A weekly report by the US Department of Labor on the number of applications for unemployment benefits was published yesterday afternoon.

As reported by the Department of Labor, the number of pre-declared unemployed in the week ending on July 28 this year (Unemployment Claims) was 218,000, which means an increase of 1,000 compared to the previous week. The surveyed economists, however, expected an increase of up to 220,000.

On the other hand, the four-week average dropped, amounting to 214,500, which means a decrease of 3500 compared to the moving average of the previous week.

A positive overtone of this publication was also supported by the fact that the number of continuation applications for unemployment benefits (Continuing Claims) in the week ending on July 28, fell to 1,724,000 from 1,747 000 a week earlier. The forecasts assumed, however, that the number of continuing jobless claims will increase to 1,750,000, so this data was also better than expected.

That was the first part of the US job market report, the second part will be published today in form of NFP-Payrolls and Unemployment Rate.

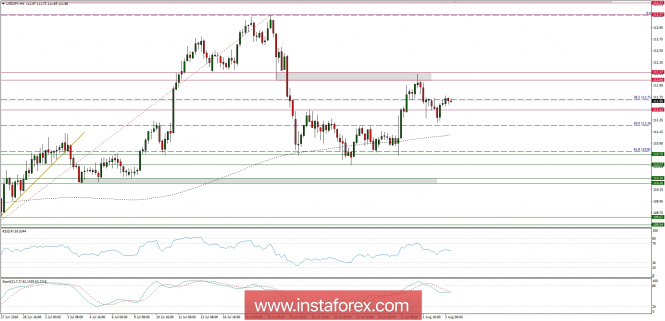

Let's now take a look at USD/JPY technical picture at the H4 time frame after the first part of the US job data was posted. The market has failed to break through the technical resistance at the level of 112.17 and the price made a Doji like candlestick formation. Since then, the market dropped towards the technical support at the level of 111.20 and bounced a little, but no new high was made. The intraday local high is seen at the level of 111.77 and this will be the point of reference for the NFP data today. The market conditions remain neutral as the traders await the NFP data to be released.