you need:

While the trade is above the support level of 1.3024, demand for the pound will remain, which will lead to the renewal of the next monthly highs around 1.3079 and 1.3119, where I recommend fixing the profits. However, do not forget about the undulating market, which demonstrates the GBP / USD pair against the background of rumors of Brexit. Therefore, if the pound is lowered in the morning under the support of 1.3024, it is better to go back to long positions for a rebound from the level of 1.2982 and 1.2946.

To open short positions for GBP / USD, you need:

Sellers will prove themselves after the upgrade of the large resistance 1.3079. However, opening short positions from him is best after forming a false breakdown. Immediately on the rebound to sell a pound I recommend from a maximum of 1.3119. The main task of the sellers will be to return to the support area of 1.3024, below which the pressure on GBP / USD will increase, which will lead to a sharp decrease and update of the level of 1.2982 and 1.2946, where I recommend fixing the profits.

Indicator signals:

The 30-day moving average is above the 50-day average - the bullish trend is maintained.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

The material has been provided by InstaForex Company - www.instaforex.com