EUR/CAD has been quite impulsive with the bearish gains it formed last week since the bullish rejection off the 1.5450 area with a daily close. While the EURO is struggling with the recent economic reports, CAD has gained momentum despite the tension growing because of Trade Wars on both countries.

Recently CAD GDP Report was published with a significant increase to 0.5% from the previous value of 0.1% which did provide the necessary push required for the CAD to continue its momentum against EUR in the process. Today CAD Trade Balance report is going to be published which is expected to increase to -2.3B from the previous figure of -2.8B.

On the other hand, EURO Final Services PMI report is going to be published which is expected to be unchanged at 54.4 and Retail Sales is expected to increase to 0.4% from the previous value of 0.0%. Moreover, there are a series of economic report on German, Italian and French Services PMI which is expected to be unchanged, providing no indication of further momentum in the process.

As of the current scenario, CAD has been quite positive with the recent economic reports and still quite optimistic with the forecasts of upcoming economic reports while EUR is expected to struggle further with indecisive unchanged value and figures. To sum up, CAD is expected to gain further momentum over the EURO in the coming days.

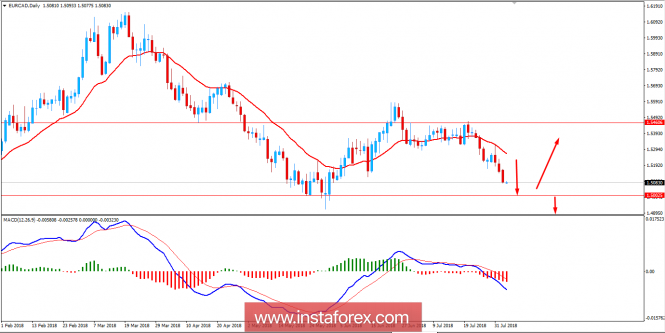

Now let us look at the technical view. The price has recently bounced off the dynamic level of 20 EMA before becoming impulsive with the bearish gains in the process. The trend has been bearish and currently expected to push lower towards 1.50 support area from where certain bullish intervention may be observed which can lead to certain bullish momentum in the coming days. On the other hand, if the price manages to break below 1.50 area with a daily close, the bearish pressure is expected to extend further with target towards 1.4850 in the future.

SUPPORT: 1.50

RESISTANCE: 1.5450

BIAS: BEARISH

MOMENTUM: IMPULSIVE