So, the Bank of England predictably increased the interest rate and finally put an equal sign between further tightening of monetary policy and the fate of Brexit. This fact completely leveled out all the positive from the rate hike, after which the pound, paired with the dollar, went to conquer the 29th figure with a claim for repeated testing of annual lows. Looking ahead, it is worth noting that the pressure on the British currency will not weaken until Brussels and London come to a deal. Now this is obvious and in general, it is a fact that was confirmed by the English Central Bank.

However, not everything is as bad as it seems at first glance. The head of the Bank of England Mark Carney noted the growth of key macroeconomic indicators, and even allowed the probability of "overheating" in the economy if the rates remain in the future at a low level. This factor, he argued, is raising the rate to 0.75%, that is, to the level of 2009. But the further prospects of monetary policy look vague, as well as the prospects of the "divorce" process of Britain with the EU.

The main conclusion that can be drawn from the results of today's meeting is the realization that the rate will be raised next time not earlier than March 2019. And this is provided, if London and Brussels still reach an agreement, which is too early to talk about. Even with the active growth of inflation indicators and other macroeconomic indicators, the English regulator will hold a pause until Britain withdraws from the EU. As we know, the date of Brexit is determined until the minute - 00:00 hours on March 29, 2019. But on what terms the country will withdraw from the Alliance, the question is still open.

It was this factor that became the theme of the August meeting of the British regulator. The possible absence of a trade deal frankly frightens regulators. According to Carney, the atmosphere of uncertainty already reduces the level of business investment. And in case of a dysfunctional outcome, like the trend, it will increase at times. The head of the regulator actually tied the outcome of the "divorce proceedings" with the prospects of monetary policy, so now traders will analyze the news background on Brexit from the point of view of a possible reaction from the English Central Bank. Actually, Brexit was previously the number one topic for traders of the GBP / USD pair but now the Bank of England has officially recognized the interconnection of foreign policy processes with its own determination.

By the way, Mark Carney was concerned not only with questions of British foreign policy: American actions concern him not less than Brexit. Today, he said that the global trade war will become a catalyst for slowing the growth of the global economy, with all the ensuing consequences. Based on these words, we can conclude that further escalation of the trade conflict between the US and China will indirectly affect the degree of determination of members of the English regulator.

From all this we can conclude that in the coming months, the Bank of England will react to an external fundamental background, regardless of the dynamics of domestic macroeconomic statistics. Naturally, the growth of key indicators will increase the likelihood that in the case of a "happy end" in the history of Brexit, the regulator will tighten monetary policy at a faster pace. However, this factor will have an indirect character and short-term impact on the GBP / USD pair.

The market quite reasonably reacted to the results of the August meeting in a negative light, despite the rate increase. The situation with Brexit is now at a crucial stage: the outcome of the next round of the negotiation process, which will take place in mid-August, largely determines the fate of the deal. At the moment, there is silence in the information field about the prospects of Brexit. Representatives of London and Brussels vied with each other that the chaotic scenario is disastrous and will only bring losses to both sides. However, at the same time, both Europeans and Britons show minimal flexibility not to lose in the final score. Until when such a "nerve play" will last, nobody knows, but most experts pin their hopes on the August talks, in which Theresa May will personally take a part of.

Recently appointed Foreign Minister of Britain, Jeremy Hunt went to Berlin last week to "prepare the ground" for future negotiations, but there is no information about the results of this visit. It is worth noting that Theresa May may relate the last hope for the "soft" Brexit, despite its reputation. According to the latest opinion polls, May's most likely successor is the odious Boris Johnson, who resigned from his post as Foreign Minister, disagreeing with her policies. His coming to power will almost certainly mean a "hard" Brexit with all the consequences - including factors for the British currency. Therefore, much has been put on the map of the August talks - both the political future of Theresa May, the prospects for a "divorce" process, and the pace of tightening monetary policy by the English regulator.

Thus, the pound will be subject to special influence from the foreign policy news background in the coming months. All other fundamental factors will play a secondary role.

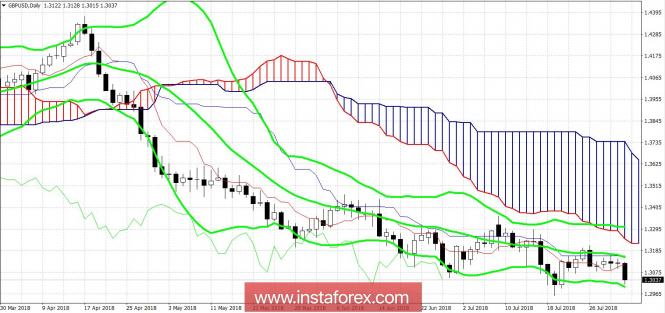

Technically, the GBP / USD pair could not impulse to break through an important support level of 1.3000 (the bottom line of the Bollinger Bands indicator on the daily chart). It is likely that the pair will be able to bear it tomorrow, after the publication of Non-farm. If the US data disappoint, the pair has a chance for corrective growth, the upper path of which is limited by the mark 1.3150 (the middle line of the indicator Bollinger Bands on D1).

The material has been provided by InstaForex Company - www.instaforex.com